[ad_1]

In current days, Bitcoin has proven indicators of a possible reversal, with the cryptocurrency charting three consecutive inexperienced each day candles. The final time such a sample was noticed was early July and between mid and late June, when Bitcoin rallied from slightly below $25,000 to over $31,000. This shift in value dynamics has led to a change in market sentiment, with the bearish outlook slowly giving option to a extra bullish perspective.

While Bitcoin has efficiently averted the affirmation of a double prime on the 1-week chart fo the second, this value motion has fueled discussions amongst analysts about the opportunity of Bitcoin forming a double backside sample, a big technical indicator.

Bitcoin Double Bottom In The Making?

A double backside is a basic technical evaluation sample that signifies a possible pattern reversal from bearish to bullish in markets. It is characterised by two distinct troughs or lows within the value chart, separated by a peak or a minor excessive in between. The sample resembles the letter “W,” with the primary trough indicating a big low, adopted by a brief rebound, after which a second trough, normally close to the identical value stage as the primary. A legitimate double backside is confirmed when the worth breaks above the height or resistance stage between the 2 troughs, signaling a possible upward pattern reversal.

Rekt Capital, a famend crypto analyst, not too long ago shared his insights suggesting that Bitcoin’s present value sample within the weekly chart resembles a double prime, which usually signifies a bearish reversal. This sample is characterised by an ‘M’ form. However, for this to be confirmed, the worth would wish to interrupt down from the $26,000 help. At press time, Bitcoin was buying and selling at $26,618, efficiently warding off the double prime validation in the intervening time.

On the flip facet, a double backside, which varieties a ‘W’ form, would require Bitcoin to rebound from the $26,000 mark and tweeted right now, “Could this BTC Double Top actually be a Double Bottom? And the simple answer is – technically, yes. […] But for BTC to form a Double Bottom, it would need to rebound from $26k and rally to $30.6k (which is its validation point).”

He additional highlighted the challenges Bitcoin faces, noting the uncertainty surrounding the $26k help stage and the quite a few confluent resistances forward, which could hinder the completion of the double backside formation. Rekt Capital elaborated on the importance of the $26,000 stage, tweeting, “It looks like BTC may be choosing the ‘relief rally’ route first in an effort to potentially turn old support into new resistance. The black Monthly level (~$27,200) is approximately confluent with the Bull Market support band as well.”

He additionally pointed to Bitcoin’s current bearish month-to-month candle shut for August, emphasizing that Bitcoin closed beneath roughly $27,150, thereby confirming it as a misplaced help. Therefore he warns that the present value transfer by Bitcoin may solely be a reduction rally to verify $27,150 as new resistance earlier than dropping into the $23,000 area.

“It’s possible BTC could rebound into ~$27,150, maybe even upside wick beyond it this September. […] $23,000 is the next major Monthly support now that ~$27150 has been lost,” he remarked.

More Resistance Levels For BTC Price

So it’s clear that BTC has a serious resistance stage of $27,150 to interrupt earlier than the bulls may even dream of confirming a double backside sample. But there are additionally different key resistances to beat earlier than $30,600 may be breached and the double backside confirmed.

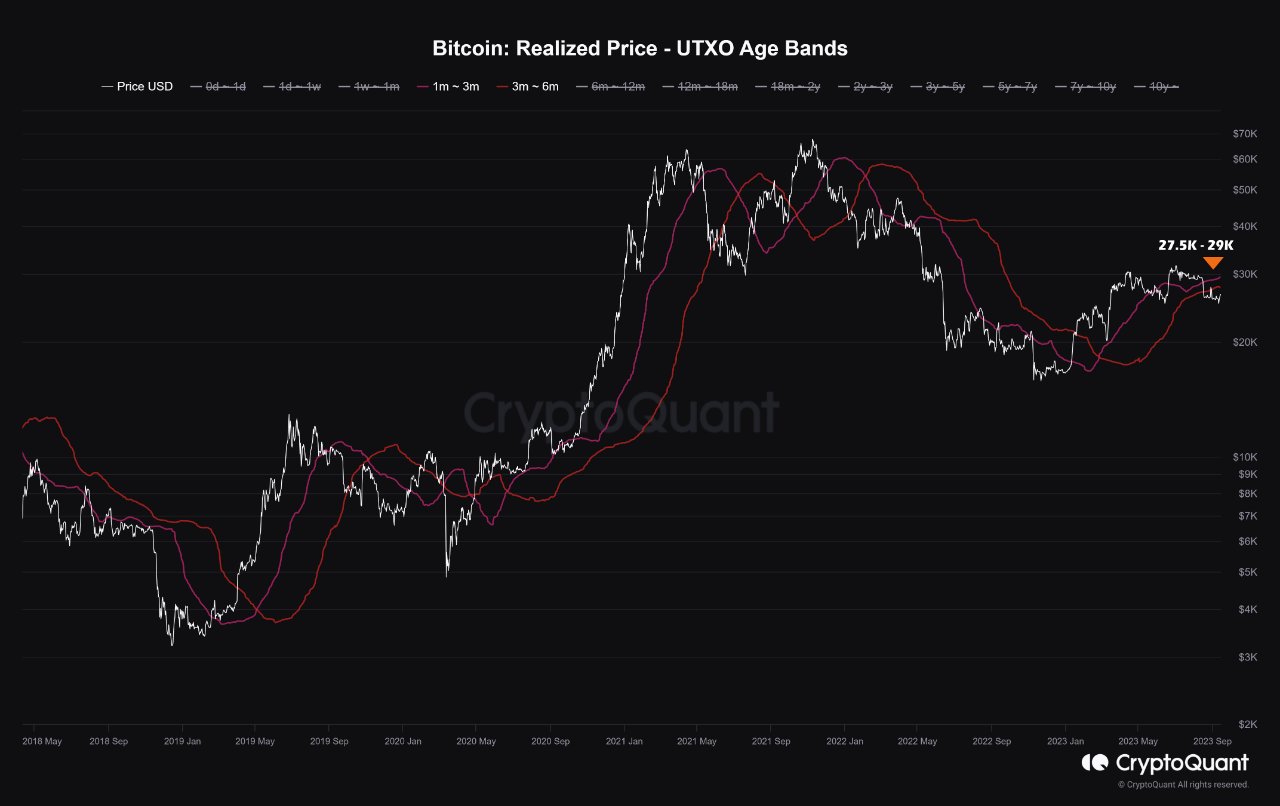

On-chain evaluation agency CryptoQuant emphasized the position of short-term Bitcoin holders, who typically present the liquidity for important value actions. According to their information, the break-even value for these holders lies between $27,500 and $29,000. If Bitcoin stays beneath these ranges for an prolonged interval, these holders may be incentivized to promote, probably exerting downward strain on the worth:

The extra time we spend beneath these value ranges, the extra incentive there can be to exit liquidity from the market, and the premise situation for the return of the upward pattern of Bitcoin is determined by the worth soar above the short-term realized costs.

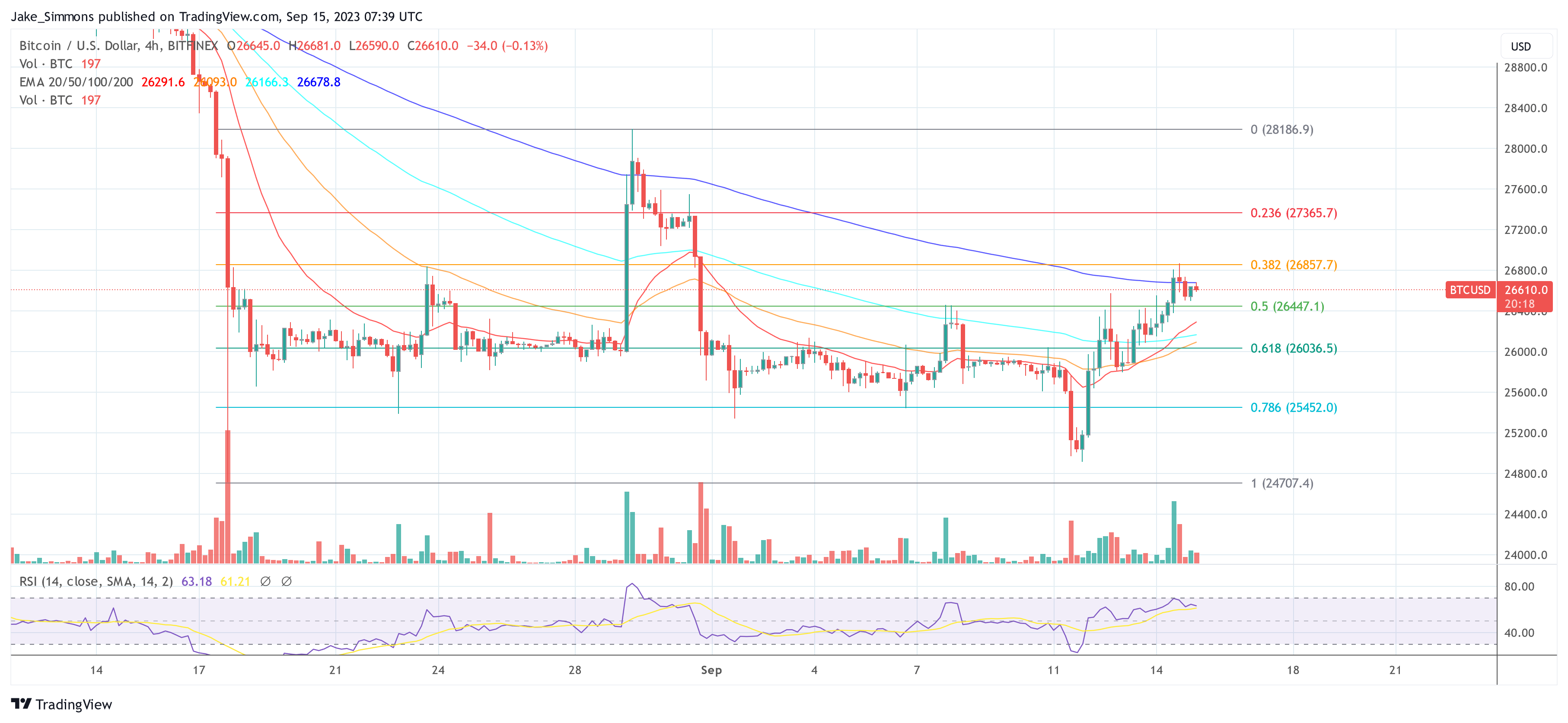

On the 4-hour timeframe, BTC wants to beat three main resistances: $26,857 (38.2% Fibonacci retracement stage), $27,365 (23.6% Fibonacci retracement stage) and $28,186 (post-Grayscale excessive from August twenty ninth).

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link