[ad_1]

Ethereum merchants have been considering their subsequent steps because the second-largest crypto slid beneath $1,600 and revisited help at $1,564. While a kneejerk response is anticipated, it’s not assured, contemplating the state of the crypto market – low volatility.

The hype to purchase the dip with the potential for a reduction rally has pale since June. Investors choose to observe from the sidelines afraid of capitulation not less than till the crypto market typically improves.

Moreover, market-moving occasions have been scarce other than the push for the spot and futures-based Ethereum exchange-traded funds (ETFs). There have been reviews that the Securities and Exchange Commission (SEC) goes to greenlight a futures-based ETH ETF in October.

Futures-based Bitcoin ETF merchandise have been in existence for greater than two years, permitting traders, particularly institutional to hunt publicity to crypto with out having to purchase and retailer BTC.

Following the approval of the primary BTC ETF product, Bitcoin price rallied by over 60%. Hence, the constructive outlook traders have for Ethereum value in October.

Ethereum Price Set To Reclaim $1,600 Support

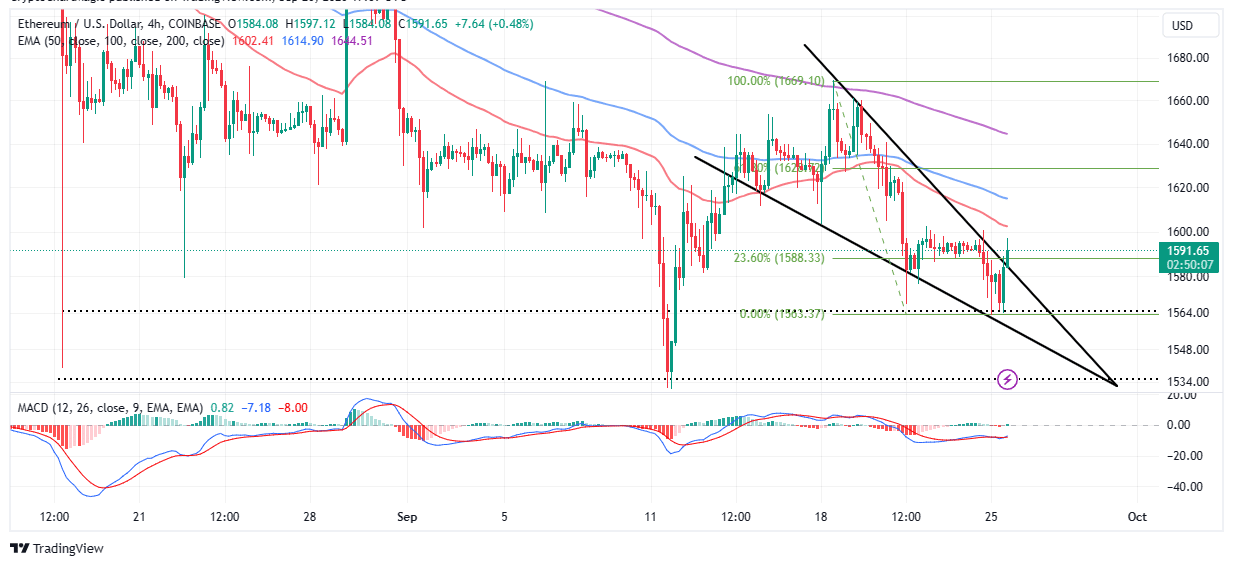

Ethereum swept via recent liquidity at $1,564, paving the best way for 2 bullish successive candles on the four-hour chart. Due to this rebound, a breakout from a short-term falling wedge sample has been validated.

The falling wedge, shaped by connecting a sequence of decrease lows and decrease highs utilizing two trendlines is a reversal sample that reveals the downtrend has come to an finish and bulls are able to take the reins.

A wedge sample alone doesn’t have an effect on the pattern till Ethereum price makes it above the resistance trendline. Traders would discover a spike in quantity following the breakout because the sign to put their purchase orders marginally above the trendline. It is usually really useful to attend for a retest of the resistance trendline to substantiate the breakout.

A purchase sign from the Moving Average Convergence Divergence (MACD) may increase the bulls’ rising presence out there as patrons improve their publicity to Ethereum. Such a name to purchase ETH manifests with the blue MACD line crossing above the pink sign line whereas the momentum indicator typically slopes upward towards the imply line (0.00) and into the constructive area.

Based on the Fibonacci ranges, ETH value will doubtless rebound 61.8% from help at $1,564 to $1,628, particularly if bulls retake the $1,600 resistance.

Ethereum Open Interest Soars To $5.31B

Interest in Ethereum derivatives has been rising over the previous few days, with Coinglass showing the open interest up 4.1% to $5 billion. In whole, quantity is up 332% to $10.35 billion. Liquidations over the past 24 hours rekt $5.55 million in brief positions and $3.88 million in lengthy positions.

If curiosity retains rising forward of the anticipated approval of the futures ETF in October, Ethereum value may launch the run-up to $1,800 and finally carry down the psychological resistance at $2,000.

Related Articles

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link

✓ Share: