[ad_1]

For many buyers, ETH worth is again to the drafting board, down 9.7% in every week to $1,664 on Tuesday.

The main good contracts token tumbled from assist at $1,800 final week amid a market-wide sell-off that noticed Bitcoin price drop from its vary assist at $29,000, earlier than in search of assist at $25,000.

Ethereum got here underneath heavy promoting stress, as merchants swiftly switched to brief positions that left many buyers liquidated.

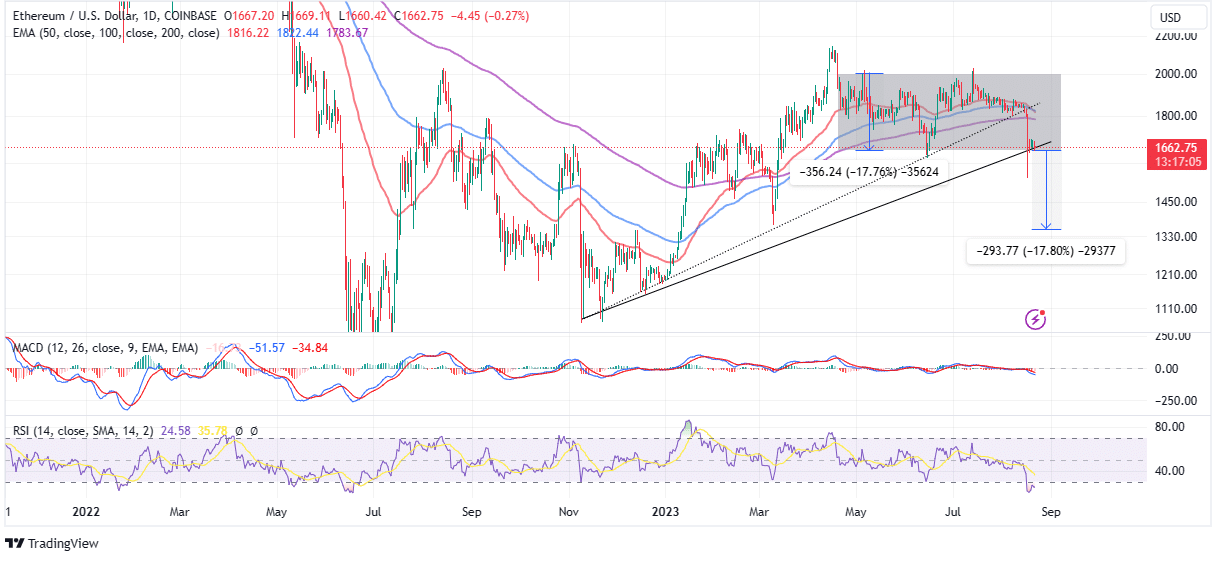

Support that had been anticipated within the area between $1,780 and $1,800 because of the presence of the 200-day Exponential Moving Average (EMA) did little to cease bears from pushing the worth decrease.

Trading beneath the higher dotted ascending trendline, which had supplied assist since November 2022, following the FTX alternate implosion enhanced the bearish sentiments, and thus inspired merchants to promote extra.

Although ETH price touched $1,545 during the descent, a knee-jerk response reclaimed assist at $1,600 aided by the decrease ascending trendline. This purchaser congestion stays vital for the resumption of the uptrend, whilst Ethereum dodders at $1,664.

ETH Price On The Cusp Of Another 17% Sell-Off

Ethereum has from April, following the Shapella upgrade rally to the 2023 highs of $2,144, been dealing with a weakening market construction. The tug of struggle between bulls and bears confined Ether in a rectangle sample, with resistance at $2,000 and assist at $1,650 – name it consolidation.

Within the rectangle, a slender vary shaped with Ethereum holding onto increased assist at $1,800. Following, the losses incurred final week, ETH worth now faces a crossroads:

A break beneath the rectangle assist at $1,650 may set off one other breakdown, the place Ethereum might drop 17.76% to $1,56. On the opposite facet of the fence, if this assist holds, bulls will seemingly be inspired to double down their efforts and push for a breakout above $2,000.

In the brief time period, the result is more likely to be bearish primarily based on the outlook exhibited by the Moving Average Convergence Divergence (MACD) indicator because it strikes additional beneath the imply line (0.00).

The Relative Strength Index (RSI), though in a sustained downtrend from the overbought area in early July, is just not fairly oversold. This means that sellers nonetheless have room to wiggle, pushing the worth additional down.

Uncertainty About the SEC’s Spot ETF Approval Dampens Crypto Markets

Investors are jittery on the subject of in search of extra publicity to crypto merchandise, as revealed by CoinShares’ digital asset investment products report.

Digital asset funding merchandise recorded outflows of as much as $55 million final week in comparison with $29 million in fund inflows within the earlier week.

Although the market-wide sell-off might have contributed to the dismal numbers in digital asset funding merchandise, the CoinShares report argued that it could be attributed to a “reaction to recent media highlighting that a decision by the US Securities & Exchange Commission in allowing a US spot-based ETF is not imminent.”

According to John Reed, a former SEC legal professional, the SEC is unlikely to approve a spot ETF. Reed cited insights from Better Markets who wrote a letter to the SEC urging the company to not approve any spot ETFs.

Will the SEC Approve Any Of The Recent Bitcoin Spot ETF Applications?

People usually ask for my opinion on whether or not the SEC will approve any of the latest spate of bitcoin spot ETF functions, which is an fascinating and vital query.

My take is that the present SEC will… pic.twitter.com/lPXebl03Y4

— John Reed Stark (@JohnReedStark) August 13, 2023

Although Bitcoin was essentially the most hit by the uncertainty surrounding the ETF approval, Ethereum noticed $9 million in outflows, which erased the $2.5 million it recorded within the week earlier than.

Crypto markets are more likely to stay on this dilapidated setting, particularly with the Federal Reserve contemplating extra fee hikes in September.

Related Articles

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link