[ad_1]

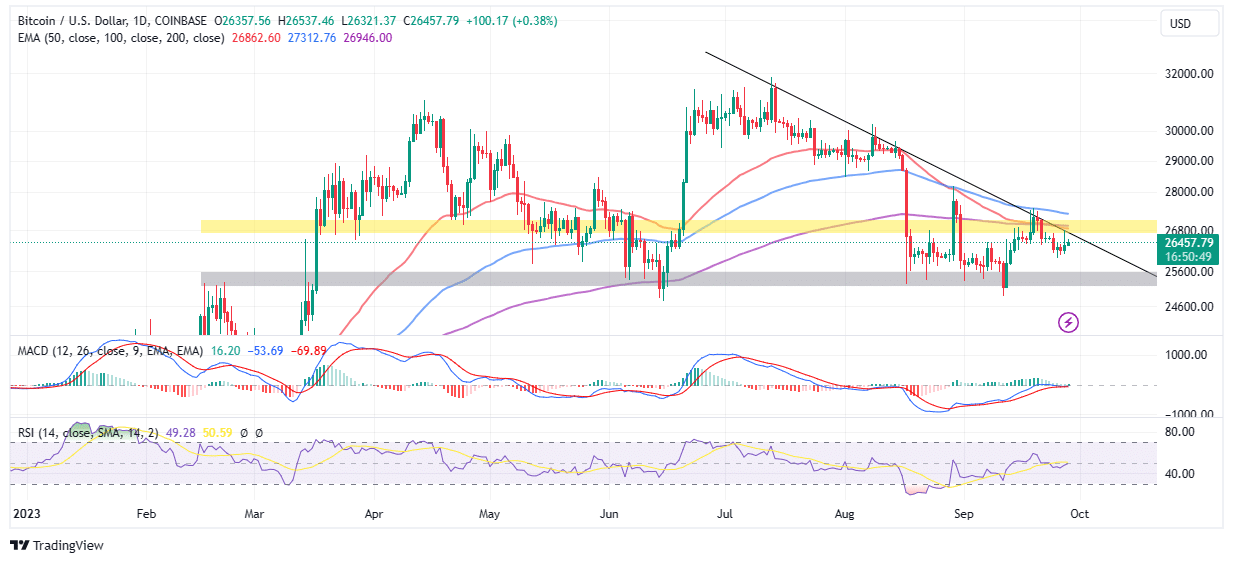

Bitcoin value is hovering above $26,000 as each bulls and bears exert their management amid a flurry of stories concerning each Ethereum and BTC exchange-traded funds (ETFs). The largest cryptocurrency is buying and selling barely above $26,400 on Thursday, up 0.5% in 24 hours with $14.8 billion in buying and selling quantity dashing in.

The stalemate between bulls and bears will probably proceed amid the low volatility and a stoop in spot buying and selling volumes to a six-year low, CryptoQuant reported earlier this week. Traders are properly conscious that BTC just isn’t out of hazard, with declines more likely to lengthen if assist between $25,000 and $26,000 is compromised.

#Bitcoin spot buying and selling quantity drops to 6-year low🚨

“People are more interested in holding their coins, believing in their future value, than selling at the first sign of profit.”

by @caueconomy— CryptoQuant.com (@cryptoquant_com) September 26, 2023

On the opposite hand, it will be untimely to rule out an instantaneous rebound above the slim vary higher restrict at $27,500. Such a transfer would sign merchants on the sidelines to hitch the uptrend, concentrating on $31,000 forward of the bull run affirmation or invalidation.

SEC Accepts Franklin Templeton, Hashdex Spot ETF Proposals

The United States Securities and Exchange Commission (SEC) has accepted functions by Franklin Templeton and Hashdex to offer spot ETFs.

Franklin Templeton in a submitting with the company sought to function a spot BTC ETF product whereas Hashdex utilized for a spot Ethereum ETF.

The SEC has 240 days from the date of submitting through which it’s anticipated to both deny or approve the proposals. In different phrases, the ultimate choice by the SEC might go so far as May 2024. However, there are a number of interim consideration deadlines that the SEC can use to get the general public view on the matter.

This just isn’t the primary time the SEC is delaying its selections on ETF proposals with some fearing that the company might be doing so intentionally to exhaust the 240 days. The regulator additionally moved to delay two different functions for spot BTC ETFs from Ark 21Shares and GlobaX amid the looming government shutdown in the US.

On Wednesday, the Commission delayed selections on two Ethereum ETF proposals from VanEck and ARK Invest. The proposals can be thought of once more on December 25 and December 26, 2023.

Can Bulls Regain Control Over Bitcoin Price

It is believed that the approval of a spot Bitcoin ETF would kickstart the following bull run. An ETF product would function a conduit for institutional traders to hunt publicity to Bitcoin thus growing the inflow of cash into the market, to not point out the approval that BTC is a mature asset class.

Investors are additionally wanting ahead to the miner reward halving in 2024 which is able to reduce provide whereas demand will increase thus creating an appropriate surroundings for a rally.

In the meantime, bulls seem like holding regular and are able to take one other sweep on the speedy resistance posed by a descending multi-month trendline. With a pure break above this stage, a brand new path might emerge for bulls to sort out the next vendor congestion space at $ 27,500 – the higher vary restrict.

The Moving Average Convergence Divergence (MACD) indicator presently with a purchase sign hints on the uptrend gaining momentum. At the identical time, the Relative Strength Index (RSI) confirms the rising bullish energy because it steps above the midline.

Note that if bulls fail on the subsequent try to push above $27,000 and $27,500, consolidation above $26,000 might observe or set off a sell-off beneath $25,000 major assist for an additional sweep at $22,000 and if push involves shove $20,000 forward of the following vital restoration.

Related Articles

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link

✓ Share: