[ad_1]

Bitcoin is nowhere shut to a right away restoration now that declines have began a brand new section beneath $29,000. Its buying and selling quantity soared to $16 billion on Thursday, however largely due to a bearish wave sweeping throughout the crypto market.

Down 2.3%, Bitcoin is buying and selling at $28,230 on Thursday and beginning at a doable drop beneath $25,000 earlier than the subsequent main rebound happens.

Bitcoin Could Breakout of Sideways Trading

Bitcoin and the crypto market have as soon as once more been spooked by inflation in the United States after the Federal Reserve launched minutes of the assembly in July used to deliberate how the financial coverage would play out in the coming months.

In the minutes, the Federal Open Markets Committee (FOMC) opined that with out rate of interest hikes, inflation was seemingly to keep elevated. After pausing the fee hikes in June, the financial institution resumed with a 25-basis level hike in July – an element that doesn’t sit effectively with traders in danger property like BTC.

“With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy,” the minutes learn in half.

Bitcoin and altcoins encountered headwinds following the launch of the FOMC minutes regardless of the regulator seeming unsure about the affect of the longstanding tight financial coverage.

Looking at a Potential 13% Crash

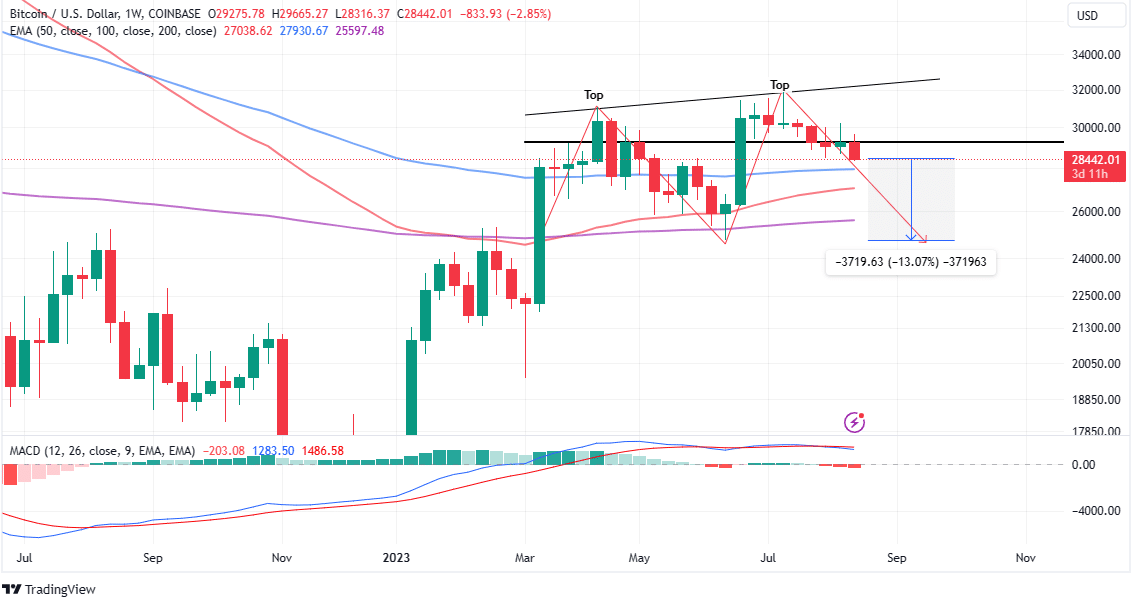

The each day chart reveals the formation of a double-top sample, which might name for a 13% drop in BTC value to full.

This is a bearish reversal sign that happens when an asset reaches a excessive value twice with a reasonable decline in between. It exhibits that the BTC price confronted resistance at the excessive stage of round $32,000 and failed to break by means of.

The sample is confirmed when the value falls beneath a help stage equal to the low between the two highs. With the sample, merchants anticipate a downward development and sell-off or quick BTC earlier than it drops additional.

According to analysts at Rekt Capital, “BTC would need to drop an additional -9% to -13% from current prices to complete its potential Double Top.”

The Moving Average Convergence Divergence (MACD) indicator exhibits that sellers have the higher hand and Bitcoin may keep it up with its downward journey towards the main help at $25,000.

A promote sign from the momentum indicator manifests with the MACD line in blue crossing beneath the sign line in crimson. The crimson histograms add credence to the bearish outlook.

If help by the 100-day Exponential Moving Average (EMA) (blue) comes in useful at $27,931, Bitcoin may witness a knee-jerk response – abandon the drop to $25,000 and launch one other assault at $30,000 and $32,000 resistance stage, respectively.

Related Articles

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link