[ad_1]

Bitcoin value blasted above $28,000 for the primary time since August as buyers embraced information surrounding Ethereum futures exchange-traded funds (ETFs) approvals. The largest cryptocurrency sustained the bullish outlook from Friday, ignoring the US Securities and Exchange’s (SEC) choice to delay its verdict on a number of spot Bitcoin ETFs.

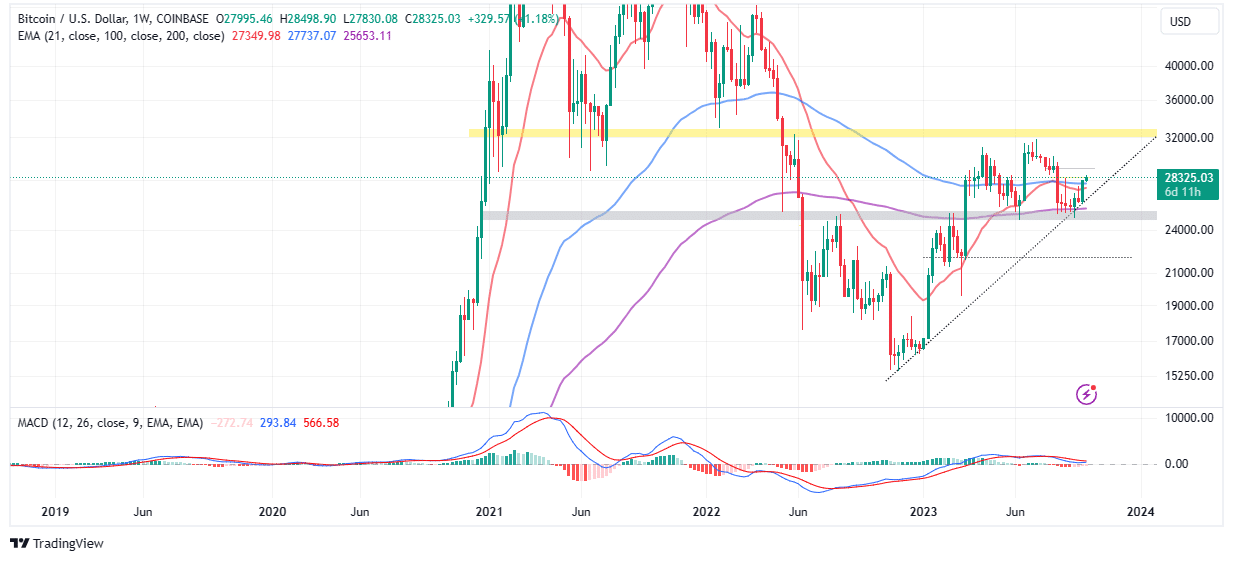

Several vendor congestion areas threatened the uptrend, together with $27,000, $27,500, and $28,000 however BTC continues to uphold the bullish outlook bolstered by rising curiosity amongst massive quantity holders, additionally referred to as whales.

Bitcoin Whales Increase Exposure to BTC

According to the newest on-chain insights from Santiment, whales have been rising their Bitcoin holdings because the technical construction improves. Addresses with between 10 and 10,000 BTC have gathered a mixed $1.17 billion since September 1.

If this curiosity in Bitcoin continues, a return to $30,000 is very seemingly. However, these beneficial properties may additionally hamper the uptrend if the identical whales begin dumping to guide early income.

How High Can Bitcoin Price Go – Short-Term Analysis

Bitcoin value upholds help at $28,000 whereas buying and selling at $28,300. A break and maintain above the fast resistance at $28,400 are required to maintain merchants interested by protecting their lengthy positions open whereas gazing upon a possible breakout above $30,000.

The SuperTrend indicator on the four-hour chart reveals that consumers are holding the reins, therefore Bitcoin has a higher chance of closing in on $30,000 than dropping to $25,000. This indicator sends a bullish sign when it flips to path BTC value, which modifications the colour from purple to inexperienced.

According to crypto dealer and analyst Rekt Capital “Bitcoin needs to rally higher & break its Lower High to completely invalidate this Bearish Bitcoin Fractal.” As mentioned just lately, a fractal is a pattern that allows Bitcoin price to climb to a sure stage, earlier than retracing and climbing once more.

This sample varieties each a bullish and bearish fractal, the place a bearish fractal hints at a reversal as proven on the chart beneath. Therefore, for Bitcoin value to invalidate the bearish fractal, it should break above resistance at $28,400.

Bitcoin must rally larger & break its Lower High to utterly invalidate this Bearish Bitcoin Fractal$BTC #Crypto #bitcoin pic.twitter.com/OaqFdI1RWj

— Rekt Capital (@rektcapital) October 2, 2023

It is value mentioning that Bitcoin has also broken above three bull market indicators, together with the 21-week Exponential Moving Average (EMA) (purple), the 100-week EMA (blue), and the 200-week EMA (purple).

According to Rekt Capital, a bull run is more likely to stem from buying and selling above the three shifting averages.

Bitcoin has damaged past the Bull Market Support Band cluster of shifting averages$BTC #Crypto #Bitcoin pic.twitter.com/EqwrSSCKKc

— Rekt Capital (@rektcapital) October 2, 2023

The Moving Average Convergence Divergence (MACD) is about to ship a purchase sign on the weekly chart. As the blue MACD line crosses above the purple sign extra merchants and buyers could be keen to purchase BTC thus creating the mandatory momentum for a breakout above $30,000 and ultimately aligning with the bull run.

With the halving anticipated in April 2024 and a spot Bitcoin ETF approval on the horizon, promoting stress could also be drastically lowered as a result of buyers are more likely to overlook short-term income in favor of ready for larger beneficial properties within the bull run.

Related Articles

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link

✓ Share: