[ad_1]

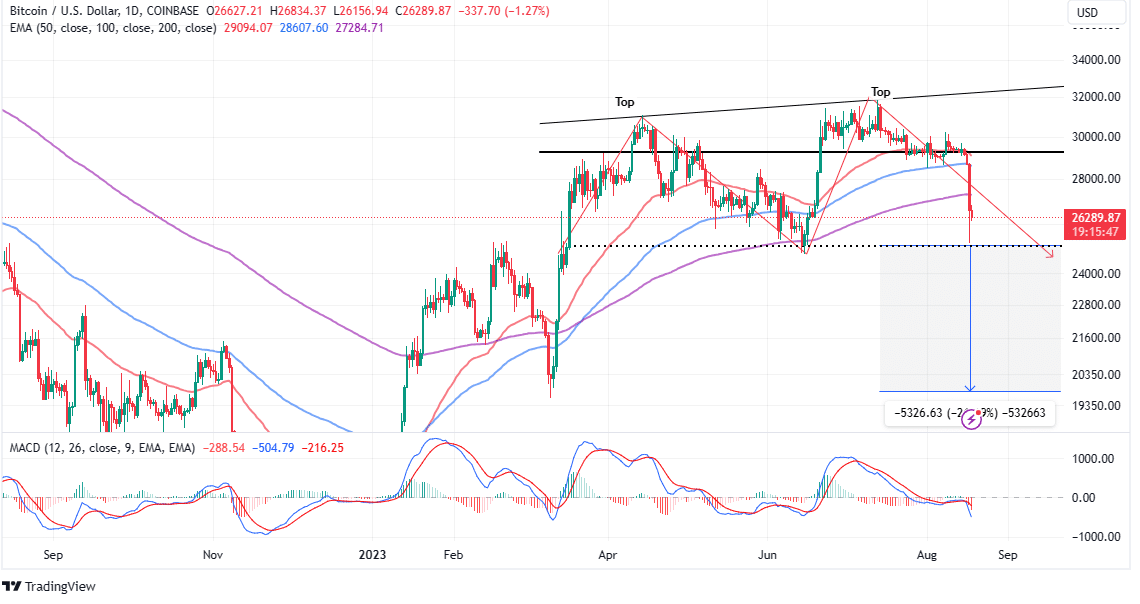

Bitcoin worth continued with the sell-off through the Asian enterprise hours on Friday, dropping almost 8% in 24 hours to $26,362. The most distinguished crypto has damaged out of the vary channel between $29,000 and $30,000 and examined ranges barely above $25,000. In the method of this decline, BTC worth would possibly validate a double-top sample and result in sub-$20,000 losses earlier than one other substantive rebound.

BTC Price Signals More Losses

Bitcoin broke out of its ranging channel, solely to set off a sell-off to ranges seen final in June. Indicators each micro and on-chain trace at a continued droop in costs with BTC price likely to drop to or under $20,000.

Crypto analytics platform CryptoQuant of their newest BTC market outlook stated that the open curiosity within the futures market “was showing the build-up of short positions since at least mid-July.” In different phrases, the open curiosity was rising whilst costs dipped from $32,000.

The Federal Reserve’s hawkish approach to inflation prompted a major lower in demand for Bitcoin within the US. According to CryptoQuant “the sell-off was preceded by a period of low demand” leading to a unfavourable Coinbase premium.

On-chain information additionally revealed that giant holders of BTC doubled down on their “spending exercise earlier than and through the sell-off. The failure of Bitcoin to interrupt resistance at $30,000 and maintain an uptrend, noticed many withdraw their lively consideration. Although whale spending elevated, it was not vital to show across the market.

Long-term holders of BTC might determine to maintain their positions intact, contemplating the Spent Output Value Bands present that elevated whale spending has traditionally preceded worth surges.

Bitcoin Sentiment In the Negative

The present sentiment in Bitcoin markets stays unfavourable with losses prone to lengthen under $25,000 through the weekend. Traders can be extra excited by shorting BTC versus betting on an instantaneous restoration.

Adding credibility to the unfavourable funding fee is the Moving Average Convergence Divergence (MACD) indicator, which reconfirmed the promote sign. This might have additional exacerbated the state of affairs, which @Onchained, a crypto analyst opined on Thursday that “the drop from $29.5k to $28.3k in BTC’s price brought the price closer to the realized price of short-term holders, considered a macro support.”

BTC worth had recovered to commerce at $26,200 on Friday forward of the European session. Investors can be watching the help at $25,000 keenly as a result of if damaged, they’ll put together for prolonged losses to sub-$20,000.

Price motion under $25,000 would validate a double-top sample, mentioned within the earlier BTC price analysis.

However, a rebound can’t be dominated out simply but, with some famend merchants like @DrProfitCrypto saying a restoration might start within the vary of $23.5k – $24k. Long positions entered on this area would goal revenue as Bitcoin recovers between $30,000 and $31,000.

Related Articles

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link