[ad_1]

The Bitcoin worth trajectory has as soon as once more taken a pointy upward flip, marking its ascent previous the $28,000 landmark for the primary time since its notable surge on August 29. This prior leap had been attributed to Grayscale’s triumph over the US Securities and Exchange Commission (SEC) of their authorized battle concerning the Bitcoin Trust (GBTC) conversion to a spot ETF.

In a hanging demonstration of Bitcoin’s notorious volatility, the BTC skilled a worth escalation of over $800 inside a minuscule 5-minute window on Sunday night, rocketing from $27,250 to a peak of $28,053 between 6:15 and 6:20 pm ET.

Why Is Bitcoin Price Up Today?

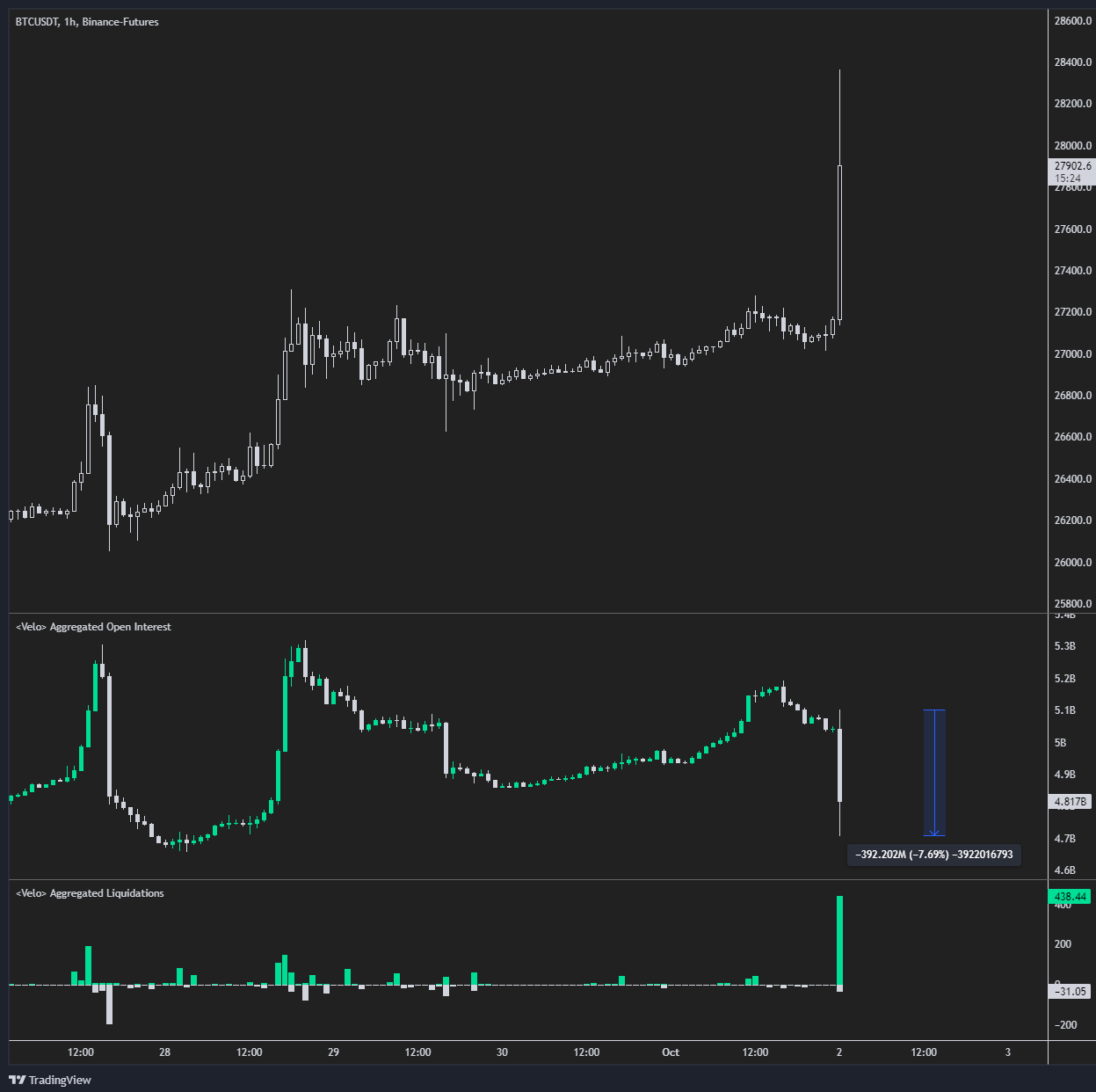

One major catalyst behind this dramatic worth motion, as pinpointed by the esteemed crypto analyst Byzantine General, is the phenomenon often known as a “short squeeze.” In the realm of futures buying and selling, a brief squeeze is characterised by a speedy worth enhance, forcing merchants who had wager towards the asset’s worth (brief sellers) to purchase it to forestall additional losses. This reactive shopping for can intensify the asset’s worth bounce.

During yesterday’s surge, a staggering $392 million in Bitcoin brief positions, or about 7.7% of the full open curiosity out there, have been swiftly liquidated. Byzantine General additional elaborated available on the market’s resilience, observing that the Bitcoin open curiosity bounced again swiftly with an increment of $350 million, humorously suggesting the market’s willingness to embrace such a unstable maneuver once more: “The whole market was actually like ‘I’ll fucking do it again.”

Crypto analyst Fabian D. deepened the evaluation by declaring the intricate interaction between brief sellers being ousted and the potential for additional Bitcoin appreciation. He indicated that the upward trajectory of Bitcoin from this level hinges on two major components: the entry of spot consumers pushed by the concern of lacking out (FOMO) and whether or not brief sellers resolve to re-establish their positions.

Fabian additionally alluded to the absence of institutional shopping for exercise within the week previous this surge however underscored the significance of monitoring premium charges on platforms like Coinbase and CME upon market opening in the present day. Adding to the complexity of the market panorama, Fabian flagged two impending occasions: the anticipation surrounding the Ethereum Future ETF inflows, and the court docket listening to in regards to the Celsius platform, which could doubtlessly refocus consideration on its creditor distributions.

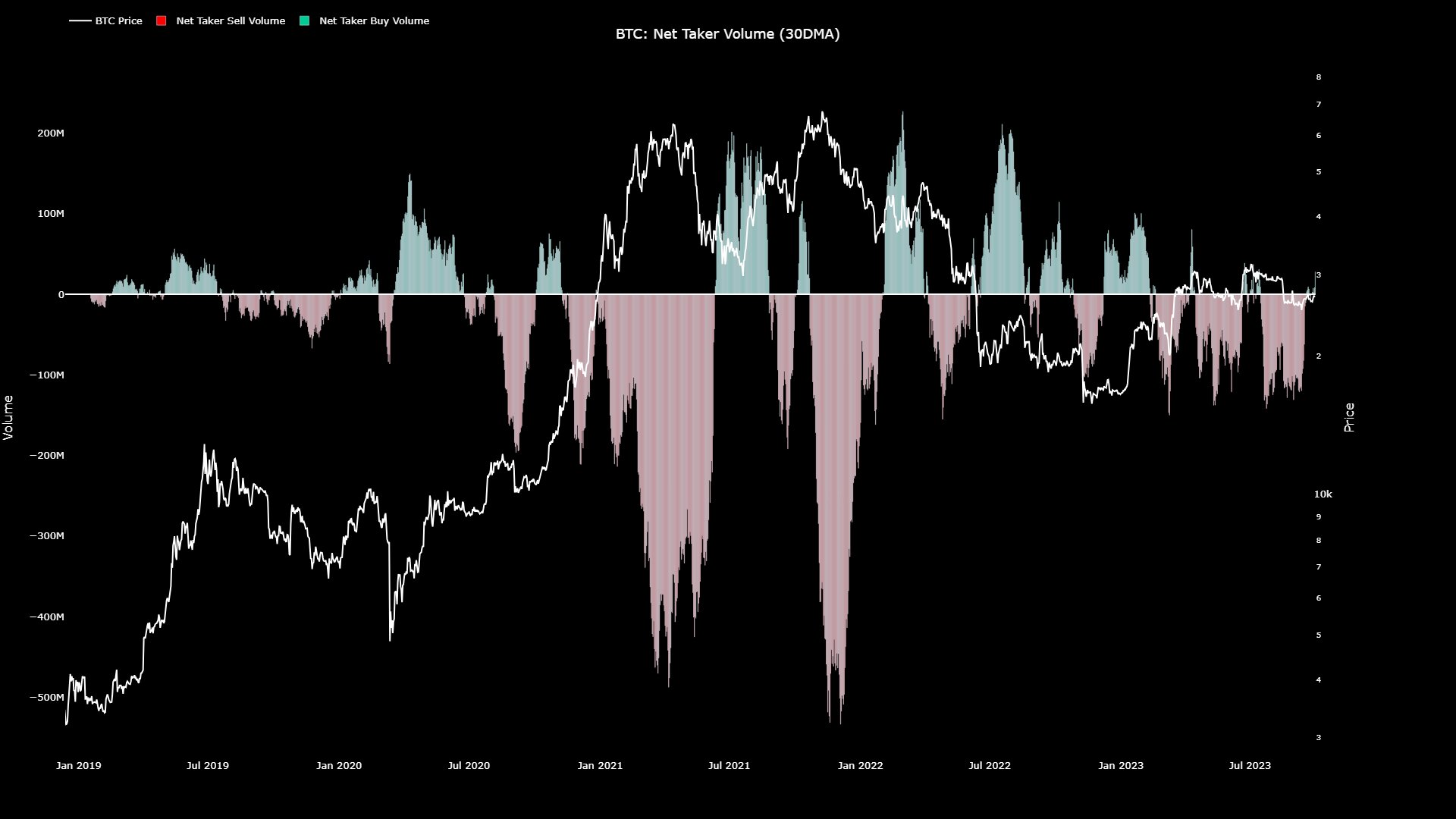

Drawing insights from on-chain information, analyst Maartunn launched one other layer of optimism, noting that “Net Taker Volume has crossed into the green zone, indicating that buyers are in control. The last time was four months ago.”

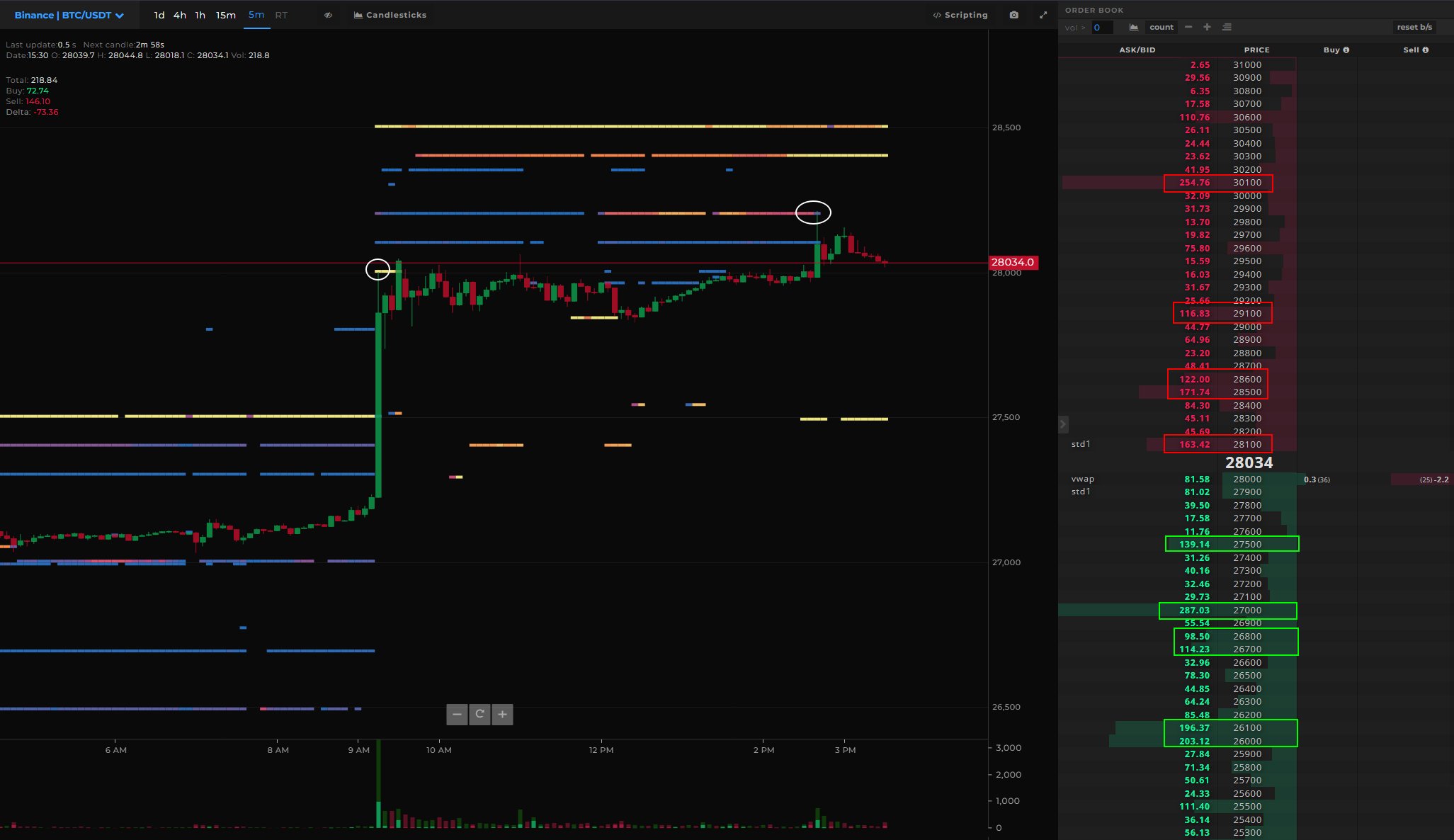

Diving into granular analytics, quant dealer Skew make clear the dynamics at play on platforms like Binance and Bybit. He emphasised that the current worth upswing wasn’t totally unexpected, notably given the noticeable shift away from brief positions and the sturdy perpetual bid main as much as the spike.

Looking on the Bitcoin combination CVDs & delta, he additional famous: “Mostly seeing sell pressure just in perps for now. Price decline with Perp CVD decline & Perp sell delta picking up. Next move that decides the fate of this entire move is spot.”

Highlighting the evolving market dynamics, Skew pointed out that the BTC Binance Spot exhibited a notably broad order e book with a major quantity of accessible and resting liquidity. He inferred that such a setup might result in extra pronounced worth reactions.

Highlighting the evolving market dynamics, Skew remarked that the BTC Binance spot market displays a notably broad order e book with a major quantity of accessible and resting liquidity. He inferred that such a setup might result in one other pronounced worth response. “Increasing ask liquidity on spot order books; implies greater volume needed by spot takers to clear $28K – $29K (Market structure shift),” he warned.

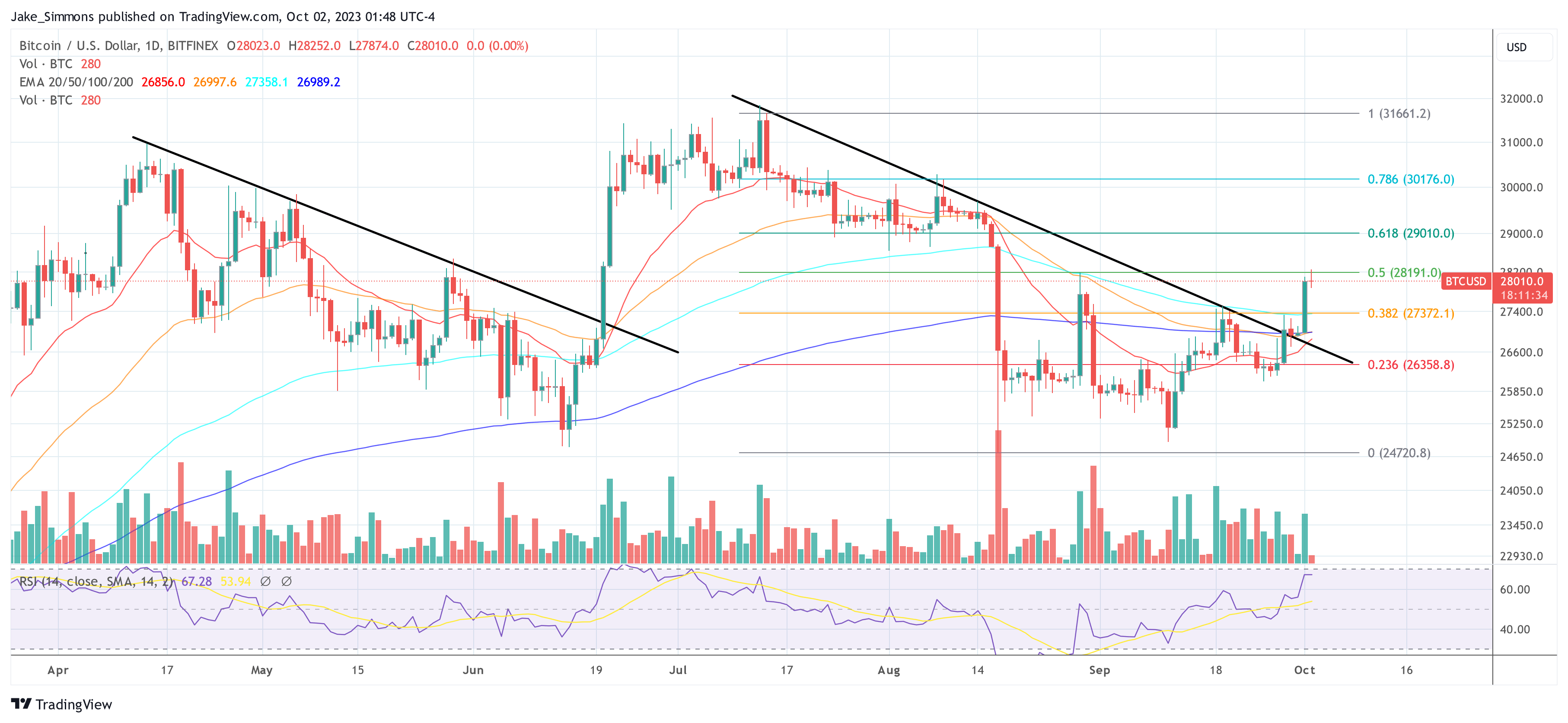

It can be attention-grabbing to notice that the worth motion was already evident within the 1-day chart. As defined within the final Bitcoin worth analyses, the worth broke by the (black) downtrend line established in mid-July final Thursday. While the profitable re-test of the trendline occurred on Friday and Saturday, confirming the bullish momentum, the anticipated bounce occurred yesterday.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link