[ad_1]

ETH value strengthened the bullish outlook from the start of this week with features exceeding the present assist at $1,600. This bullish comeback may be attributed to sentiment surrounding the Franklin Templeton spot BTC ETF filing. Franklin is a $1.5 trillion asset administration agency and its curiosity within the crypto market has been perceived to be constructive.

ETH Price Comeback Stalls – What To Expect

The largest good contracts token had plunged to $1,531, revisiting ranges seen six months in the past in March earlier than making a pointy rebound to $1,640. While the US Consumer Price Index (CPI) data got here out unfavorable, it didn’t destabilize the crypto market.

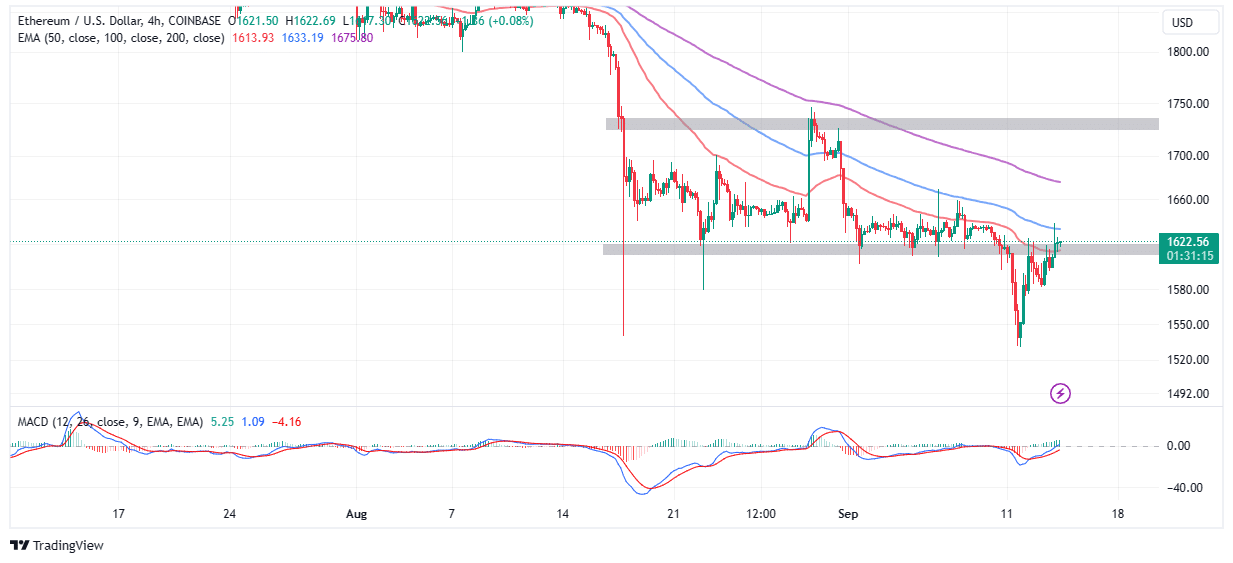

Due to the dearth of momentum to nurture the continued restoration to $1,800 after which to $2,000, Ethereum live price holds between a rock and a tough place. On the upside, the 100-day Exponential Moving Average (EMA) serves as a significant boundary at $1,633, with the 50-day EMA proving short-term assist at $1,613.

A break both above or beneath the transferring averages would both validate features to $1,800 or set off one other sell-off beneath $1,600, the place ETH value could also be pressured to hunt aid at $1,531.

Traders ought to think about holding their lengthy positions in Ethereum as long as the price is above $1,600. The Moving Average Convergence Divergence (MACD) indicator is solidifying the bullish narrative with a purchase sign. Recovery above the imply line (0.00) into the constructive area may additionally name extra merchants to purchase ETH, constructing the momentum for a rally.

Ethereum Network Activity Spikes

Ethereum noticed the largest enhance within the variety of distinctive addresses transacting on the community on Wednesday – the second highest in eight years. According to the on-chain analytics platform Santiment, addresses transacting on the protocol rose to 1,089,893.

“This historic anomaly could be the capitulation signal needed for prices to rebound.”

A spike within the distinctive addresses transacting on Ethereum is usually thought-about a bullish sign. Solldy, an analyst who shares his view of ETH price and other cryptos on Tradingview believes that:

“The downward momentum has slowed down. The chart confirmed the current support level several times. The volumes of trades decreased even more. I believe that Ethereum is preparing for growth, which will start only after overcoming the resistance level.”

The short-term assist at $1,600 stays crucial to ETH value. It is the crossroads that can decide if Ethereum rallies above $2,000 from the prevailing stage or sweeps by means of decrease ranges at $1,531, $1,450, or $1,000 earlier than the run-up into the bull market begins.

Related Articles

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link

✓ Share: