[ad_1]

Bitcoin is again beneath $30,000 however firmly holding above help at $29,000. Although many buyers are displaying withdrawal signs because of the market doldrums, BTC price seems to be getting ready for a significant leg up.

BTC Price Flaunts Key Bullish Pattern

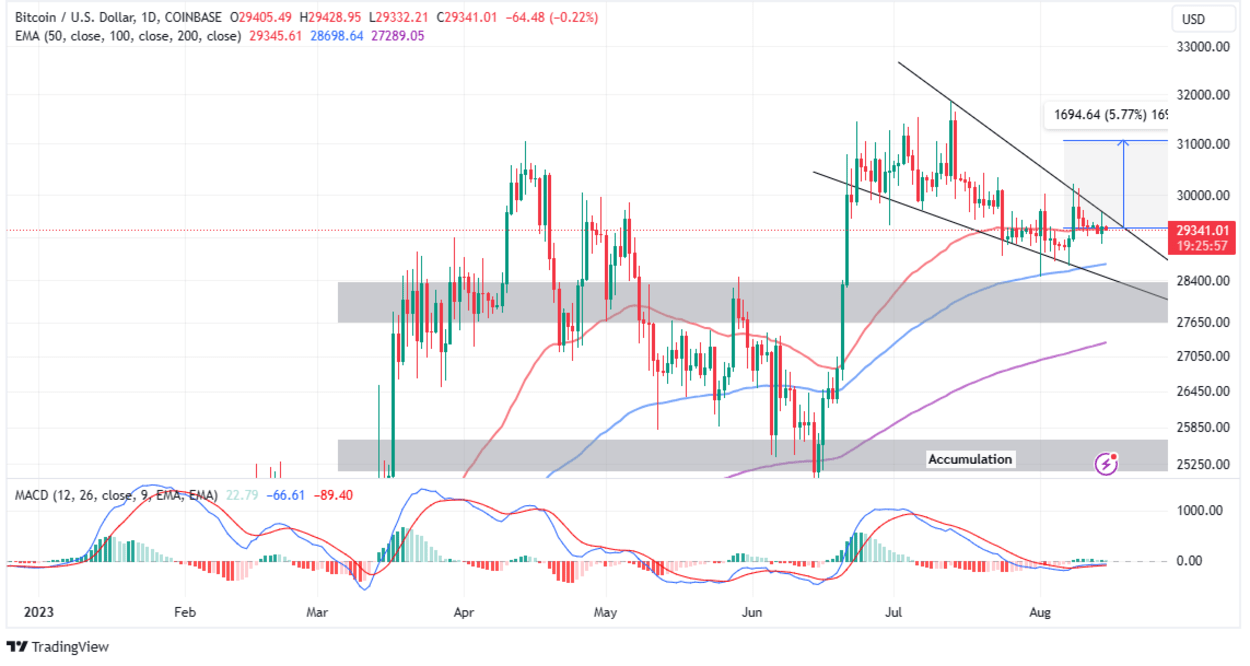

The most outstanding crypto is buying and selling at $29,360 with its value comparatively unchanged within the final 24 hours. If short-term help at $29,200 holds, there’s a risk of a sudden pump, because of the formation of a falling wedge sample on the four-hour.

Notably, the falling wedge sample is a bullish formation that happens when the worth of an asset declines inside a slender vary, forming a wedge-like form on the chart.

The sample signifies that promoting strain in Bitcoin markets is weakening and that the patrons are able to take management.

To commerce this sample, buyers ought to ideally search for a breakout above the higher pattern line of the wedge someplace round $29,400 within the case of Bitcoin – a transfer that confirms the bullish momentum.

Such a breakout is normally accompanied by a spike in quantity, which provides validity to the sign. The goal value could be estimated by measuring the peak of the wedge and projecting it from the breakout level.

For occasion, for lengthy positions activated above 29,400 buyers may anticipate a 5.77% climb to $31,074.

Realize that BTC needs a catalyst to rise above the cussed resistance at $30,000 to begin the run-up to the tip 12 months and a pre-halving rally more likely to propel it above $40,000.

With that in thoughts, retail buyers are seemingly to make use of the falling wedge sample breakout as affirmation of a considerable leg up.

Likely so as to add credence to the bullish outlook is a possible purchase sign from the Moving Average Convergence Divergence (MACD) indicator.

Traders tapping this momentum index to make their choices would usually be looking out for the MACD line in blue flipping above the sign line in pink. As the MACD returns into the optimistic area above the imply line, the trail with the lease resistance would flip to the upside.

BTC Price Pain Before Gain

The buyers in Bitcoin are for the time being praying for information {that a} breakout has occurred above $30,000 however might need to first swallow the bitter tablet of a drop to gather liquidity at decrease ranges probably beneath $29,000 however ideally not decrease than $28,000 for short-term actions.

Based on the four-chart, Bitcoin holds beneath all the foremost shifting averages, together with the 200-day EMA (purple) at $29,432, the 100-day EMA (blue) at 29,386, and the 50-day EMA (pink) at $29,372.

This place means that bears have the higher hand and with the MACD virtually validating a promote sign in the identical timeframe, BTC may shut the day hovering round $29,000.

Several instances Bitcoin has sought liquidity at $29,000 however failed to collect sufficient to propel it above $30,000.

“Bitcoin prices are infamously volatile, however, the market is currently experiencing an extreme volatility compression,” Glassnode told investors on Monday. “Whilst options markets reflect this, it suggests that Bitcoin is either no longer infamously volatile… or volatility could be mispriced.”

Therefore, a drop to $28,000 may expose the coin to patrons who could be prepared to guess on a tactical rebound.

Related Articles

The introduced content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link