[ad_1]

Ethereum, like its prime ten friends, is scuffling with charting its manner out of the August sell-off that noticed ETH price plunge to $1,580. The second-largest crypto holds above barely greater help at $1,630 following a failed restoration try above $1,700 final week.

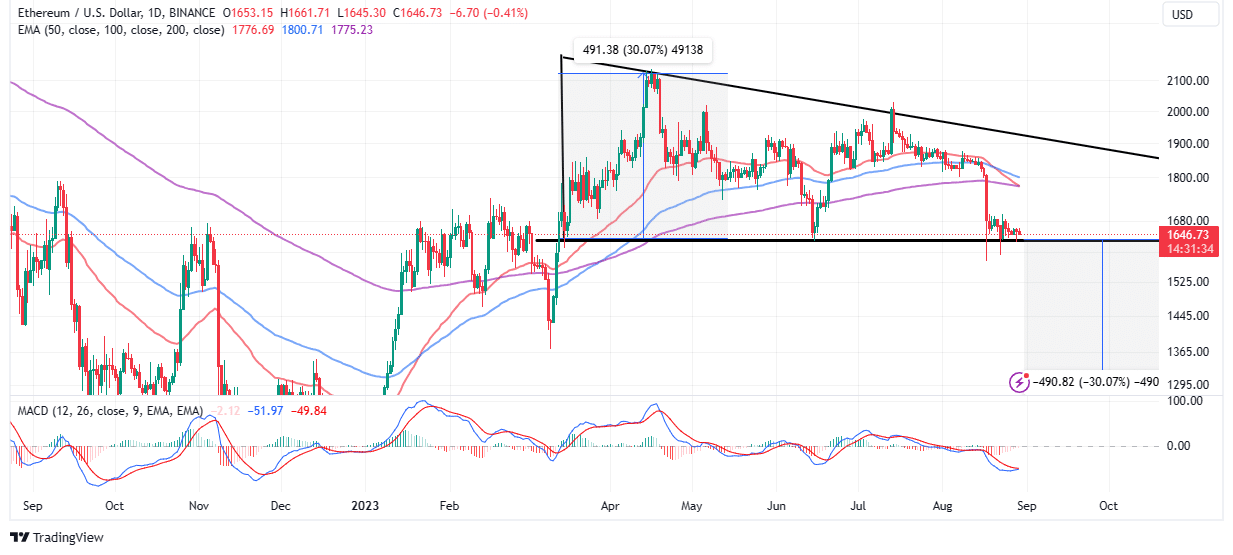

Up a mere 0.2% on Tuesday, Ether trades at $1,646 amid a constructing bearish pattern, with the potential of validating an prolonged downtrend to $1,140, contemplating the presence of a descending triangle sample.

ETH Price Sits At Breakout Zone

Ethereum has usually sustained a downtrend because the final bull run to $4,878 in November 2021. Within this crypto winter, there have been moments when ETH worth has pushed to reverse the pattern just like the rally in January and April 2023. The latter hit $2,125 as buyers embraced the Shapella improve, which marked the completion of the transition to a proof-of-stake mechanism.

Although bulls gathered rallied behind ETH in June, leading to an upswing to $2,000, a scarcity of momentum noticed the good contracts token trim positive aspects again to help between $1,600 and$1,630.

The technical image on the day by day chart presents a disquieting scenario, the place ETH worth may tumble 30% under the breakout level at $1,630 to $1,140.

A descending triangle sample as seen on the day by day chart may additional jeopardize Ethereum’s restoration, paving the best way for the downtrend to stretch to $1,140 earlier than ETH worth aligns with the anticipated uptrend into the bull market.

Traders should, nevertheless, anticipate the sample’s affirmation earlier than going all-in with their quick positions in ETH. It can be prudent to set off the promote orders as soon as the help on the triangle’s x-axis round $1,630 breaks.

Profit reserving could begin as Ethereum drops by way of potential help areas at $1,400 and $1,200. However, the triangle sample tasks a 30% drop from the axis to $1,140 which represents the peak of the sample extrapolated under the breakout level.

An incoming dying cross on the identical day by day chart may complicate the scenario additional for bulls, holding Ether from beginning the transfer to $2,000 and specializing in sweeping the ground for liquidity on the $1,140 help.

A dying cross types with a short-term shifting common just like the 50-day EMA (pink) in Ethereum’s case flipping under a longer-term shifting common such because the 200-day EMA (blue).

The path with the least resistance will more than likely stay downward as a result of dying cross in addition to the prevailing ETH worth place under all three shifting averages, together with the 100-day EMA.

Despite the bearish outlook, markets will not be set in stone and an reverse response to help at $1,630 may disregard the triangle sample breakout and permit for a right away rebound above $1,700 whereas bringing the coveted $2,000 degree inside attain.

That mentioned, it’s important to commerce rigorously protecting in thoughts a attainable purchase sign from the Moving Average Convergence Divergence (MACD) indicator. If the MACD line in blue completes the flip above the sign line in pink, ETH worth may quickly be on the restoration path eyeing $2,000.

Related Articles

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link