[ad_1]

Bitcoin worth strengthened the bullish outlook available in the market on Monday, blasting previous resistance at $27,000 earlier than coming to a sudden cease at $27,000. Due to this outstanding climb, sentiment improved for many cryptos, beginning with Ethereum reclaiming the ground above $1,600 however stalling at $1,650.

Other prime altcoins like XRP, Cardano, and Toncoin are performing impressively, posting beneficial properties of three%, 2.5% and 4.5%, respectively. The whole market capitalization has additionally elevated by 1.4% to $1.1 trillion, implying that bulls are taking again the reins.

Bitcoin Price Gearing Up To Conquer 27k Resistance

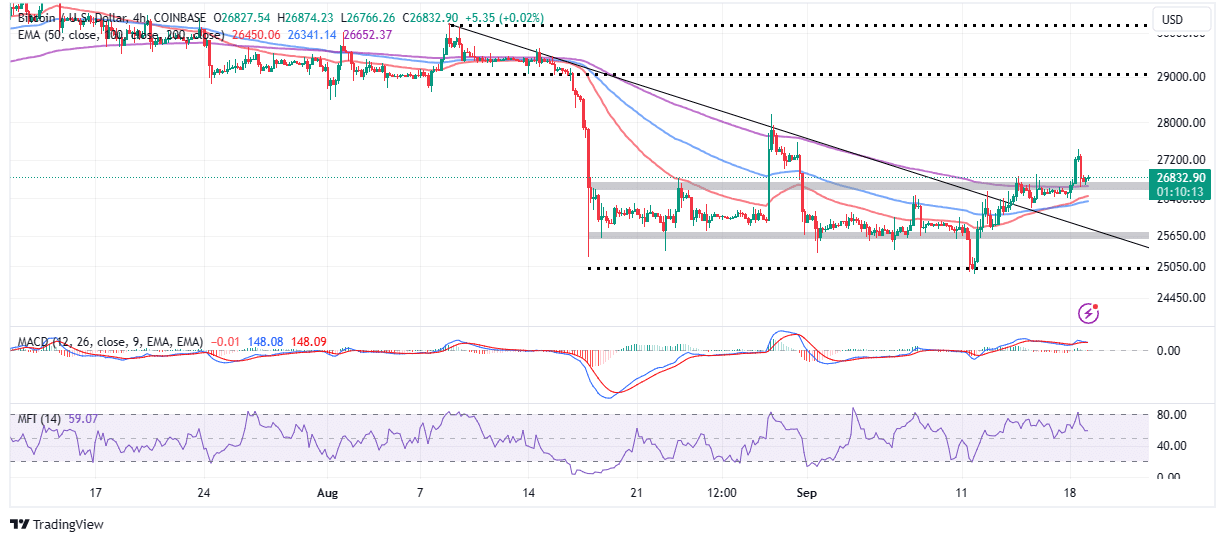

BTC worth revered the bearish fractal as mentioned within the previous price analysis. Due to the vendor congestion at $27,200, Bitcoin price slipped beneath $27,000 assist/resistance and is at the moment buying and selling at $26,830.

Support on the quick draw back has been offered by a confluence created by the higher vary channel boundary and the 200-day Exponential Moving Average (EMA) (purple) at $26,652.

The sideways development within the Moving Average Convergence Divergence (MACD) indicator exhibits that bulls had management briefly however faltered on Monday searching for increased assist to gather extra liquidity and construct momentum for a considerable breakout above $27,000.

Analysts and merchants like @CryptoFaibik consider that the time has come for bulls to completely take the reins and “conquer the $27k resistance.” He added that “if bulls succeed” traders ought to anticipate a rally aiming for the $31.800 resistance.

However, if the resistance at $27,000 stays cussed, a rejection would imply that BTC worth could revisit the following main assist space at $25,000.

Holding firmly onto the quick assist at $26,652 which coincides with the vary resistance have to be the bulls’ precedence over the following classes. If promoting stress peaks up probably because of a spike in profit-booking actions amongst short-term merchants, a promote sign from the MACD could come into play.

The potential bearish outlook coupled with the adverse move of funds into BTC markets primarily based on the downward development within the Money Flow Index (MFI) would imply that the mini pump to $27,200 is unsustainable.

The 50-day EMA (purple) and the 100-day EMA (blue) are in line to offer assist at $26,448 and $26,340 within the occasion Bitcoin is rejected from the $27,000 resistance.

Bitcoin Whales Accumulating

The crypto market is coping with combined indicators, bearish and bullish sentiments all at the identical time. Some folks consider Bitcoin bottomed at $15,000 and is awaiting a catalyst to rally into the bull run, whereas others say one other dip to $22,000 is probably going earlier than the following main reversal begins.

Whales, then again, proceed to take the chance to purchase Bitcoin, contemplating addresses with 1 – 10k BTC account for 66% of the quantity to change inflows. According to CryptoQuant a rise within the Coinbase Premium Index reveals “accumulation in the spot exchange” is on the rise.

The open curiosity within the futures market, which is at the moment above $1 billion confirms a constructive funding charge and subsequently “the predominance of long traders and an optimistic sentiment.”

Related Articles

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: