[ad_1]

Ethereum worth jumped to $1,750 on Monday, a worth stage seen in mid-August. The largest good contracts token was the point of interest of the crypto market because the US Securities and Exchange Commission (SEC) raced to approve Ether futures exchange-traded funds (ETFs). However, the uptrend encountered headwinds resulting in a decline again to the $1,600 vary.

The bearish grip on ETH has continued to accentuate, with the token remaining comparatively unchanged during the last 24 hours and buying and selling at $1,645 on Friday. Bulls should rally behind Ethereum price to forestall one other dip beneath $1,600.

Why This fall 2023 Could Be Explosive For Ethereum Price

The crypto market tends to carry out properly within the final quarter of yearly, besides in 2022 as a result of implosion of FTX trade. Investors are already trying ahead to a bullish October, which has come to be generally known as the “Uptober.”

Analysts and merchants like Altcoin Sherpa consider the fourth quarter of 2023 is the time for Ethereum and different altcoins to shine.

“I expect an extremely explosive Q4 or early Q1, as it always happens.” Altcoin Sherpa mentioned through X. “These are arguably the best times of the year to trade.”

Reading from the ETHBTC worth chart, the dealer mentioned that he expects Ethereum worth to bounce again laborious.

$ETH: The time is coming quickly to scale into altcoins. I anticipate an especially explosive This fall or early Q1, because it all the time occurs. These are arguably one of the best instances of the yr to commerce.

Watch for .055 space after which I anticipate #Ethereum to bounce laborious with ETHBTC pic.twitter.com/d0YxeYGELg

— Altcoin Sherpa (@AltcoinSherpa) October 5, 2023

Santiment, an on-chain analytics platform, revealed that exchange outflows amounting to 110k ETH have been recorded on Wednesday – “the largest outflow since August 21.” Non-exchange Ether subsequently spiked to an all-time excessive of 115.88 million ETH with the availability of the token on exchanges dwindling to a five-year low.

This reveals that essentially, Ethereum is powerful which suitably locations it able to rally if given an opportunity.

😮 #Ethereum noticed about ~110K $ETH ($181M) transfer off of exchanges Wednesday, the biggest outflow day since August twenty first. The quantity of non-exchange Ethereum now sits at an #AllTimeHigh 115.88M $ETH, whereas its trade provide is at its lowest in ~5.5 years. https://t.co/PUOWGt0KS0 pic.twitter.com/u54pp6LZij

— Santiment (@santimentfeed) October 5, 2023

Ethereum Price In Search For Higher Support

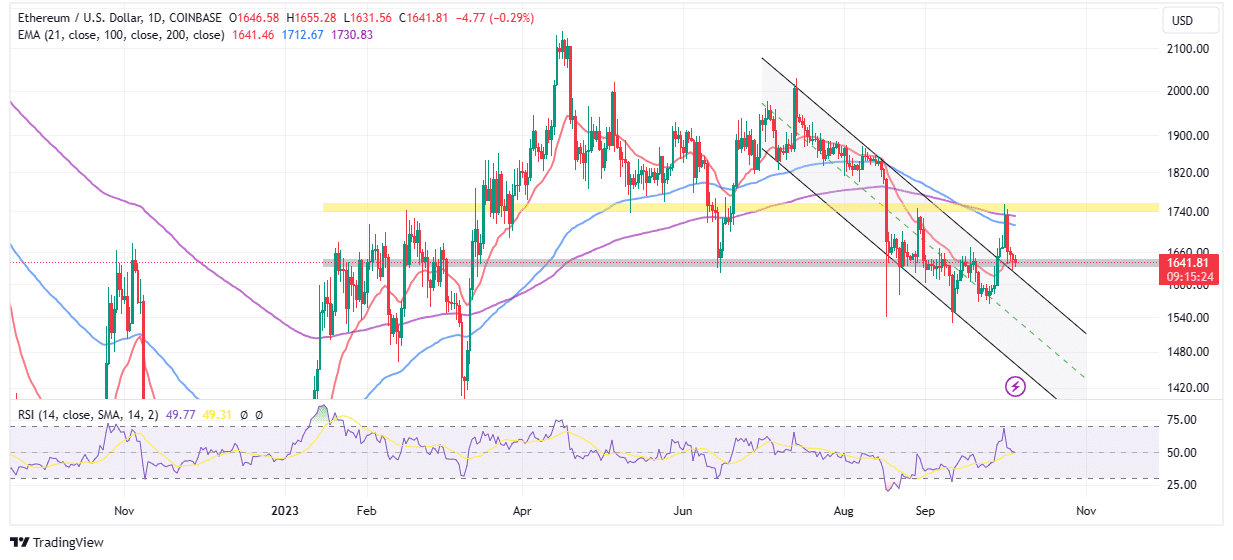

Ethereum has since its rejection from $1,750 earlier within the week been concerned in an infinite seek for assist to regulate its draw back. The 21-day Exponential Moving Average (EMA) (purple) serving because the speedy assist at $1,641 should maintain in place, in any other case, this search would prolong to $1,600.

The Relative Strength Index (RSI) upholds the downward development because it retests assist on the midline. Traders fascinated by shorting Ether should test that the RSI continues to drop towards the oversold space beneath 30.

Meanwhile, bullish merchants ought to take into account the opportunity of Ethereum worth bouncing again from the assist presently supplied by the falling channel. A retest of the earlier resistance is commonly interpreted as bullish.

On the upside, a break above resistance at $1,750 would imply that Ethereum is holding above all the important thing transferring averages, together with the 21-day EMA, the 100-day EMA, and the 200-day EMA. Such a place would go an extended approach to lock within the uptrend, thus encouraging merchants to contemplate longing ETH for a bigger breakout to $2,000.

Related Articles

The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link

✓ Share: