[ad_1]

XRP worth bulls are doing all they’ll to make sure the pivotal $0.5 stage stays inside their management within the wake of a minor rebound from short-term help at $0.56. Like different cryptos available in the market, XRP is struggling the dearth of liquidity brought on by disinterest from traders who’ve in latest months resorted to a hands-off method.

Although barely within the inexperienced, XRP price has not modified a lot for the final 24 hours. Trading volumes barely hit $1 million whereas the market capitalization holds at $26.8 billion, barely above USD Coin (USDC) with $25.6 billion.

XRP Price Set To Confirm 10% Breakout?

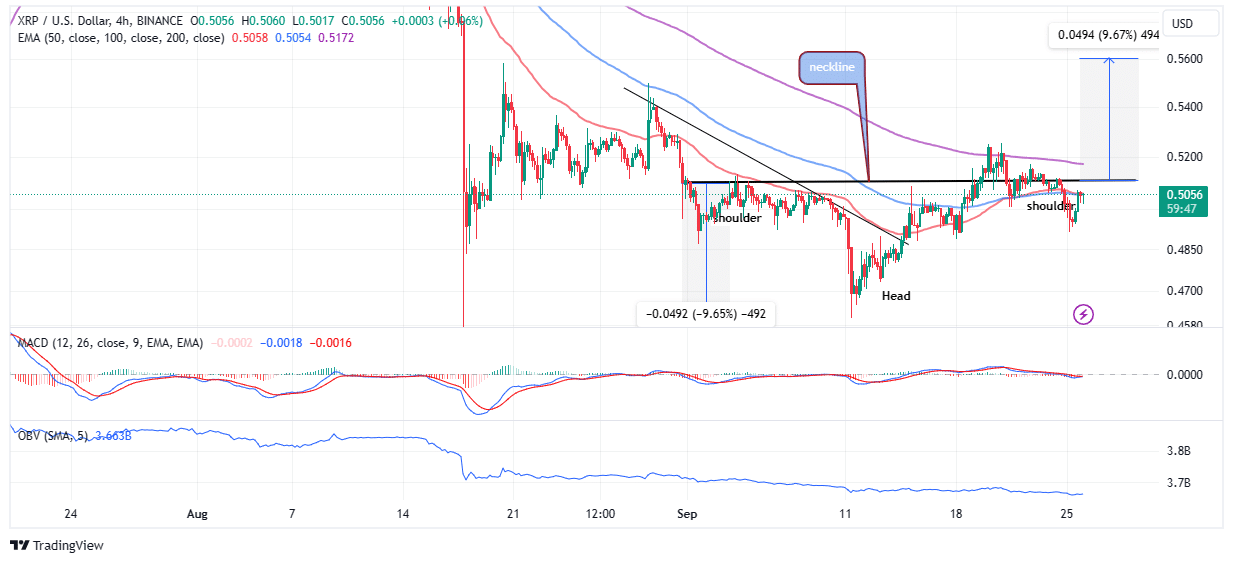

XRP has over the previous few weeks shaped an inverse head and shoulders (H&S) backside sample which relies upon extremely on volumes to play out. As a basic rule, this reversal sample tends to look throughout a downtrend. Following its completion, a whole pattern change happens because the downtrend offers approach to an uptrend.

The presence of the inverse H&S sample alone doesn’t change the outlook of the market. Therefore, merchants should tick sure key bins earlier than buying and selling the sample. For occasion, XRP worth should push for the neckline resistance break, which should be accompanied by a spike in quantity, in any other case, it may very well be a bull lure.

The On-Balance Volume (OBV) indicator reveals the state of the quantity. Hence, for the incoming breakout at $0.51, the OBV should be trending aggressively towards the overbought area to maintain the uptrend.

Before going through the neckline resistance, the confluence resistance at $0.5054 created by the 50-day Exponential Moving Average (EMA) (pink) and the 100-day EMA (blue) should come down.

Based on the Moving Average Convergence Divergence (MACD) indicator’s place, bulls have the higher hand. However, merchants ready on the sidelines needs to be keen to again the breakout in XRP price to build the required momentum and maintain the inverse H&S sample.

Ideally, purchase orders needs to be positioned marginally above the breakout level at $0.51 with a cease loss at $0.5054 – the confluence help/resistance. The breakout goal is calculated by measuring the peak of the sample from the neckline to the pinnacle and extrapolated above the breakout level. To $0.56.

Ripple CTO Addresses Centralization Concerns

As XRP worth struggles to interrupt the stalemate available in the market, Ripple’s CTO David Schwartz has addressed issues concerning the centralization of XRP. Schwartz in response to “Wolf of Golden Street” a consumer on X (previously Twitter) who talked about Max Keiser, a Bitcoin maximalist on the forefront of the accusation to bolster his level, mentioned that the claims had been baseless with out proof to again them up.

“I haven’t been able to find a coherent claim to answer,” Schwartz added. “Any particular tweet that makes an actual claim? They all just seem like random assertions mixed with insults.”

Wolf of Golden Street pushed more durable amid allegations that XRP was created solely to empower the highest 1% holders. Schwartz defended Ripple saying, XRP was created for everyone with its issuance backed by the XRP Ledger (XRPL).

1.Does XRP actually empower the highest 1% who’s controlling the principle XRP system.

I’m unsure I perceive this declare. The high 1% of what precisely? XRP empowers anybody who need to use the ledger to trace the possession and trade of property. What sort of management is he speaking about…

— David “JoelKatz” Schwartz (@JoelKatz) September 24, 2023

In a slight acceptance of the centralized declare, the CTO mentioned that whereas the structure of XRP could seem centralized the token itself is decentralized.

This is just not the primary time Ripple has needed to defend the decentralization of XRP and is probably going to not be the final. Meanwhile, the “Proper Party” celebrating the win against the SEC is anticipated later this week on September 29.

Ripple may make key bulletins throughout this occasion together with the potential for an IPO and a settlement between the SEC to keep away from going to trial.

Related Articles

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: