[ad_1]

Bitcoin value is trending larger on Thursday following a usually sluggish week within the cryptocurrency market. The most outstanding coin is up 0.8% to $29,444 amid a renewed bullish push, with a 24-hour buying and selling quantity of $12 billion and $572 in market capitalization.

This bullish wave seems to be traversing the market, as Ethereum is up 1.3% to $1,876, XRP is up 2% to $7.1 whereas BNB is buying and selling at $242 following 1.8% of 24-hour positive aspects.

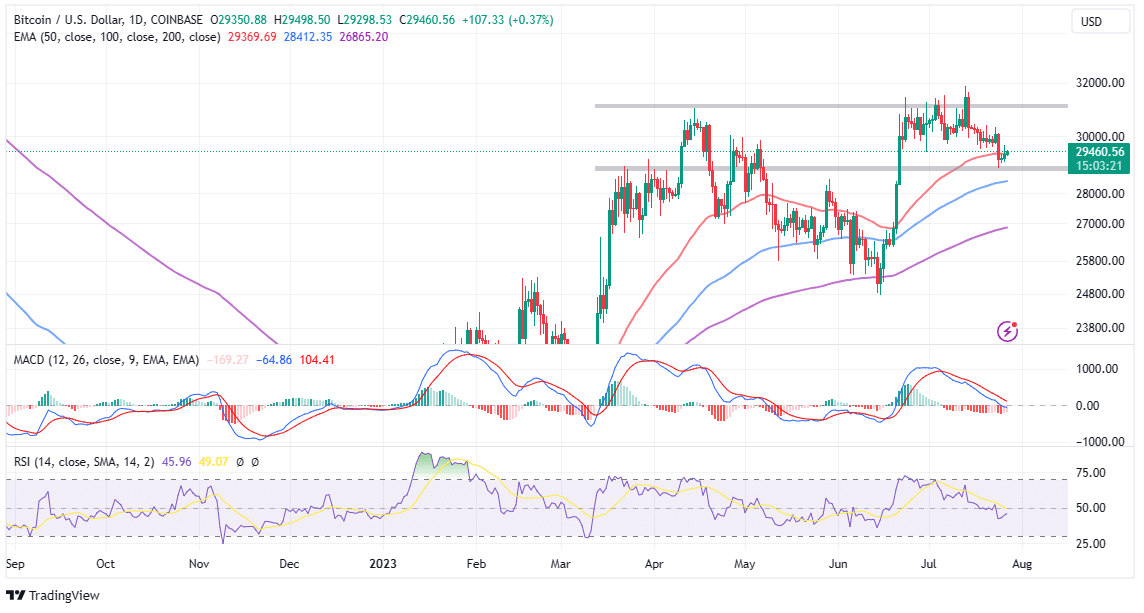

Bitcoin Price Ready to Tackle $30k Resistance

Bitcoin price is on the transfer to retest the vendor congestion at $30,000. Its uptrend is grounded within the assist established round $29,000 – an space that has been instrumental in stopping declines to $28,000 and subsequently $25,000.

The ongoing uptrend might be attributed to oversold situations in decrease timeframes – more likely to lead to a purchase sign from the Moving Average Convergence Divergence (MACD) indicator.

That mentioned, merchants needs to be looking out for a possible bullish cross within the momentum indicator, particularly on the every day chart, marked by the MACD line in blue crossing above the sign line in crimson.

The Relative Strength Index (RSI) will present additional assurance of the uptrend if it begins trending larger throughout the impartial space (30 – 70). Traders looking for publicity to lengthy positions might need to wait till Bitcoin price sustains support above the 50-day Exponential Moving Average (EMA) (crimson) at $29,367.

A sustained break and maintain above would amplify the shopping for strain, with buyers reaffirming their bullish projections for positive aspects above $32,000 and ultimately to $35,000.

According to Captain Faibik, a well-liked crypto analyst and dealer, Bitcoin will possible “hit $32k first, and then we may witness a 15 – 20% correction in the coming weeks.”

The chart within the tweet beneath reveals that Bitcoin price recovery above $30,000 might decelerate on approaching the cussed resistance at $32,000, thus triggering a sell-off to $25,000.

I believe $BTC will hit 32k first, after which We might Witness a 15-20% Correction within the Coming Weeks.

Share Your Thoughts 💭#Crypto #Bitcoin #BTC pic.twitter.com/Qni4cCBxLX

— Captain Faibik (@CryptoFaibik) July 27, 2023

Bitcoin Volume Dominance Drops – What Does This Mean?

Bitcoin dominance volume has been on a long-standing downtrend, dropping by 8% because the starting of July and 27% since April. The Ripple ruling noticed a sudden shift in investor curiosity to altcoins, on the expense of the BTC dominance, an image that has been mirrored throughout 25 centralized exchanges.

Offshore exchanges have been impacted probably the most by the drop in BTC buying and selling exercise. The Kaiko report says that this might be “partially due to a spike in South Korean altcoin volume.”

“Since the start of 2023, BTC dominance has fallen by 20%. On U.S. exchanges, altcoins have also gained traction over the past month, which suggests the regulatory crackdown has not yet dampened demand,” the Kaiko report states.

On the opposite hand, altcoin liquidity “measured by 1% market depth,” has recorded a minor uptick because the starting of July. Market depth for the highest 10 altcoins shot up by roughly $20 million.

Since nobody can inform how lengthy this drop in BTC dominance is more likely to final, it could be prudent for merchants to organize for a possible retracement to $28,000, whereas not ruling out additional declines to $25,000.

Related Articles

The introduced content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link