[ad_1]

Bitcoin value bulls are coming again stronger following a rejection from resistance at $27,200 earlier within the week. Investors are keenly watching to see whether or not BTC will settle above $27,000 and maintain rallying to $31,000 or drop in search of extra liquidity from the main assist at $25,000 and if push involves shove stretch the down leg to $22,000.

How Will Bitcoin React To The FOMC Meeting?

The crypto market is looking out for the result of the Federal Open Market Committee (FOMC) assembly on Wednesday amid considerations over doable ramifications for Bitcoin value and the remaining of the crypto market.

Economists, according to Reuters anticipate the Federal Reserve to pause rate of interest hikes for the second time this 12 months whereas holding the course open for future will increase earlier than the top of the 12 months. The Federal Reserve benchmark rates of interest at present vary between 5.25% and 5.5%.

Remarks from previous FOMC conferences confirmed that after the primary pause in June, the Fed anticipated two extra fee hikes to struggle the persistent rise in inflation earlier than the 12 months ends. The first hike occurred in July with market watchers suggesting a skip over September earlier than the regulator considers the second hike.

Bitcoin has continued to regular the uptrend for the reason that launch of the August Consumer Price Index (CPI) information, which confirmed inflation was slowing. However, value will increase attributed to the rise in the price of crude oil ship blended indicators with most committee members seeing “important upside danger to inflation.

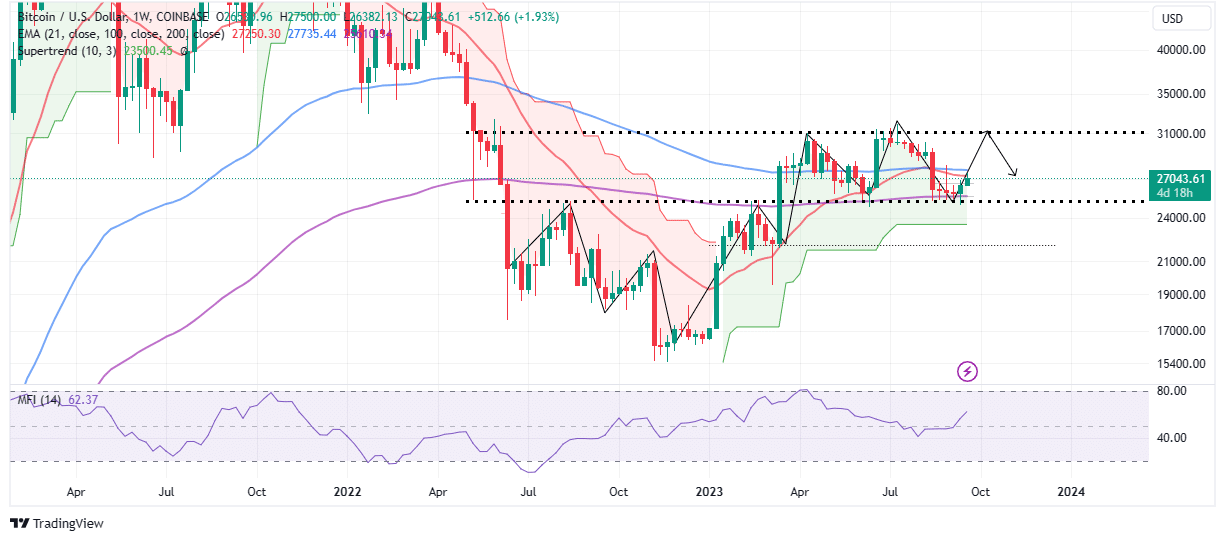

Meanwhile, the weekly chart reveals the Bitcoin fractal discussed earlier in the week taking part in out. Rejection from resistance at $27,200 resulted in a fast retracement under $27,000 however the higher vary restrict served as assist, permitting BTC value to comb by contemporary liquidity and reclaim the $27,000 assist.

The 200-weekly Exponential Moving Average (EMA) (purple) at $25,609 is a sign that Bitcoin’s market construction is bettering. If bulls flip the 21-week EMA (pink) and the 100-week EMA (blue) into assist, a breakout to $31,000 may ensue earlier than the following fractal pushes the value under the $30,000 stage.

Key pattern indicators such because the SuperTrend and the Money Flow Index (MFI) affirm the bullish grip. The former gauges market volatility whereas the MFI compares the quantity of cash flowing out and in of BTC markets.

As lengthy because the SuperTrend is trailing Bitcoin price whereas offering assist and the MFI upholds the uptrend towards the overbought area, the chances will probably be in favor of a bigger uptrend.

Bitcoin Institutional Adoption On The Rise?

Interest amongst institutional buyers has continued to develop regardless of the crypto winter leading to a number of capitulations. Driving this curiosity is the push for a spot Bitcoin exchange-traded fund (ETF), which has attracted main world companies like Blackrock, Fidelity Investments, and Franklin Templeton amongst others.

Santiment believes that the launch of an Adoption Fund for institutional investors by Nomura, Japan’s largest financial institution boosted Bitcoin’s ongoing value motion above $27,000.

🏦 #Bitcoin obtained a lift to $27.2K after Japan’s largest funding financial institution, #Nomura, launched an Adoption Fund for institutional buyers. This is the newest in #crypto‘s efforts to extend publicity for events past conventional merchants. https://t.co/ylDEDG9ehY pic.twitter.com/qDau3TzlEB

— Santiment (@santimentfeed) September 20, 2023

The enhance within the quantity of establishments searching for publicity to Bitcoin is anticipated to have a long-term optimistic affect on the value. However, within the short-term, another insight from Santiment reveals that “whales have been dropping stablecoins” – a scenario that might stifle the uptrend since “their buying power isn’t as strong as when Bitcoin was above $30k back in June.”

The stablecoin provide held by whales with a stability of greater than $5 million now stands on the lowest stage within the final six months. For a considerable upswing in Bitcoin value to play out, these whale addresses should enhance the provision they maintain.

Related Articles

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link

✓ Share: