[ad_1]

In an in depth chart evaluation of the XRP/USD buying and selling pair, seasoned crypto analyst Dark Defender has make clear a number of vital indicators that time in the direction of a bullish trajectory for the favored cryptocurrency.

Taking to Twitter to share his insights, Dark Defender remarked, “Morning All. Hope you had a great weekend. XRP in the daily time frame is still within our price range. Above $0.52 – $0.55 is a challenge, first to break the resistance & stay above the Ichimoku Clouds.”

This sentiment aligns with the depicted interplay of XRP with the Ichimoku Cloud on the chart, a famend technical software that provides insights on assist, resistance, and momentum. Furthermore, the analyst outlined particular worth brackets, stating that XRP is: “Bullish above $0.55 – $0.66, Extra Bullish between $0.66 – $1.33, and envisions a New All-Time High Above $1.966.” These delineations echo the marked areas on the chart, notably the “Bullish Area” and “Extra Bullish Area.”

When To Get Extra Bullish On XRP

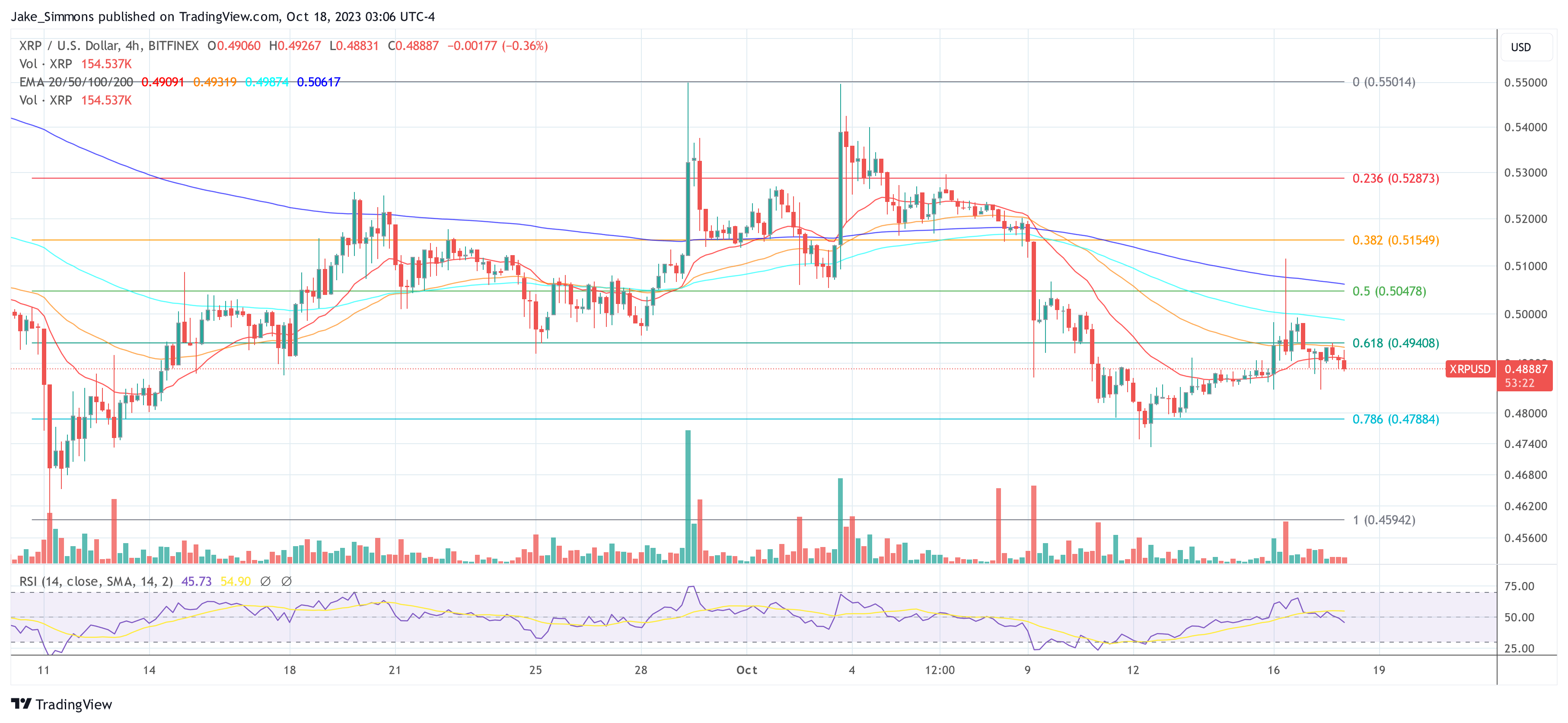

One of the first takeaways from the chart is the “RSI Double Tap” occasion. For these unfamiliar, the Relative Strength Index (RSI) is a momentum oscillator that measures the velocity and alter of worth actions. An RSI studying under 30 is often thought of oversold, whereas an RSI above 70 is seen as overbought. The “Double Tap” signifies that XRP has been undervalued in mid-August and mid-September, however discovered a robust basis.

Further boosting the bullish sentiment is the declining trendline within the RSI that the XRP worth just lately broke out of, implying a possible shift in momentum. Remarkably, the RSI broke out of the downtrend for the primary time on the finish of September.

However, the XRP worth couldn’t maintain this momentum, and in consequence, the RSI as soon as once more fell under the development line drawn by Dark Defender. But in current days, one other breakout has occurred, which may predict bullish worth actions.

Moving onto the value motion, the chart depicts XRP’s constant interplay with the Ichimoku Cloud, a famend technical software that provides insights on assist, resistance, and momentum. The indisputable fact that XRP is inching nearer to coming into the ‘Bullish Area’ of the Ichimoku Cloud is kind of vital. This may imply that the asset is on the verge of a bullish reversal if it climbs again above $0.52.

Moreover, the chart additionally demarcates two distinct areas labeled “Bullish Area” and “Extra Bullish Area.” The latter is located between the $0.66 and $1.33 mark, suggesting that if XRP manages to interrupt above the decrease boundary and maintain above this worth level, we would witness intensified bullish momentum. The XRP worth may then greater than double earlier than main resistance is predicted on the $1.33 degree by Dark Defender.

Additionally, the Fibonacci retracement ranges, drawn from the height to the trough of the value motion, emphasize the 50% degree at $0.5286 as a vital resistance level. Breaking by means of this degree would possibly propel XRP towards the “Extra Bullish Area” as specified by the analyst.

Concluding his tweet, Dark Defender aptly said, “The clock is ticking,” indicating the expectation that the cryptocurrency may carry out a robust bullish transfer into the “Bullish Area” between $0.55 and $0.66 at any time.

In summation, whereas the crypto market stays unpredictable, the technical indicators for XRP, mixed with Dark Defender’s evaluation, recommend a promising bullish trajectory. But as at all times, traders ought to conduct thorough analysis and stay cautious of their funding selections.

At press time, XRP traded at $0.4888.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link