[ad_1]

Key Takeaways

- Last week noticed crypto suffered its worst 24 hours since FTX as over one billion dollars in derivatives had been liquidated on Thursday

- Derivative quantity outstrips the extraordinarily low spot quantity, with cascading liquidations having the potential to exacerbate value strikes

- Volatility was sparked by sell-off in the bond market

- Developments re-affirm how susceptible Bitcoin is in the short-term to the extremely uncommon macro local weather

Following an prolonged interval of relaxation in the crypto markets, the beast re-awakened final week. Crypto markets plummeted late Thursday and early Friday, led as at all times by Bitcoin. The world’s largest cryptocurrency shed 7% in what amounted to the biggest one-day drop since the spectacular collapse of FTX final November.

The 12 months 2023 has been characterised to this point by the bizarre incontrovertible fact that crypto’s rise has been sluggish and regular. Aside from a leap in March amid the regional financial institution disaster, Bitcoin has been perceptively devoid of the standard spikes and freefalls.

The Bitcoin value shows this clearly in the following chart, in addition to Friday’s journey south.

Digging additional into final week’s value drop reveals that, remarkably, Bitcoin fell 8% in simply ten minutes from 9:35 PM GMT on Thursday night. Looking at information from Coinglass, this contributed to a surge of liquidations. All in all, over one billion dollars was liquidated in what amounted to the most important day of liquidations since the FTX demise (anytime the phrase “since FTX” is used in crypto, it not often spells excellent news).

The flood of liquidations highlights how a lot higher the quantity was in derivatives markets than spot, with the latter remaining extraordinarily skinny. Order books have been perceptibly shallow ever since Alameda evaporated amid the FTX debacle (liquidity was skinny even earlier than then).

What induced the unload?

The underlying explanation for the volatility was a sell-off in the bond market, with yields spiking to multi-year highs. Yields on long-term US authorities debt neared their highest degree since 2007, UK 10-year gilts rose to their highest yield since 2008, and Germany’s 10-year bund reached its highest yield since 2011.

Higher yields spell hassle for threat property, as we’re effectively conscious by now, with Bitcoin despatched tumbling amid the tightening financial atmosphere final 12 months. The current transfer was borne out of traders betting that top rates of interest will persist for longer than beforehand anticipated, or additional hikes might not be as inconceivable as beforehand anticipated.

The inverse relationship between Bitcoin and yields has been robust, demonstrated in the beneath chart. Hence, Bitcoin’s drop is no surprise in the context of the developments in the bond market final week.

The sell-off reaffirms how susceptible Bitcoin is to a macro scenario that continues to perplex – excessive however falling inflation, whereas excessive rates of interest distinction with record-low unemployment and comparatively resilient financial information.

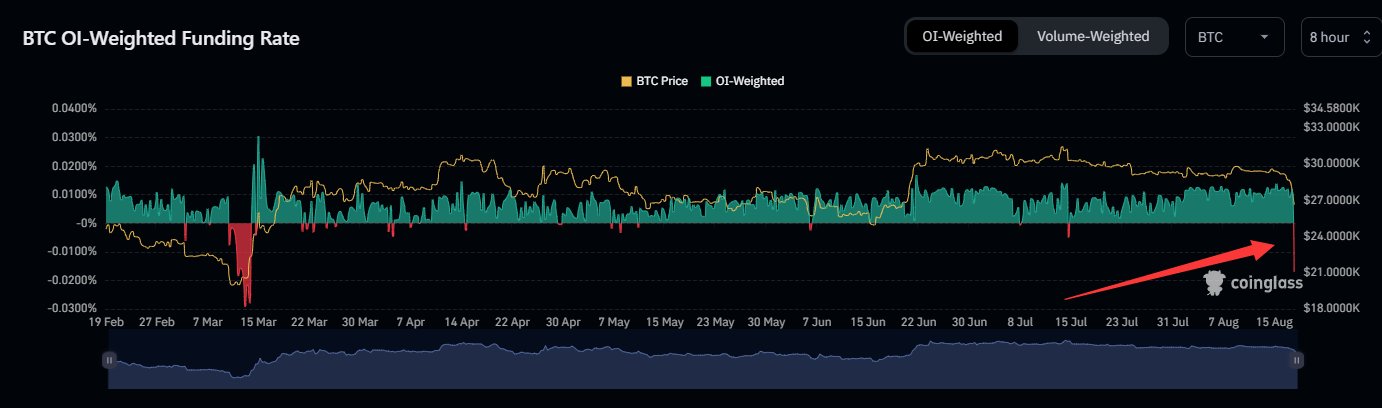

Getting again to the derivatives market, the shift was additional evident by taking a look at funding charges, with the Bitcoin OI-weighted funding charge dipping beneath -0.01% for the primary time since March.

Finally, adverse funding charges and freefaling open curiosity returned. It took a whereas, however volatility has returned.

What subsequent for crypto?

What this spells going ahead is up for debate. Some analysts affirm that is a mere blip, a drop sparked by complacent overleverage following a interval of calm that felt like eternally. A slight improve in hawkish sentiment going ahead gained’t in the end change a lot, they argue, for an economic system which appears more and more bold about reaching a tender touchdown.

On the opposite hand, some concern there may very well be a return to 2022-like situations. While that will appear excessive, there’s each change there’s a recalibration away from the borderline-celebratory stance that rate of interest hikes had been full and the tender touchdown was already assured.

If that had been the case, this might mark the tip of the bear market rally for crypto. Few property are as delicate to international liquidity as Bitcoin is, that means a reversion in the direction of the tightening seen final 12 months would undoubtedly spell purple candles on value charts.

This can be getting forward of oneself, nevertheless. The macro local weather stays largely unprecedented and really difficult to foretell. Even the Federal Reserve’s language betrays this, with some notable see-sawing in current conferences.

Last Wednesday, assembly minutes stated that there are “significant upside risks to inflation, which could require further tightening of monetary policy”. Going again to the assembly in July, minutes say that the Fed believed inflation was falling and dangers “titled to the downside”, with Jerome Powell asserting that “given the resilience of the economy recently, (the Fed is) no longer forecasting a recession”.

While these are usually not essentially conflicting – one can have inflation and tightening with out a recession, it’s simply fairly tough (however the place we have now been dwelling for the final eighteen months) – it does spotlight how unsure the entire local weather is.

Bitcoin is once more caught in the crossfire, a threat asset topic to the whims of the broader market because it grapples with this fast-changing atmosphere.

[ad_2]

Source link