[ad_1]

XRP value downtrend from the Ripple ruling triggered rally early final month to $0.93, has continued to kill investor sentiment, with declines stretching to $0.60. However, with help at this stage seemingly intact and XRP testing resistance at $0.65, there’s a obvious chance of beneficial properties extending to $0.7 and $1, respectively.

XRP Price Eyes Bullish Breakout As SEC-Ripple Hype Fades

Many buyers anticipated a large breakout following the partial ruling within the Ripple vs. SEC lawsuit, which decided that XRP isn’t a safety when bought on third-party exchanges like Coinbase and Binance.

Although the initial breakout propelled XRP price to $0.93, profit-booking and a dilapidated crypto market setting noticed beneficial properties to trimmed to $0.60.

Data by Coinglass on the XRP derivatives market reveals a drop in open curiosity to $786.81 million from barely above $1 billion round mid-July.

Based on on-chain information from the XRPSCAN, day by day community transactions have continued to maneuver sideways round $1 million for no less than 12 months, implying that the cross-border funds token has not improved basically.

How To Profitably Navigate Current XRP Market Structure

Based on the prevailing market construction, XRP price is poised to rally – first to $0.7 the place consolidation could happen forward of the final word rally above $1.

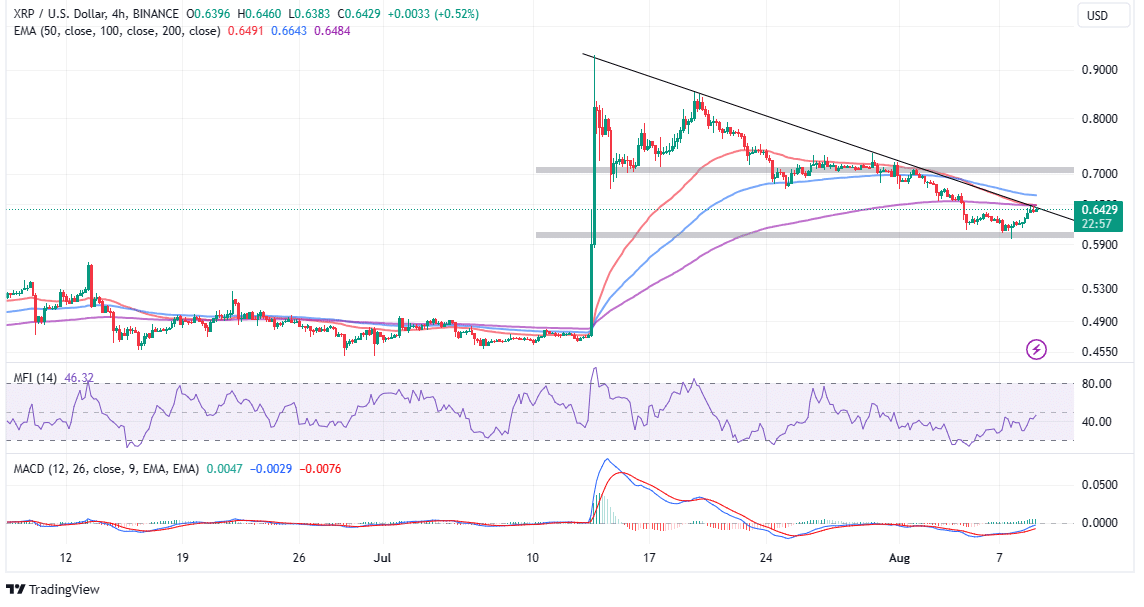

Traders searching for publicity to XRP longs could wish to maintain on till the value breaks above the descending trendline on the four-hour chart, which marks a confluence resistance at $0.6484 with the 200-day Exponential Moving Average (EMA).

The path with the least resistance might stay to the upside for the remainder of the week, bolstered by the optimistic outlook of the Moving Average Convergence Divergence (MACD) and the Money Flow Index (MFI), which have been trending upward since late final week.

The MACD dons a purchase sign following a bullish cross whereas the MFI reveals that buyers are open to searching for publicity to XRP markets.

Although the technical image on the day by day chart is barely completely different, it validates the bullish outlook. For occasion, the 50-day EMA (purple) bolstered help at $0.6. If declines soar, the 100-day EMA (blue) at $0.57 and the 200-day EMA (purple) at $0.52 will come in useful.

Traders should, nevertheless, be cautious maintaining in thoughts the promote sign as offered by the MACD. Besides, the MFI reveals outflows from XRP markets fall behind the influx quantity.

In that case, failure to increase the uptrend above $0.7 might problem the bulls’ place available in the market and thus exert extra stress on the help areas highlighted above.

Related Articles

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link