[ad_1]

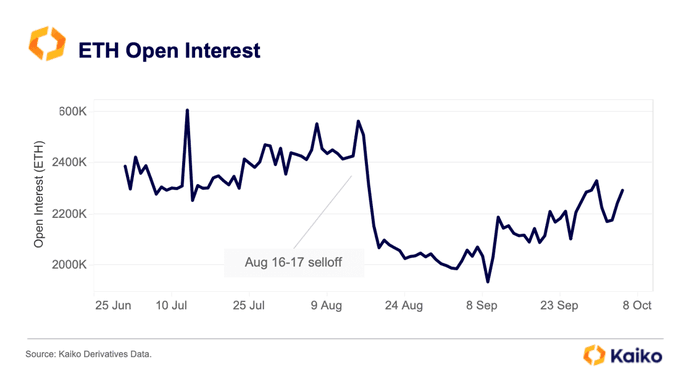

Ethereum costs is perhaps stagnant at spot charges, weaving across the $1,540 and $1,560 zone, taking a look at technical charts. However, amid this era of consolidation and holders worrying about Ethereum’s prospects, Kaiko notes that the coin’s open curiosity has been step by step rising since September 2023.

Ethereum Open Interest Rising: What Does It Mean?

As of October 10, Kaiko observes that there are greater than 2.2 million contracts, and the quantity has been rising steadily over the previous few buying and selling weeks. With rising open curiosity, it could actually trace that bulls are within the equation, which can help costs now that costs are below immense strain.

In crypto buying and selling, open curiosity is the entire variety of excellent spinoff contracts of a given coin. Meanwhile, derivatives are contracts that derive worth from the underlying asset, on this case, Ethereum. Herein, the entire open curiosity knowledge is accrued from ETH choices, futures, and perpetual futures from platforms the place merchants can use leverage.

There may be completely different interpretations of open curiosity relying in the marketplace state. Since open curiosity contains lengthy and quick positions at any time, gauging the instructions of how market contributors are posting trades may be difficult.

Even so, rising open curiosity signifies that extra merchants are opening positions, which may be seen as bullish, particularly if costs are increasing. Conversely, falling open curiosity means that merchants are exiting, which suggests waning momentum and bearish sentiment.

ETH Consolidates Even After Ethereum Futures ETF Approval

Based on this, Ethereum stays in a important place and help. Notably, the coin is transferring sideways with low buying and selling volumes.

From the day by day chart, ETH is across the $1,500 and $1,550 major help. Though patrons look like in management, since costs are boxed contained in the June to July 2023 commerce vary, any break beneath the help zone might set off extra losses.

The basic optimism explaining rising open curiosity might be because of the current approval of Ethereum Futures exchange-traded funds (ETFs). The United States Securities and Exchange Commission (SEC) approved a number of Ethereum Futures ETFs for the primary time.

This choice noticed Ethereum costs edge larger in early October. Though costs have since contracted, institutional traders can now discover publicity in Ethereum by way of structured and controlled merchandise accepted by the stringent regulator.

It is unclear whether or not the rising ETH open curiosity alerts power and if the coin will recuperate going ahead. From the day by day chart, ETH has robust liquidation at across the $1,750 stage and stays consolidated.

Feature picture from Canva, chart from TradingView

[ad_2]

Source link