[ad_1]

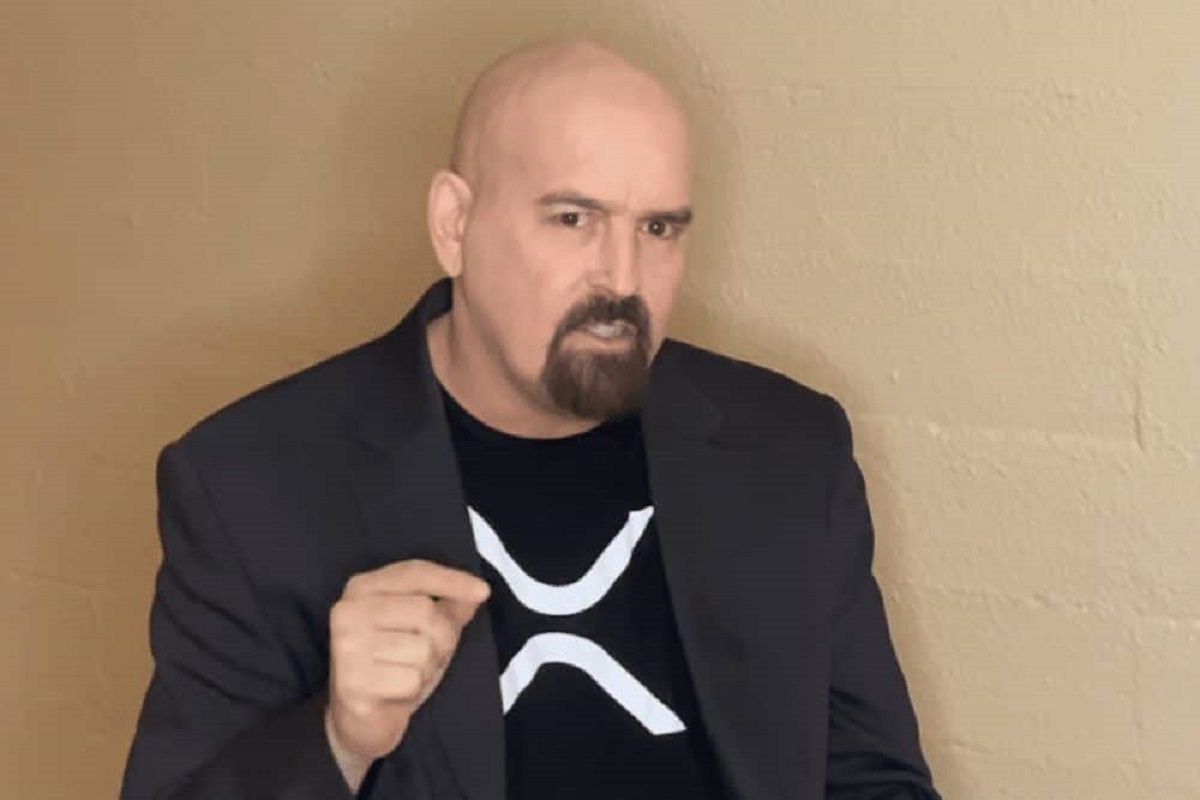

Pro-XRP lawyer John E Deaton has responded to the current U.S. Securities and Exchange Commission (SEC) determination to delay the approval of a Bitcoin exchange-traded fund (ETF) by international asset supervisor BlackRock. Deaton, referencing current statements by former SEC Chairman Jay Clayton, highlighted issues that regulators might prioritize institutional pursuits over retail entry.

Notice that Clayton says till the big establishments (eg BlackRock) provide it, we gained’t permit retail entry. He actually admits that’s the way it works within the United States. Now, after all, he couches all of it within the identify of investor safety, which I reject as bullshit. We are… https://t.co/Eb04fLuHhG

— John E Deaton (@JohnEDeaton1) September 1, 2023

US SEC’s History with Crypto ETF Approvals

The SEC’s hesitance isn’t new in relation to the cryptocurrency realm. In a squawk field interview, former SEC Chairman Jay Clayton acknowledged the obvious demand from retail and institutional traders for entry to Bitcoin. While Clayton agreed that Bitcoin isn’t categorised as a safety, the talk facilities on whether or not the money buying and selling market might be simply manipulated to a level that may preclude retail entry.

However, the tides could be turning with giant monetary establishments introducing surveillance mechanisms. These establishments are vouching for the legitimacy of the money market, suggesting that it’s now an applicable product.

Deaton’s Stance on Regulator Bias

Citing Clayton’s phrases, Deaton expressed frustration, insinuating that regulators within the U.S., below the guise of “investor protection,” could also be biased in favor of enormous monetary entities like BlackRock. He contends that by delaying selections like these, regulators would possibly try to govern crypto costs to learn these “incumbent friends.”

In his interview, Clayton emphasised the distinction between a Bitcoin futures product and a money product, hinting that this distinction may not be sustainable in the long term. Despite the SEC’s delay, he stays optimistic concerning the future, mentioning that the 45-day window for reconsideration isn’t a big delay within the broader context.

The rigidity between the necessity for regulatory prudence and market demand for Bitcoin ETFs continues to form the panorama. While the SEC’s determination to delay could be seen as a precautionary transfer, voices like Deaton’s are allegedly important in making certain that the pursuits of all market contributors, particularly retail traders, stay within the highlight.

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link