[ad_1]

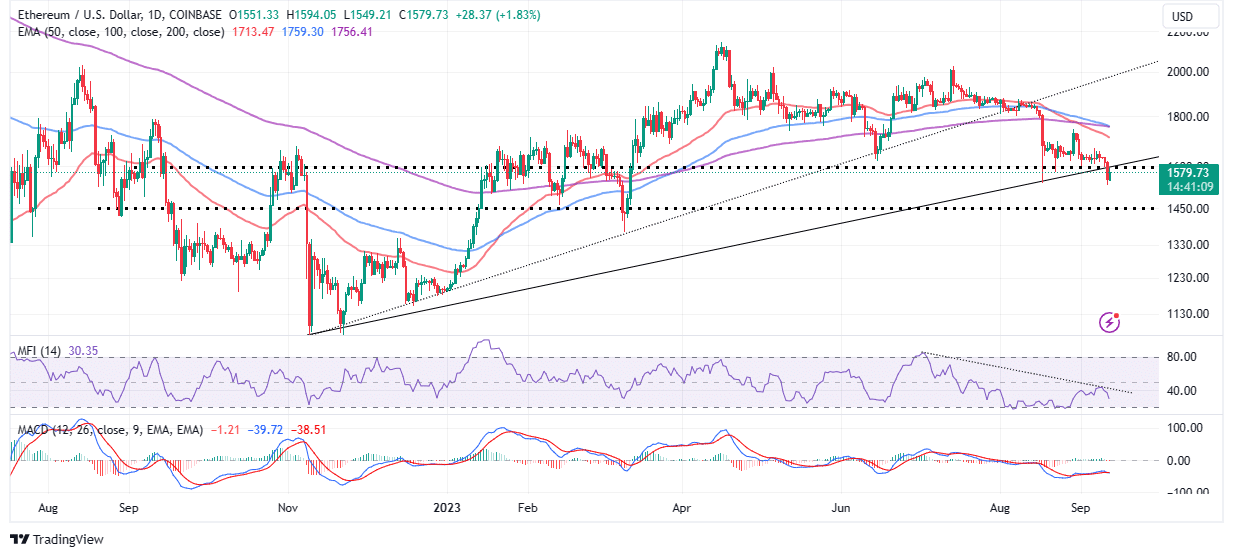

Ethereum value prolonged the down leg under the earlier assist at $1,600 – a transfer that noticed declines sweep by ranges seen final in March. The main good contracts token traded new weekly lows of $1,540 earlier than launching an ongoing rebound searching for to reclaim the bottom above $1,600.

Dormant ETH Finally On The Move

The sell-off on Monday additionally coincided with a spike within the motion of beforehand dormant tokens away from outdated wallets. According to the Age Consumed on-chain metric by Santiment, there was a noticeable enhance in probably the most dormant ETH over three months.

“A continued dip in mean $ age while prices drop is a capitulation sign, which foreshadows reversals.”

The rollback to March value ranges may appeal to extra lengthy merchants, who by profiting from the dips, are focusing on short-term earnings as ETH value rebounds to shut the hole to $2,000. This uptake of Ethereum means contemporary momentum is brewing for the subsequent rally, first above $1,600 then to $1,800, and later to $2,000.

A sustained break previous $2,000 may sign the beginning of a much-awaited bull market in 2024 going into 2025.

This present bullish outlook can’t be relied on till ETH price clocks highs above the decrease ascending trendline or closes the day past the pivotal $1,600 degree.

Upholding assist at $1,600 may assist ease the potential promoting strain more likely to observe the affirmation of a loss of life cross sample. This bearish chart formation happens with a short-term transferring common such because the 50-day EMA (crimson) crosses under a long-term one just like the 200-day EMA (purple).

The loss of life cross provides credence to the bearish outlook, implying that sellers have the higher hand and the continued downtrend is way from over.

Unless traders put the concern of uncertainty apart and rally behind Ethereum, the Money Flow Index (MFI) will drop into the oversold area, which is able to validate one other sell-off to $1,450.

Will ETH Price Drop To $1,000 Before The Bull Market?

Analysts at Matrixport in their latest report on the efficiency of altcoins, stated that “with Ether being close to the psychologically important $1,600 level, a break could carry prices lower, especially as revenue growth disappoints.”

The longer the value stays under the $1,600 degree, the upper will enhance the possibilities of one other sell-off trimming positive factors and forcing traders to capitulate. Matrixport believes it’s too early to rule out a possible drop to $1,000 – “a level that would appear justified based on the revenue projection from the Ethereum ecosystem.”

Related Articles

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link

✓ Share: