[ad_1]

Binance Smart Chain (BNB) has seen important development in its day by day lively addresses and transactions within the second quarter of 2023, in response to a report by blockchain analytics agency Messari.

The improve in exercise was primarily pushed by LayerZero, a cross-chain messaging protocol that permits light-weight and environment friendly communication between totally different networks.

However, BNB’s market cap declined by 25.2% after the US Securities and Exchange Commission (SEC) alleged that BNB is a safety in its regulatory actions towards Coinbase and Binance.

Despite this, the full cryptocurrency market cap elevated by 2% quarter-over-quarter (QoQ), primarily pushed by Bitcoin (BTC) and Ethereum (ETH).

BNB Q2 Revenue Declines

Per the report, BNB’s income in BNB decreased by 6.1% QoQ as common transaction charges declined 25.5% after BSC validators voted to scale back fuel charges from 5 to three Gwei.

Nevertheless, staking on the community remained steady. BNB Chain plans to extend the variety of validators from 29 to 100 with a brand new validator reward mannequin (balanced mining) and a validator repute system.

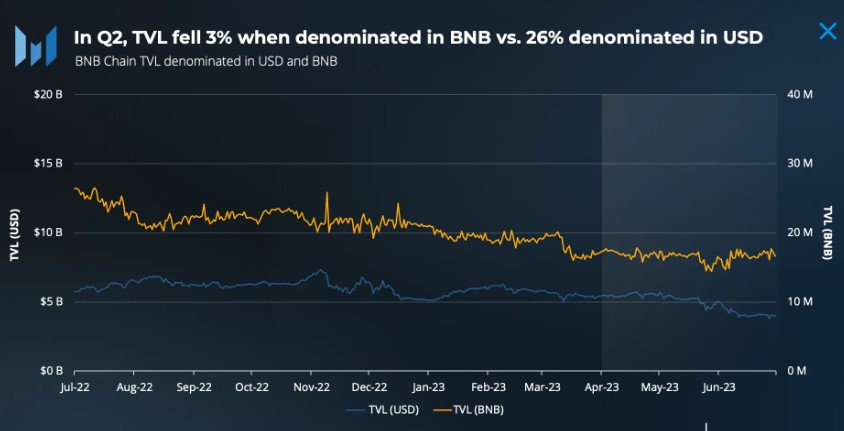

On the opposite hand, the Binance Smart Chain noticed a lower in whole worth locked (TVL) denominated in USD throughout Q2 2023, lowering by 26.3%. However, TVL denominated in BNB was comparatively flat at -2.8%.

While PancakeSwap remained essentially the most outstanding protocol by TVL on the BNB Chain, its dominance decreased from 45% to 37% throughout the quarter, indicating a shift in TVL focus in direction of a extra sturdy DeFi ecosystem.

In the stablecoin house, Binance Smart Chain has the third-highest whole stablecoin market cap of roughly $5.7 billion, trailing behind Ethereum and TRON. The BUSD market misplaced a few of its customers after regulators compelled Paxos to stop the issuance of BUSD, leading to a decline of roughly 54% within the BUSD market cap on the BNB Chain throughout Q1.

Developer engagement additionally confirmed constructive development throughout Q2, with the variety of distinctive contracts verified rising by 51.9% QoQ, and full-time builders on the BNB Chain rising from 130 to 133 QoQ.

Despite the decline in TVL denominated in USD, the BNB Chain’s continued enlargement of its DeFi ecosystem and the shift in TVL dominance in direction of a extra various vary of protocols sign a promising outlook for the ecosystem’s future.

Binance Smart Chain Outlines Ambitious Plans For 2023

Despite the regulatory challenges, BNB Chain has laid out sturdy plans for 2023, together with rising the community’s fuel restrict to spice up throughput and lowering the information footprint by way of state offload.

BNB Chain additionally plans to additional decentralize by introducing a brand new validator reward mannequin and a validator repute system to extend the variety of validators from 29 to 100.

The roadmap highlights different initiatives, together with elevated scalability by way of modular structure, creating a knowledge storage community, and implementing shopper protections supplied by blockchain safety companies.

In Q2, BNB Chain validators and initiatives mentioned the mixing of miner extractable worth (MEV) inside the BSC community, with some validators piloting MEV in numerous codecs. With its wide-reaching plans, BNB Chain goals to stay aggressive for the remainder of 2023.

While the regulatory challenges confronted by Binance and Binance.US immediately influence all the crypto ecosystem, Binance and BNB Chain are separate entities. Binance, Binance Labs, and the Binance Launchpad assist develop the BNB Chain ecosystem by way of asset listings, liquidity provision, funding, and venture launches.

The outcomes of the continuing lawsuits are unpredictable, and opposed outcomes may gradual the development of the BNB Chain ecosystem and convey continued volatility to its native BNB token.

Featured picture from Unsplash, chart from TradingView.com

[ad_2]

Source link