[ad_1]

Cardano (ADA) and different cryptos accomplished two-month-long market doldrums characterised by record-low volatility ranges by dumping massively. The eighth-largest digital asset, with $9.2 billion in market capitalization has during the last 24 hours witnessed a big enhance in buying and selling quantity to $414 million because of the sell-off to $0.26.

Since the Securities and Exchange Commission (SEC) laid claims on ADA being a safety token, it has developed a noticeable correlation to XRP price.

When Ripple partially received the case in July, the place Judge Analisa Torres dominated that programmatic gross sales of XRP, reminiscent of these carried on third-party platforms like crypto exchanges are usually not securities, Cardano rallied roughly 32% from $0.278 to $0.367.

Investors abruptly began listening to tokens alleged to be securities by the SEC in June, together with the likes of Polygon (MATIC) and Solana (SOL). Their curiosity was grounded on the truth that a win for XRP would offer priority for tokens like ADA.

However, the SEC’s request to the court docket searching for to attraction part of the ruling that states that XRP just isn’t a safety was granted on Thursday, sending shockwaves in XRP markets, with declines amounting to over 20%.

In addition to the weakening crypto market construction, made worse by experiences that SpaceX has dumped $377 million of its BTC holdings, the SEC’s interlocutory movement contributed to the losses in Cardano.

Cardano Bears Face Exhaustion

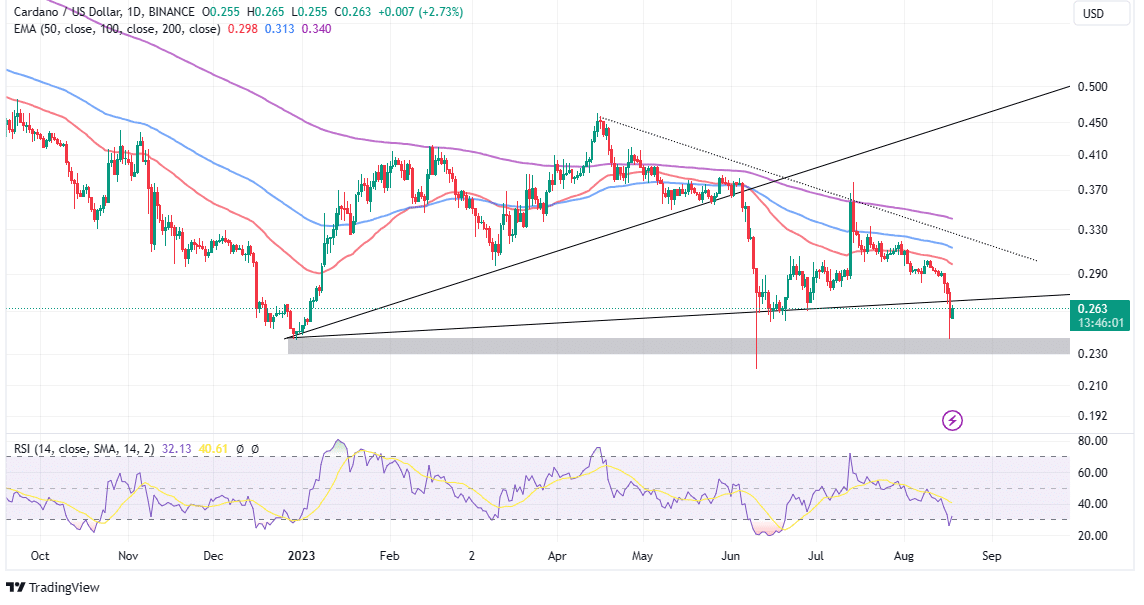

ADA price is again to the drafting board, and buying and selling ranges in early June round $0.26. If the present value motion is ignored, ADA has been on a downtrend since mid-April, following the New Year rally to $0.46.

The day by day chart exhibits sustained downward strain under a multi-month macro trendline the place makes an attempt to interrupt out have resulted in futility.

The ongoing retracement solely rolled again the good points accrued in June and July, because the long-term outlook of ADA value continued to weaken. As noticed, sellers pushed by way of the decrease ascending development line regardless of arresting the bearish scenario in June triggered by the SEC’s safety allegations.

Support at $0.24 got here in helpful, because it gave bulls an opportunity to stabilize the value earlier than planning on the subsequent plan of action. A interval of accumulation is anticipated between this help and the trendline resistance at $0.27.

Investors can be gauging the outlook of the remainder of the crypto market, particularly with the Federal Reserve insisted rate hikes, that are more likely to proceed regardless of the disinflation remarks made by the Chair Jerome Powell since June.

Traders would to any extent further be looking out for a break above two key ranges; the quick trendline resistance at $0.27 and the following hurdle at $0.3. If efficiently conquered, their consideration would shift to the macro downtrend proven by the dotted trendline, the place bulls can have a possibility to push for good points focusing on $1.

The Relative Strength Index (RSI) already exhibits ADA value is closely oversold. In different phrases, there’s a chance of a rebound occurring as traders guide their positions afresh. Losses under the gray band on the chart don’t appear possible within the short-term however some analysts believe that the crypto market might face one other dip earlier than the subsequent bull run begins.

Related Articles

The introduced content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link