[ad_1]

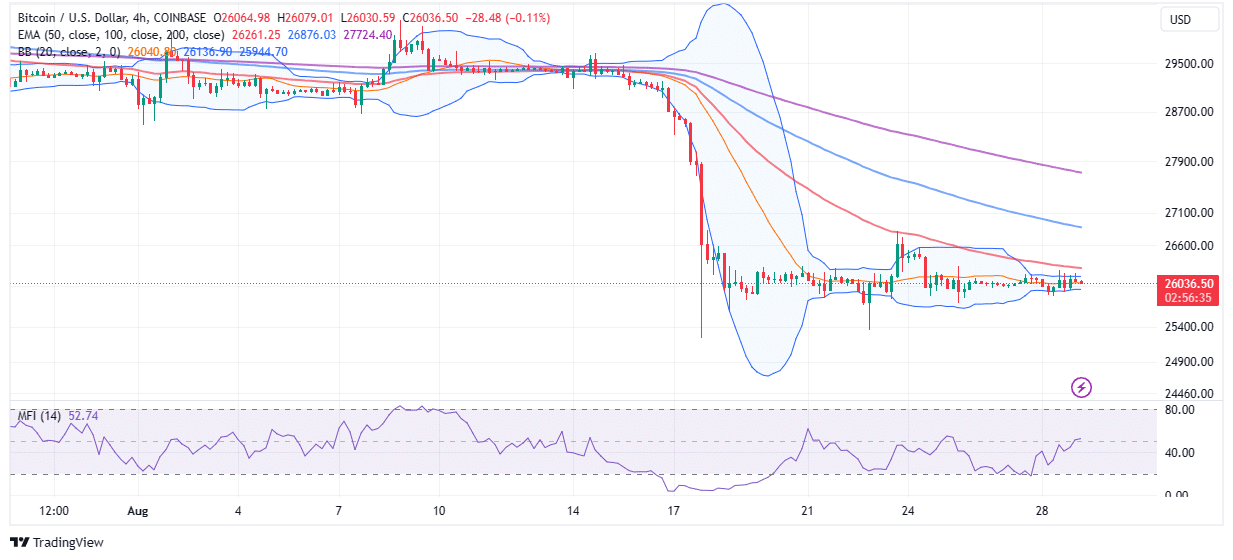

BTC value will not be bearish in direction of the top of the Asian enterprise hours on Tuesday, however it isn’t bullish both. The largest crypto, with $507 billion in market capitalization, has remained pivotal at $26,000 following a failed try to interrupt resistance at $27,000 late final week.

Another failed rebound might affirm rising issues available in the market that Bitcoin might should drop beneath $30,000 earlier than making a sound bid for highs above $30,000.

BTC Price Is Close To A Breakout

There are vivid indicators of a breakout approaching in BTC price based on the four-hour chart. The Bollinger bands indicator could be seen squeezing – an prevalence that always characterizes the interval earlier than a breakout.

The fundamental apprehension is that the breakout might begin out bearish with BTC value tumbling beneath $25,000 earlier than resuming the uptrend above $30,000.

Another downward swing would grow to be obvious if BTC value slips beneath the decrease Bollinger band restrict. In addition to jeopardizing the short-term assist, such a transfer would put extra stress on the subsequent purchaser congestion at $25,000.

A sustained break beneath the important $25,000 stage is more likely to improve the possibilities of losses stretching to $23,500, a area the place many merchants are more likely to search publicity to BTC whereas wanting ahead to a stronger climb past $30,000.

That mentioned, prolonged losses to $20,000 can’t be dominated out, particularly with market watchers already anticipating one other charge hike by the United States Federal Reserve. The speech by Fed Chair Jerome Powell final week indicated that there was a necessity for one more spherical of charge hikes.

The regulator’s hawkish stance on financial coverage relies on varied financial indicators considering indexes just like the Consumer Price Index (CPI), which prompt in August that inflation continues to be a problem.

In case of one other charge hike in September, Bitcoin would wrestle to carry above $25,000, thus considerably growing the likelihood of one other sell-off to $23,500 and if push involves shove $20,000.

Exploring The Hidden Bullish Case In BTC Price

Despite the drop to $25,000 assist almost a few weeks in the past, “larger volume holders show unwavering confidence,” IntoTheBlock, an on-chain analytics platform stories.

“There was a positive netflow for large holders of 24.08k $BTC on Aug 18 & 16.37k on Aug 23—right around the $26k mark.”

This along with the drop within the provide on exchanges as discussed in the previous BTC price analysis, reveals that investor sentiment continues to be optimistic and a restoration will happen earlier than later.

Bitcoin might abandon the anticipated drop below $25,000 if the Money Flow Index (MFI) holds the uptrend above the midline intact. The MFI compares the influx and outflow quantity of cash into the BTC markets. Therefore, an uptrend means that traders are able to throw their weight behind BTC value, betting on a right away rebound towards $30,000.

Some hurdles merchants ought to put together for embody the 50-day Exponential Moving Average (EMA) (pink) at $26,262, the 100-day EMA (blue) at $26,876, and the 200-day EMA (purple) at $27,724.

Related Articles

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link