[ad_1]

Ethereum value has steadied its bullish outlook this week regardless of worrying sentiments over a big switch of the main good contracts token to a serious trade. After bagging 3% in beneficial properties during the last week, ETH trades at $1,634 on Wednesday.

The crypto market, which has surprisingly sustained a constructive outlook, with Bitcoin soaring by 5% to trade at $27,156, is awaiting for the choice on the September financial coverage from the Federal Open Market Committee (FOMC) assembly.

Ethereum and Bitcoin have lined appreciable upside floor because the launch of the United States Consumer Price Index (CPI) per week in the past, which revealed that inflation was nonetheless a problem.

An rate of interest hike is the most certainly possibility because the Federal Reserve seeks to curb the skyrocketing inflation primarily brought on by a persistent enhance in international crude oil costs.

On the opposite hand, the crypto market has over the previous couple of months proven commendable resilience in opposition to rate of interest hikes. Hence, traders are more likely to hold a constructive outlook whatever the end result of the FOMC assembly.

The Odds Of Ethereum Price Rallying To $3,325

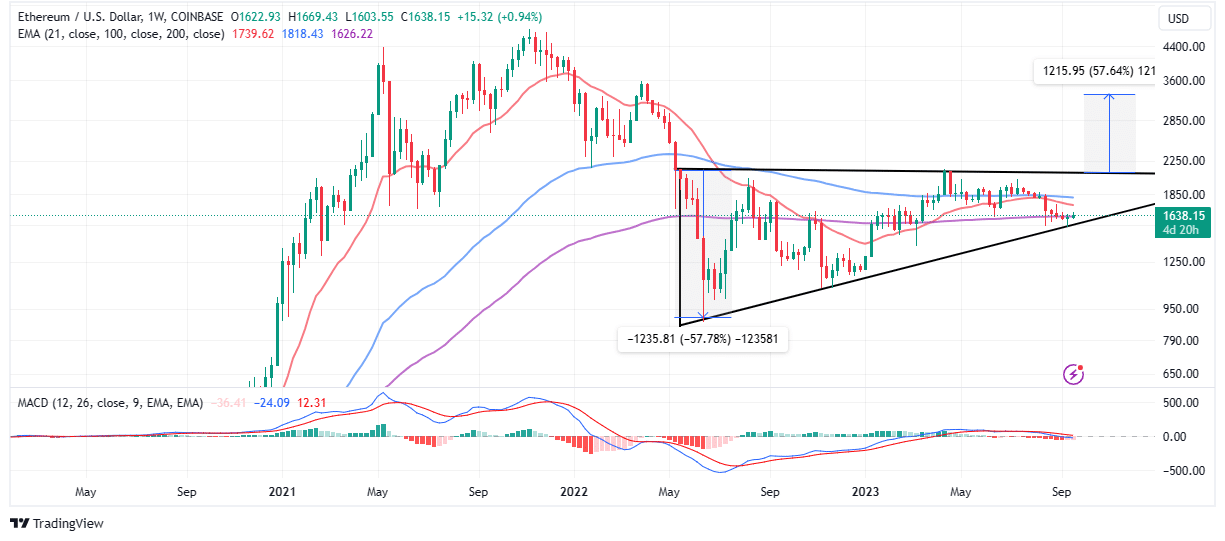

Ethereum price bulls face one essential stumbling block between $1,650 and$1,700. A profitable break and maintain would affirm the breakout to $1,800 and subsequently set off a shopping for spree as a consequence of an enhanced market construction for beneficial properties previous $2,000.

According to the weekly chart, ETH now sits on prime of one of many bullish market indicators; the 200-weekly Exponential Moving Average (EMA) (purple) at $1,626. Every time Ethereum value breaks above this stage, a rally ensues earlier than profit-booking actions dampen the uptrend.

Traders should, nevertheless, notice that the 200-weekly EMA shouldn’t be sufficient to launch Ethereum price into the anticipated rally. Therefore, it should be a collective effort among the many bulls to defend the assist at $1,600 and push for the repossession of the 21-weekly EMA (purple) and the 100-weekly EMA (blue).

With all three transferring averages serving as assist, bulls could have an opportunity to push for a bigger breakout above a forming ascending triangle sample.

A breakout from this sample would happen after ETH value pushes above resistance at $2,100. It could be accompanied by a spike in quantity, calling for purchase orders positioned above the resistance.

The breakout goal, 58% to $3,325 is the space equal to the peak of the triangle extrapolated above the breakout level.

Some merchants could need to affirm the rally with a purchase sign from the Moving Average Convergence Divergence (MACD) indicator. Such a name manifests with the blue MACD line crossing above the purple sign line and the momentum indicator typically slopes upward.

Large Holders Send ETH To Exchanges

On-chain transaction trackers have revealed a pattern the place whales aka large holders are sending large amounts of ETH to exchanges. Ethereum price roughly $60 million has made it from fairly dormant wallets to trade platforms amid fears of the impression the transfers could have on the value.

Ethereum co-founder Vitalik Buterin is reported to have transferred 300 ETH price roughly $492,000 to the Kraken trade on Tuesday. Although this single transaction won’t impression ETH value, it has spurred discussions amongst lovers, contemplating Buterin’s place locally.

Another notable switch price round $50 million was deposited to a number of exchanges together with OKX, Binance, and KuCoin during the last 5 days, based on the blockchain information tracker Lookonchain.

A whale that had been dormant for two years wakened 4 days in the past and transferred 10K $ETH ($16.5M) out.

Then deposited 10K $ETH($16.5M) to #Binance, #OKX and #KuCoin through 3 addresses prior to now 4 days.

And the whale transferred 10K $ETH ($16.5M) out once more simply now. pic.twitter.com/YhuIJegPtv

— Lookonchain (@lookonchain) September 19, 2023

That’s not all, there was one other transaction price $10 million to Kraken by a crypto pockets that participated within the protocol’s ICO 9 years in the past.

A whale deposited 6,000 $ETH ($9.96M) into #Kraken 50 minutes in the past.

This whale is an Ethereum ICO participant, receiving 254,908 $ETH($422.6M presently), the ETH ICO value is ~$0.31.https://t.co/f0Ob9tqPqc pic.twitter.com/n3aj96tA31

— Lookonchain (@lookonchain) September 18, 2023

Transfers to exchanges usually imply that traders are on the brink of promote, which explains the spike in hypothesis over the latest whale transfers.

Related Articles

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: