[ad_1]

Bitcoin worth has been shifting decrease inside the slim vary between $29,000 and $30,000 since final week, with analysts beginning to acclimatize to declines stretching to $28,000.

The most distinguished crypto’s commendable stability might be attributed to low volatility, decoupling from the inventory market which suggests restricted response to financial components like Thursday’s Consumer Price Index (CPI).

Bitcoin Price Stable But Ready To Move

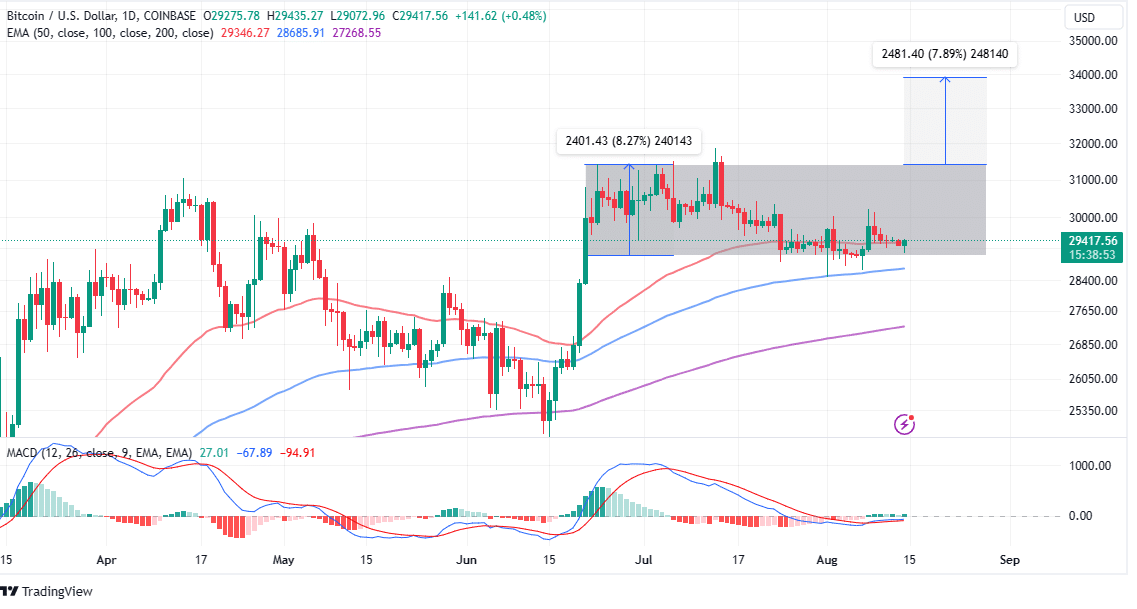

Bitcoin price is buying and selling at $29,404 after testing and rebounding from assist at $29,000. After efficiently coping with resistance on the 50-day Exponential Moving Average (EMA), the trail with the least resistance appears to be to the upside, bringing the psychological vendor congestion at $30,000 inside attain.

Despite the flat motion of the Moving Average Convergence Divergence (MACD), a purchase sign is extremely doubtless. Traders looking for new publicity to lengthy positions in BTC ought to be searching for the MACD line in blue crossing above the sign line in purple.

A bullish rectangle, as noticed on the chart implies that Bitcoin price is in the process of breaking out to higher levels.

The bullish rectangle sample signifies a robust uptrend that pauses earlier than resuming its upward motion. It types when the worth strikes sideways between two parallel horizontal strains, making a box-like form.

Traders can capitalize on this sample by shopping for when the worth breaks above the higher line, indicating a continuation of the bullish development.

Note that, merchants use the peak of the rectangle to estimate the goal worth after the breakout. In this case, purchase when Bitcoin has damaged above $resistance at $31,450 and think about cashing out at $33,911.

Ahead of the rectangle breakout, buyers could experience the wave to $31,430 by shopping for BTC because it recovers above the 50-day EMA (purple) at $29,346.

If vary assist at $29,000 weakens, the MACD would possibly affirm a promote sign as a substitute, thus forcing Bitcoin to abandon the breakout above $30,000.

Miner Accumulation To Precedes Bitcoin Price Rally

Discussions round main institutional buyers like Blackrock coming into the crypto market have continued to warmth, particularly with the Securities and Exchange Commission (SEC) deliberating approving the primary exchange-traded product (SEC).

According to on-chain insights from CryptoQuant “… if ‘Token Transferred’ and ‘Velocity speed’ increase along with the price increase, this is likely a precursor to an upward rally.”

Meanwhile, miner exercise implies that Bitcoin is consolidating forward of the following bullish breakout. Past bullish cycles have proven that miners are likely to accumulate forward of the halving.

“Miners were sellers starting in Aug 2022 and finally starting on May 27 this year they started accumulating. Technically speaking, it’s in their best interest economically speaking to start accumulating before the halving which is scheduled for April 2024.”

However, there was a noticeable enhance in BTC inflows into spot exchanges more likely to have dampened the potential momentum from “muted outflows as worth hovered in a good vary of 29k-$31k.

Related Articles

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link