[ad_1]

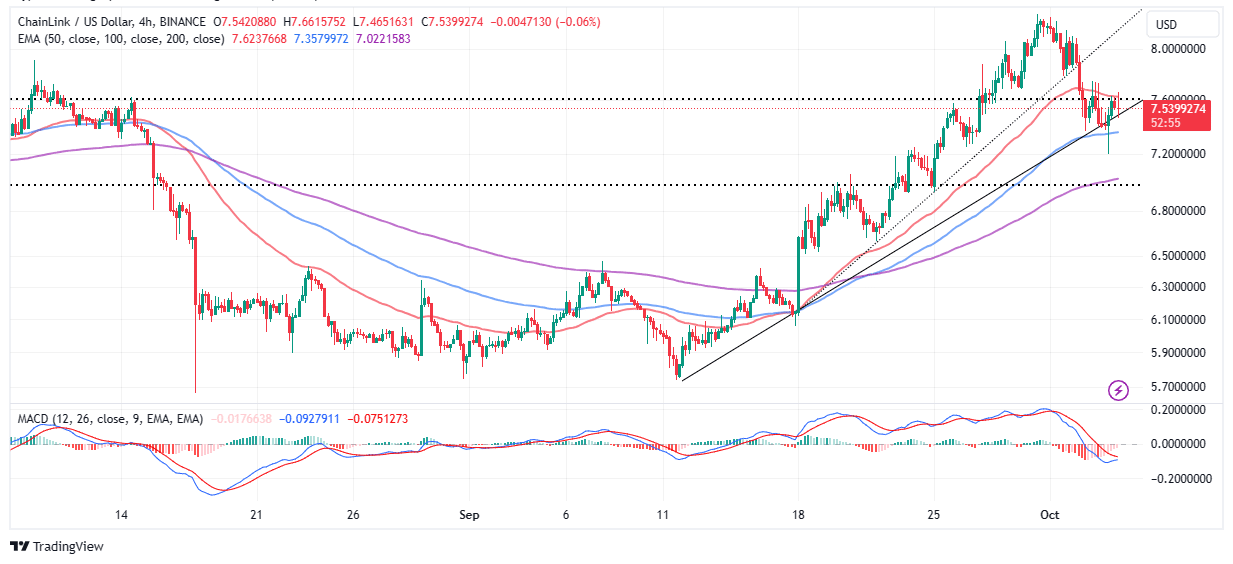

Chainlink (LINK) has been one of many best-performing altcoins, rallying by 24% within the final 30 days to commerce at $7.5 on Wednesday. The dwell value feed Oracle token for good contracts hit a three-month excessive at $8.2 after upholding help at $5.7 on September 11.

As discussed in the previous analysis, analysts expect LINK to right in the hunt for contemporary liquidity earlier than rebounding for an additional vital uptrend above $10.

Chainlink’s Automation 2.0 Is Live

Chainlink introduced the discharge of its Automation 2.0 improve for good contracts on October 3. With this software program replace, good contracts will be capable of “offload compute at as low as 1/10 of the cost without compromising on security, and connect dApps using log triggers—equivalent to the pub/sub messaging bus used to connect microservice in Web2.”

Automation 2.0 Is Live

Offload compute at as little as 1/tenth of the price with out compromising on safety, and join dApps utilizing log triggers—equal to the pub/sub messaging bus used to attach microservices in Web2.

Access the next-gen options: https://t.co/75Rl6bBcJ6

— Chainlink (@chainlink) October 3, 2023

Apart from Automation 2.0 for good contracts, Chainlink additionally launched the Data Streams Mainnet. This low-latency resolution could be a recreation changer, unlocking “CEX-like DeFi trading experiences built on decentralized infrastructure.”

Data Streams Mainnet Early Access

Chainlink’s low-latency oracle resolution unlocks CEX-like DeFi buying and selling experiences constructed on decentralized infrastructure.

Learn all about Data Streams: https://t.co/83P6jLOWkz

— Chainlink (@chainlink) October 3, 2023

The Data Streams have additionally been pushed to Mainnet Early Access on Arbitrum. DeFi protocol GMX is among the many first tasks to expertise the brand new options to energy its “highly performant and secure decentralized perpetual futures exchange.”

“With Chainlink Data Streams, decentralized applications (dApps) now have on-demand access to high-frequency market data backed by decentralized and transparent infrastructure,” Chainlink said via a blog post. “This innovation enables DeFi protocols, such as derivatives dApps, to deliver a centralized exchange (CEX)-like user experience with onchain execution faster than ever before—all without compromising on Web3 values.”

Chainlink Price Falters – Can Support At $7.5 Hold?

Chainlink might be in a position to resume the uptrend if help at $7.5 holds. This space coincides with the ascending trendline help and is located marginally above the 50-day Exponential Moving Average (EMA) (blue).

The Moving Average Convergence Divergence (MACD) which is about to validate a purchase sign exhibits that the trail with the least resistance may quickly shift to the upside. Traders ought to take into account searching for the MACD line in blue crossing above the pink sign line.

Crypto dealer @AltcoinSherpa has a long-term bullish outlook for Chainlink regardless of its longstanding vary channel. He suggests giving LINK between 6 and 12 months to nurture the following vital transfer.

$LINK: Flipped the EQ of this vary and it is also flipped all 1D EMAs.

Still seems respectable to me however general, nonetheless within the massive buying and selling vary its been in for over a yr.

Still extraordinarily bullish on this within the subsequent 6-12 months although. Great venture. #Chainlink pic.twitter.com/es8ov6KMDv

— Altcoin Sherpa (@AltcoinSherpa) October 3, 2023

In the occasion losses stretch under the ascending trendline and the 100-day EMA, buyers can look towards $7 for the following help.

Related Articles

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link

✓ Share: