[ad_1]

BTC worth reacted positively to the landmark victory of the most important digital property funding supervisor, Grayscale Investments in opposition to the United States Securities and Exchange Commission (SEC).

The appeals courtroom rejected the SEC’s determination to cease the conversion of the corporate’s Bitcoin Trust product into an exchange-traded fund (ETF), following a reevaluation of its preliminary proposal.

Will BTC Price Climb to $30k or Drop To $25k

Crypto members within the US and the world at giant proceed to attend with bated breath for the SEC to approve the primary spot Bitcoin ETF. ETFs carry lots of weight in terms of the mainstream adoption of cryptocurrencies. They are a conduit for typical traders to dip their toes within the crypto verse, with out the necessity to maintain the underlying digital asset like BTC.

Despite Grayscale’s victory, the street to the first approval of a spot ETF is very uncertain and remains at the mercy of the SEC, which is predicted to resolve on seven extra proposals whose deadlines are available per week.

99.99999% of the world would not know that the SEC has to resolve on 7 BTC ETFs inside the subsequent 3 days:

-blackrock

-bitwise

-vaneck

-wisdomtree

-invesco

-fidelity

-valkyriethe fits at our doorstep

— odin free 🦇🔊 (@odin_free) August 29, 2023

On September 1, Bitwise, an funding firm, will know the destiny of its spot BTC ETF proposal. BlackRock, VanEck, Fidelity, Invesco, and WisdomTree are all ready for the SEC’s verdict for his or her funds – anticipated by September 2, as indicated in quite a few SEC filings.

Concurrently, Valkyrie is anticipating a response from the SEC about its utility by September 4.

Meanwhile, BTC worth jumped within the path of $30,000 following the appeals courtroom ruling after consolidating its August losses round $26,000 and the most important help at $25,000.

Some dimension context for why $GBTC is a giant deal.

The Grayscale Bitcoin Trust controls greater than 635k BTC.

That’s like 4.5 occasions the scale of MicroStrategy.

Simply put they dominate the ETF-like merchandise holding spot BTC by a giant margin. pic.twitter.com/5lhwJKhhKy

— ecoinometrics (@ecoinometrics) August 29, 2023

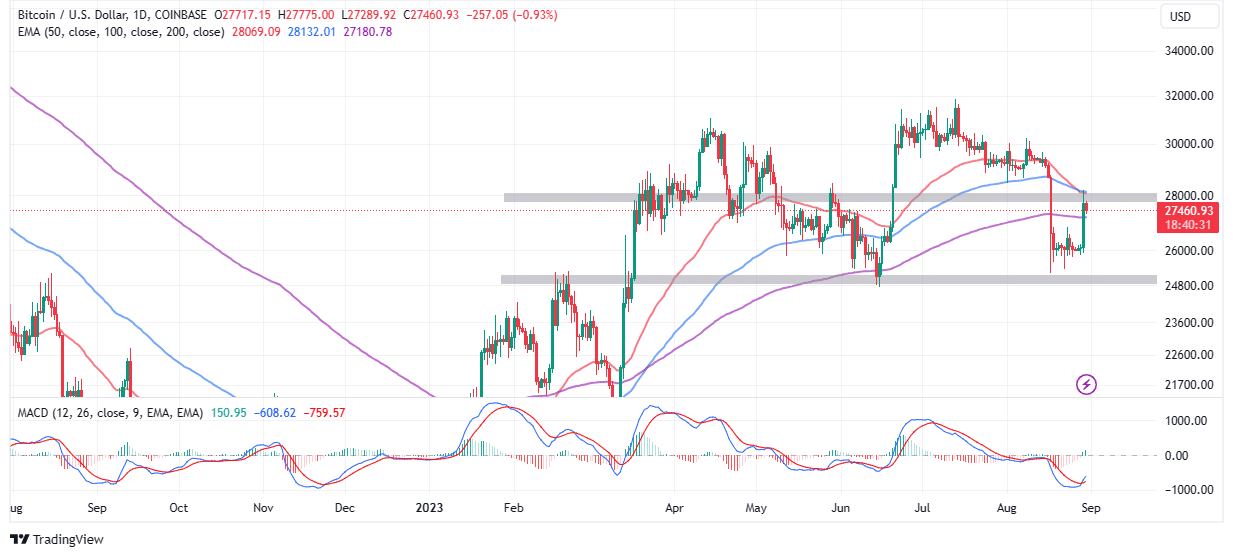

The largest crypto examined resistance at $28,000, bolstered by two indicators; the 50-day Exponential Moving Average (EMA) (purple) and the 100-day EMA (blue). Although up 5.2% to $27,420, Bitcoin has corrected from the weekly excessive of $28,280.

If traders proceed to heed the decision to guide recent positions in BTC forward of an anticipated climb above $30,000, the trail with the least resistance would follow the upside.

The Moving Average Convergence Divergence (MACD) indicator bolstered the bullish outlook with a purchase sign. Traders consulting this momentum indicator purchase when the MACD line in blue flips above the sign line in purple.

If traders missed out on the sudden rally from $26,000 to $28,230, they might wish to wait till BTC worth confirms a breakout above the confluence resistance of round $28,000. Such a transfer would function an assurance of sufficient momentum to see Bitcoin by means of $30,000.

Considering the weak market construction, traders must also put together for a believable correction again to $26,000 and presumably $25,000. At the identical time, September might not be an easy month for BTC price, particularly if the Federal Reserve within the US hikes rates of interest once more because it tightens its grip across the cussed inflation.

Additionally, there’s a chance of the SEC approving ETF proposals as a batch or suspending the choice to a later date. The former end result can be extraordinarily bullish for BTC worth whereas the latter might hold the market depressed, presumably paving the best way for losses to $20,000.

Related Articles

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link