[ad_1]

The place of XRP out there as a cryptocurrency and never a safety token is as soon as once more in query following a current ruling made by SDNY District Judge Jed Rakoff, which permits the Securities and Exchange Commission (SEC) to hold on with the lawsuit in opposition to Terraform Labs and its founder D Kwon.

Legal representatives of Terraform and Kwon had filed a movement to dismiss the SEC’s case, citing the ruling made in the Ripple vs SEC lawsuit.

Judge Rakoff didn’t give any regard to the early July ruling, delivered by Judge Analisa Torres, which distinguished between institutional XRP gross sales and public gross sales, comparable to these on third-party exchanges like Coinbase and Binance.

The choose asserted that the regulator has jurisdiction to proceed with the case which might decide if Kwon and his firm Terraform violated safety legal guidelines.

Newsflash: Ripple Decision Already in (Big) Trouble

SDNY District Judge Jed Rakoff right this moment allowed the SEC to go ahead with its case in opposition to Terraform Labs and founder Do Kwon. In doing so, Judge Rakoff particularly rejected the excellence made within the Ripple case between public… pic.twitter.com/JZZ8vukfFt

— John Reed Stark (@JohnReedStark) July 31, 2023

Meanwhile, XRP down 2.4% within the final 24 hours, is buying and selling at $0.6881. The turbulence out there cuts throughout the board with Bitcoin price falling by 1.6% to 28,932 whereas Ethereum is holding firmly to assist at $1,830 following a 1.7% drop.

How Far Can XRP Price Tumble?

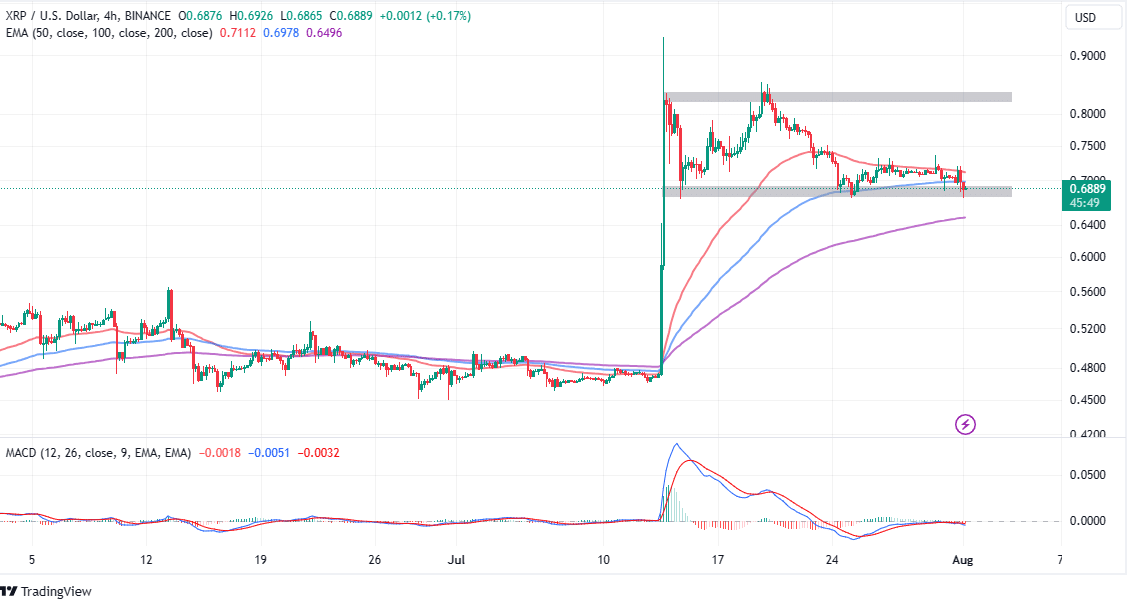

Attempts to push XRP worth to $1 have been futile regardless of the Ripple ruling, which deemed XRP not a safety token however notably for gross sales made by way of exchanges. While the token rallied substantively to commerce highs of $0.93, it has typically wobbled throughout the vary stretching from $0.68 and $0.85.

XRP price has in the previous few weeks been confined within the decrease vary of the channel, thus placing plenty of stress on assist at $0.68. It is important for bulls to maintain this assist intact, in any other case, sellers might faucet promote the sign from the Moving Average Convergence Divergence (MACD) indicator.

Such a bearish name compels merchants to shut their lengthy positions and open quick positions and is characterised by the MACD line in blue flipping under the sign line in pink. The bearish outlook in XRP turns into extra obvious with the momentum indicator sliding towards the imply line (0.00) of additional under it.

While restoration from the vary resistance at $0.68 can’t be dominated out, merchants have to be cautious maintaining in thoughts the assist turned hurdle on the 100-day Exponential Moving Average (EMA) (blue) at $0.6977.

A sustained break above $0.7 would imply that the vary assist is sturdy sufficient to arrest potential declines, presumably averting an impending sell-off, with the Ripple ruling seemingly in bother.

Traders who could also be eyeing new publicity to XRP longs ought to be looking out for positive factors above $0.7 – the resistance stage on the 100-day EMA. A pointy spike in quantity could comply with, which is essential for the climb to $0.75 in addition to the vary excessive of $0.85.

Declines under the speedy $0.68 assist may prolong to revisit the 200-day EMA and if push involves shove because of buyers promoting in panic, XRP price could sweep the liquidity at $0.6 earlier than resuming the uptrend to $1.

Related Articles

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link