[ad_1]

Ethereum value, though susceptible to the promoting strain that continues to construct up throughout the crypto market, holds strongly onto ranges above $1,800.

The largest sensible contracts token has not flinched within the final 24 hours, buying and selling at $1,847 with $5.2 billion in buying and selling quantity coming in and backed by $222 billion in market capitalization.

Ethereum Price Moves Closer to Bullish Pattern Breakout

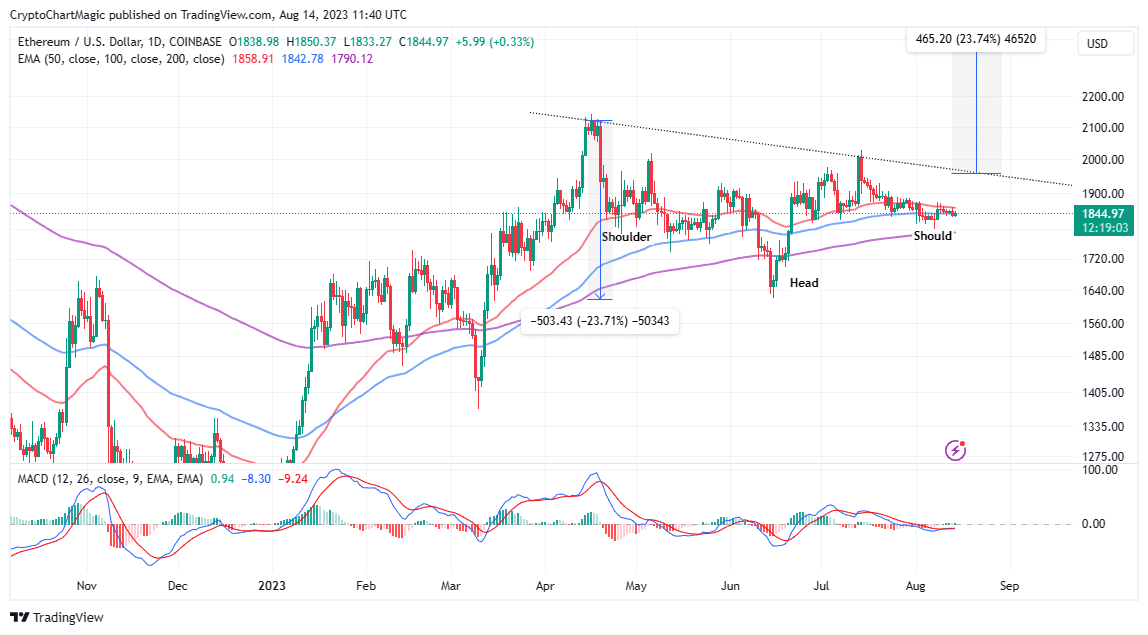

An evaluation of the Ethereum price daily chart reveals the formation of an inverse head and shoulders (H&S) sample. If validated, traders can acclimatize to a bullish end result, the place Ether climbs to $2,424.

This is a bullish reversal sample that indicators a change within the route of a downtrend. It consists of three consecutive lows, with the center one being the bottom and the opposite two being roughly equal.

The H&S is accomplished when the worth breaks above the neckline, which is a resistance line drawn throughout the highs of the 2 pullbacks $1,960 in Ethereum’s case.

Traders can capitalize on this sample by shopping for when the worth closes above the neckline and setting a stop-loss under the correct shoulder. The goal value is calculated by including the peak of the sample to the breakout level, roughly 24% to $2,424.

Like Bitcoin, Ethereum is dealing with low volatility, which in keeping with knowledge from IntoTheBlock, has dropped by 21.2% in per week. This coincided with a large drop in community charges to $34.8 million, marking a two-month low.

Ethereum charges have dropped considerably this week by 21.2%, reaching a two-month low. This decline coincides with a interval of stagnating volatility.#ETH pic.twitter.com/jgk23bbv1v

— IntoTheBlock (@intotheblock) August 11, 2023

Low volatility refers to how a lot Ethereum value strikes up and down in a specified interval. Extended durations of low volatility, in keeping with IntoTheBlock, typically level to potential risky fluctuations within the brief time period.

From the technical outlook, Ethereum is calm but a bullish breakout is in the offing, particularly if the Moving Average Convergence Divergence (MACD) indicator flashes a purchase sign.

Traders in search of publicity to new lengthy positions in Ethereum can be required to carry on till the MACD line in blue crosses above the sign line in purple.

Such a sign implores traders to fill their baggage, reserving their positions forward of an impending Ethereum price rally.

That mentioned, ETH wants to shut the day above the fast resistance highlighted by the 50-day Exponential Moving Average (EMA) (purple) at $1,858 to strengthen the uptrend eyeing the inverse head and shoulders breakout.

In the occasion Ethereum abandons the push for positive aspects above $1,960 (neckline), overhead strain will seemingly surge, pushing costs decrease under help at $1,800. If declines maintain under this help space, it will be troublesome to rule out additional losses more likely to retest the 200-day EMA (purple) at $1,790, June’s low at $1,620, and the lows in May at 1,405.

Related Articles

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link