[ad_1]

Polygon (MATIC) is wobbling in a murky technical setting, down 4.2% to $0.557 on Friday. The main Ethereum Layer 2 scaling protocol has ignored sentiments across the improvement of a significant improve, Polygon 2.0.

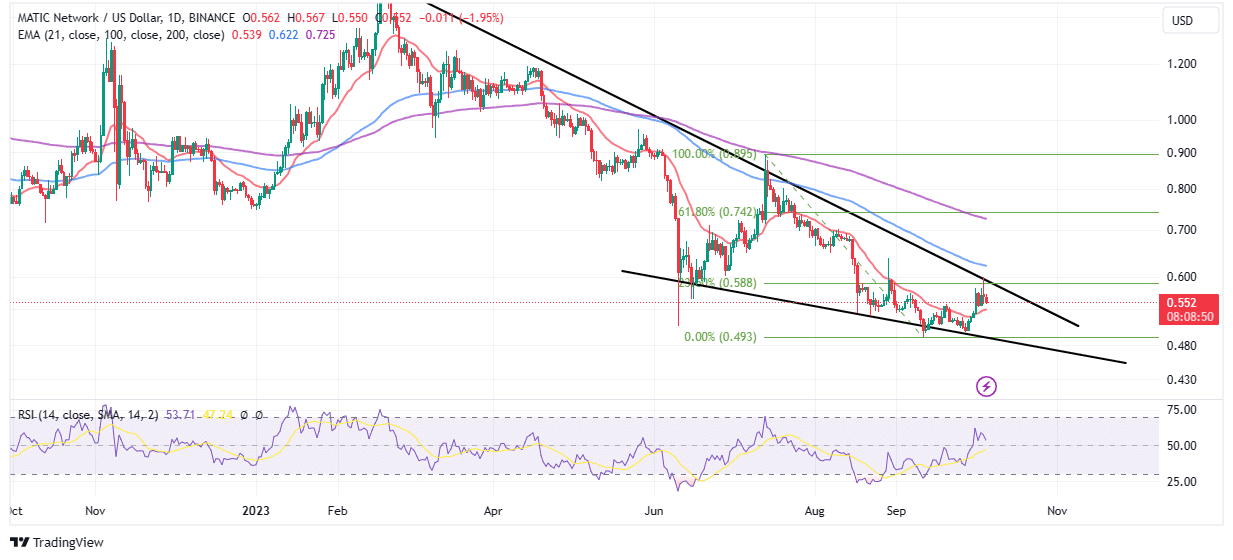

From a long-term perspective, a rebound is brewing, nonetheless, short-term evaluation reveals the potential of one other sweep at decrease assist areas – tentatively $0.54 and $0.493, respectively.

Polygon 2.0 Update – MATIC Price Drops

Polygon builders printed one other vital replace on X (previously Twitter) concerning the approaching launch of the protocol’s improve, Polygon 2.0. According to the announcement, POL contracts are set to go reside on the Goerli testnet, marking “a major step towards bringing Polygon 2.0 to life.”

Today, on account of group consultations, POL contracts shall be reside on Goerli testnet.

A serious step in the direction of bringing Polygon 2.0 to life.

Based on the group’s suggestions in the course of the PIP governance course of, PIP-24: Change EIP-1559 Policy & PIP-25: Adjust POL Total Supply,… pic.twitter.com/li8OF0o3jC

— Polygon Devs 📍 DevX Global Tour (@0xPolygonDevs) October 4, 2023

After reviewing suggestions from the group, builders set the entire provide of POL, the token anticipated to energy the ecosystem on the brand new protocol. The improvement workforce mentioned that this step is important to the “EIP-1559 burn system needed for Phase 0 of Polygon 2.0.”

“In the coming weeks, the first steps of the new proposed governance for Polygon 2.0 will be shared, the core of which will be a new Ecosystem Council composed of thought leaders and technology experts; pillars of the Web3 community with substantial security credentials,” Polygon developers mentioned through X.

The group has been requested to remain tuned for extra updates, particularly on the POL testnet as the event workforce strives to “build the value layer of the internet.”

On the opposite hand, MATIC value is holding barely above assist supplied by the 21-day Exponential Moving Average (EMA) (pink) after bulls have been rejected from resistance highlighted by the 23.6% Fibonacci retracement stage which coincidently types a confluence with the falling trendline.

The Relative Strength Index (RSI) reinforces the bearish outlook because the uptrend weakens paving the way in which for a pullback. Support on the 21-week EMA should maintain, in any other case, Polygon would possibly drop to $0.493 seeking assist.

Despite the obvious bearish outlook, there may be nonetheless hope for a Polygon price restoration primarily based on the falling wedge sample on the identical each day chart. As a reversal sample, the wedge types towards the tip of a downtrend.

A breakout could be anticipated if MATIC value obliterates resistance on the falling trendline – backed by a major improve in buying and selling quantity. It is really helpful to put purchase orders above the wedge sample amid expectations of a run as much as $1.

Related Articles

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link

✓ Share: