[ad_1]

Bitcoin worth continues to extend the monotony in a good vary above $29,100, with its fast upside capped below $30,000. Its lull market construction could, nevertheless, lead to extra volatility, implying that buyers and merchants have to be cautious.

Bitcoin Price Volatility in The Cards?

The buying and selling vary in Bitcoin price, alongside that of altcoins like Ethereum, has narrowed considerably over the previous six weeks, based on insights released by K33 Research, a digital property wealth administration platform.

According to the report, the crypto market stability continues to defy macroeconomic components, and key business occasions, which might have despatched buyers on a rollercoaster a couple of years in the past.

“A deep crypto sleep tends to be followed by a violent wake-up,” Vetle Lunde a K33 senior analyst stated. “The market is clearly in an unprecedented stable stage, which has typically acted as a massive pressure valve for volatility once it finally reignites.”

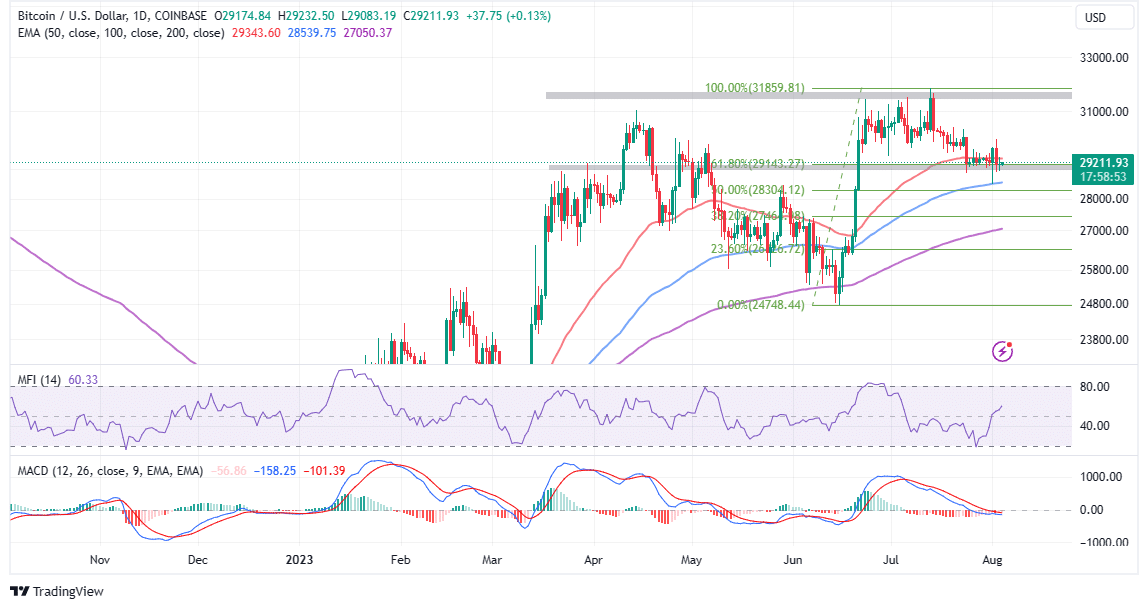

Meanwhile, help at $29,100 has been strengthened by the 61.8% Fibonacci stage, and with the Money Flow Index (MFI) transferring above the midline, the trail with the least resistance might to the upside.

A rebound from that help would verify a purchase sign from the Moving Average Convergence Divergence (MACD) indicator. Traders buying and selling this momentum indicator might want to confirm that the MACD line in blue has flipped above the sign line in purple earlier than triggering their purchase orders.

A subsequent break above the 50-day Exponential Moving Average (EMA) (purple) would add credence to the uptrend, thus rising investor confidence within the Bitcoin price recovery above $30,000.

“My short-term thesis,” Lunde continued, “is that the market’s volatility pressure is about to climax and that an eruption is near.”

Bitcoin Price Could Explode Anytime

Bitcoin’s five-day volatility low dropped under that of the S&P, Nasdaq, and gold. Based on the K33 Research report, this has occurred solely a handful of instances, with a volatility eruption following thereafter.

Investors ought to contemplate the 30-day volatility index, which has lately dropped virtually to a five-year low as well as to the quantity considerably shrinking.

On-chain insights from Glassnode present that long-term holders of Bitcoin have been lowering their provide, suggesting that they’re prepared to promote, particularly if the worth sinks additional under $30,000.

An enhance within the provide of BTC held by long-term holders exhibits that buyers are prepared to hold their positions, as an alternative of taking income.

That stated, losses under $29,100 help would possibly set off panic promoting amongst buyers, exerting extra stress on $28,000. It is simply too early to rule out the potential of declines extending to $25,000 earlier than Bitcoin begins the run-up to $35,000 and $38,000 subsequently.

Related Articles

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link