[ad_1]

The directionless buying and selling atmosphere is inflicting lots of impatience throughout the market, with merchants compelled to leap on FOMO pumps in little-known altcoins like LOOM, CREAM, and SXP. Meanwhile, Bitcoin (BTC) and Ethereum (ETH) proceed to face the bottom spot buying and selling liquidity in a few years.

🗣️🤑 #Bitcoin‘s ratio of discussions in comparison with #altcoins has simply hit a 3-month low as merchants look elsewhere to #FOMO in on #crypto pumps. Smaller tasks like $LOOM, $CREAM, and $SXP are seeing surges in chats, which generally signifies market greed. https://t.co/1WaB9rKRSp pic.twitter.com/tcIodzGPaf

— Santiment (@santimentfeed) September 25, 2023

According to CryptoQuant, an on-chain knowledge analytics platform, Bitcoin’s spot buying and selling quantity has plummeted to a six-year low. Having understood that Bitcoin tends to maneuver in cycles of 4 years because of the miner reward halving course of, buyers “are more interested in holding their coins, believing in their future value, than selling at the first sign of profit.”

Bitcoin Price Hovers Above $26,000 – Long-Term Hodlers Unfazed

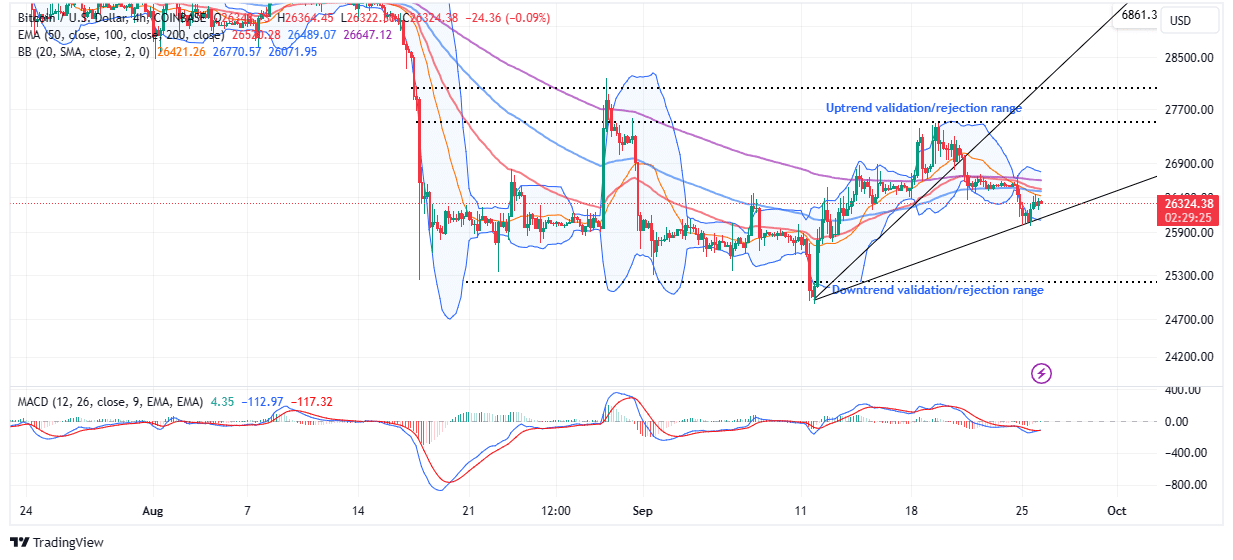

Bitcoin price bulls have all the explanations to defend help at $26,000, together with the necessity to push for a pattern reversal and avert a attainable flash drop in the hunt for liquidity at $25,000. It will not be attainable to foretell the influence of a drop to the crucial $25,000 help as a result of any signal of weak spot may ship BTC spiraling to $22,000 or $20,000 if push involves shove.

Ensuring help at $26,000 and subsequently the decrease ascending trendline is paramount for the resumption of the uptrend. It will assist bulls put together to face the rising vendor affect, contemplating Bitcoin price sits below all the three applied moving averages.

The 50-day Exponential Moving Average (EMA) (purple) and the 100-day EMA (blue) meet at round $26,500, forming a confluence resistance whereas the 200-day EMA (purple) may delay the uptrend at $26,600.

Traders are more likely to be looking out for the Moving Average Convergence Divergence (MACD) to verify a purchase sign. As the blue MACD line crosses above the sign line in purple, merchants may search new publicity to BTC longs which can contribute to constructing momentum.

Until Bitcoin rises above $27,500, it might be troublesome to validate an extended uptrend, focusing on highs above the subsequent main resistance at $31,000. In different phrases, Bitcoin is at risk of affirming the bearish grip the longer it stays under $27,500.

Buying and selling of Bitcoin on spot exchanges has gone down considerably, contributing to the plague of scarce volatility. On-chain knowledge analytics firm, IntoTheBlock, revealed on Sunday that long-term holders presently account for 69% or 13.44 million BTC of the circulating provide.

Long-term holders choose to endure the tough crypto winter with the hope {that a} market turnaround will reward their endurance. Although the crypto market is untradeable for many cryptos particularly BTC, ETH, and different main altcoins, the halving in 2024 guarantees a powerful rally as has been the norm with historic four-year Bitcoin cycles.

Despite market turbulence, long-term ‘Hodlers’ are unfazed. Our newest knowledge reveals a near-record 13.44M BTC held by long-term holders, making up 69% of the circulating provide. Historically, these holders maintain costs in bear markets and take earnings in bull runs. pic.twitter.com/99OA9LfUjU

— IntoTheBlock (@intotheblock) September 24, 2023

MicroStrategy Buys More BTC

The largest institutional holder of Bitcoin, MicroStrategy made headlines on Monday after making one other huge buy of 5,445 BTC for about $147.3 million. According to the corporate’s board chairman, MicroStrategy presently holds 158,245 BTC “acquired for $4.68 billion at an average price of $29,582 per Bitcoin.”

MicroStrategy has acquired a further 5,445 BTC for ~$147.3 million at a mean value of $27,053 per #bitcoin. As of 9/24/23 @MicroStrategy hodls 158,245 $BTC acquired for ~$4.68 billion at a mean value of $29,582 per bitcoin. $MSTR https://t.co/GbJtUoQfXv

— Michael Saylor⚡️ (@saylor) September 25, 2023

There was little to no response from Bitcoin following the announcement, which may point out an asset class that has matured or the shortage of curiosity from retail buyers who’re recognized to be the market movers by capitalizing on such whale actions.

Related Articles

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: