[ad_1]

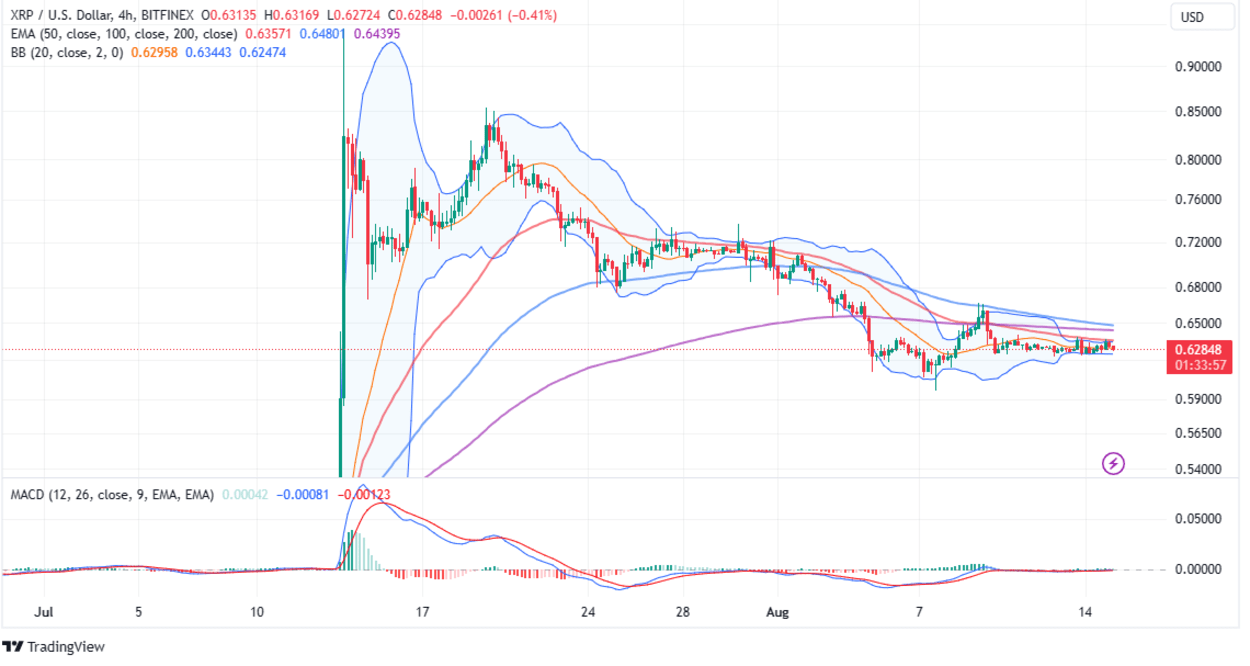

XRP, like its friends, continues with a depressed market construction, caught in a ranging channel with assist at $0.62 and a sturdy resistance at $0.65. The cross-border cash remittance token has since its July breakout to $0.93 misplaced 33% to commerce at $0.63 on Tuesday.

Amid the doldrums within the crypto market, the XRP trading volume has been shrinking beneath the $1 billion degree to $933 million on the time of writing. The cross-border funds token has additionally seen a major stoop in its market cap from $44 billion in early July to $33 billion.

XRP Considers Downward Sweep

The fifth-largest crypto sits beneath all the key utilized shifting averages, beginning with the 50-day Exponential Moving Average (EMA) (crimson) at $0.6295. the 100-day EMA (blue) at $0.6401 and the 200-day EMA (purple) at $0.6439.

This market place exhibits that bulls are bearing growing promoting stress, prone to culminate in losses beneath the speedy assist at $0.62.

However, because the Bollinger bands slim as a result of shrinking liquidity, XRP gets closer to a breakout.

Bollinger bands may also help merchants anticipate the possible value drop in XRP by searching for a bearish divergence between the worth and the bands. This can be of explicit significance when the worth makes a better excessive, however the higher band makes a decrease excessive, indicating that the upward momentum is weakening and that sellers are gaining energy.

Traders hoping to capitalize on the potential brief positions may additionally look out for a breakout beneath the decrease band (which is extremely possible based mostly on the present market construction), signaling that the worth has moved out of its regular vary and {that a} sturdy downtrend is prone to observe.

Selling XRP brief signifies that merchants are betting on the worth sliding beneath the preliminary assist at $0.62 and lengthening losses to $0.60 earlier than bulls contemplate one other vital pattern reversal.

Conversely, this sideways pattern in XRP could lead to a leg-up in the price, particularly if bulls handle to push above the primary short-term hurdle – highlighted by the 50-day EMA.

However, the uptrend concentrating on $0.7, $0.85, and $1 could take longer to materialize amidst the continuing sideways motion. The Moving Average Convergence Divergence (MACD) indicator validates the ranging motion in the identical four-hour time-frame.

XRP Transactions Will Not Be Securities Despite SEC Appeal

Outspoken crypto lawyer John Deaton has as soon as once more delved into the difficulty surrounding the partial ruling within the Ripple vs. Security and Exchange Commission (SEC) lawsuit which decided that XRP gross sales on third-party platforms like Binance and Coinbase aren’t securities whereas these made on to establishments assume the safety standing.

While XRP and the crypto market priced within the ruling in July, the SEC is looking for to enchantment the ruling with the intention to insist XRP be a safety.

In this text it’s says:

“In short, most XRP transactions might still be securities transactions.”

This is NOT true and constitutes whole FUD. Even if Judge Torres agrees to certify the interlocutory enchantment and keep the case (HUGE ASSUMPTIONS, particularly the keep), it could… https://t.co/o7VLWbszUo pic.twitter.com/5T0H57UC8A

— John E Deaton (@JohnEDeaton1) August 11, 2023

Deaton in his latest rundown of the case mentioned that even when the court docket grants the regulator’s interlocutory enchantment request, it could not imply that XRP transactions routinely turn into securities.

“That would assume just because the SEC claims it is, means it is. That’s not even close to being accurate,” Deaton mentioned through X (Twitter).

It is anticipated that the SEC’s enchantment will dwell on the programmatic gross sales of XRP on third-party platforms, which the company says raises “controlling questions of law on which there is substantial ground for differences of opinion.”

Related Articles

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link