[ad_1]

Ethereum (ETH), a big participant within the crypto house, has lately come beneath scrutiny on account of some regarding on-chain actions.

Notably, the variety of addresses holding vital quantities of Ethereum has declined, and a few long-term holders look like liquidating their positions, doubtlessly posing threats to Ethereum’s worth.

Whale Watch: A Steep Decline In Ethereum Holdings

On-chain analytics have been instrumental in providing real-time insights into crypto market traits. Recent revelations have highlighted a downturn in Ethereum’s holding patterns which may have deeper implications for the digital asset’s worth and the market.

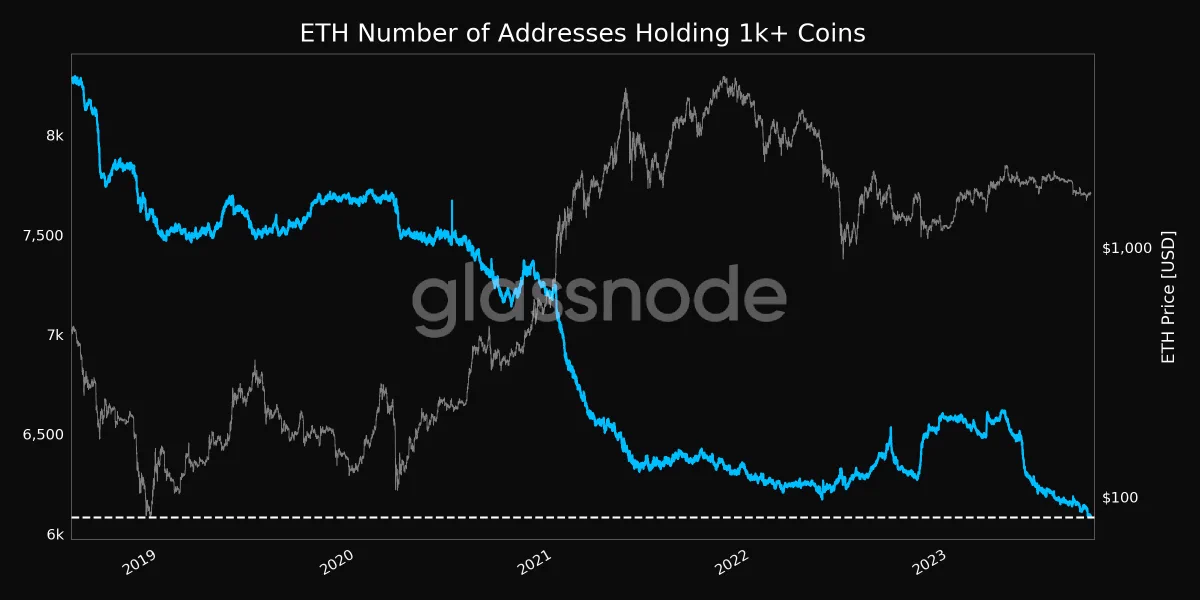

According to Glassnode, a number one on-chain analytic platform, the variety of addresses holding 1,000 Ethereum (ETH) cash or extra has plummeted to a 5-year low.

Precisely, these addresses, usually termed ‘whale addresses’ within the crypto world, have decreased to six,082. Such a pointy decline could be attributed to the liquidation actions of a few of Ethereum’s long-term holders.

It is value noting that this contraction in whale holdings might doubtlessly enhance the susceptibility of Ethereum to market bears, doubtlessly initiating a downward value trajectory.

The impression of such gross sales in the marketplace is obvious. When giant portions of a cryptocurrency, reminiscent of Ethereum, are offloaded, it usually results in a substantial inflow of promoting strain. This could cause panic amongst smaller buyers, prompting additional gross sales and probably resulting in a value drop.

Additional Pressures From Dormant Wallets

Interestingly, one other layer provides to Ethereum’s promoting strain alongside the lower in large-scale holdings. According to data from Lookonchain, a famend on-chain knowledge evaluation agency, a dormant Ethereum pockets, untouched for round 4 years, has abruptly sprung into motion.

The pockets in query liquidated its total ETH holding, rapidly pushing roughly $4.81 million value of the altcoin into the market.

A pockets that had been dormant for 4 years offered all 2,591 $ETH for $4.18M stablecoins 6 hours in the past.https://t.co/et78rXHG5u pic.twitter.com/pJanMLxwA3

— Lookonchain (@lookonchain) September 20, 2023

Such surprising gross sales from long-inactive wallets might elevate alarms available in the market. While the precise causes behind such liquidations usually stay hid, they invariably amplify the promoting pressures on the affected cryptocurrency, which, on this case, is Ethereum.

Meanwhile, Ethereum’s value has seen a slight bullish trajectory over the previous week, up 1.4%. The asset has moved from a low of $1,596 seen final Wednesday to trade above $1,650 on Monday earlier than retracing to $1,626, on the time of writing down by 1.8% prior to now 24 hours.

Featured picture from Unpslah, Chart from TradingView

[ad_2]

Source link