[ad_1]

Solana value is defying the bearish stress that has engulfed the crypto market following a exceptional upswing in Bitcoin price to $30,000 earlier this week. The aggressive good contracts token has proven excessive resilience for nearly a 12 months after being battered by the FTX implosion saga in November which noticed SOL drop to $8.

Since the FTX crash, buyers have questioned whether or not the blockchain community has a future. However, the Solana workforce has continued to show itself time and time once more by pushing out new updates and launching new merchandise.

According to a video shared by @Frankie_Candles, there’s “nonetheless loads happening behind the scenes within the Solana ecosystem. For occasion, the full worth locked (DeFi), which represents the greenback worth of belongings locked within the Solana DeFi good contracts grew from $210 million in January 2023 to $331 in October, DefiLlama shows.

This snippet is from my “Is Solana Dead” video. Despite the FTX fallout, $SOL nonetheless has loads happening behind the scenes!

If you wish to see the entire video, its on my channel, I’ll put up the hyperlink on my X profile! pic.twitter.com/De6j5aNGxx

— Frankie Candles (@Frankie_Candles) October 19, 2023

The actual query, nonetheless, is whether or not Solana can carry out in addition to it did within the earlier bull run the place it tapped $260 in 2021.

Can Solana Price Rally To $30?

Although Solana’s restoration has been lock-step for the reason that starting of the 12 months, the final 24 hours have seen bulls make a comeback, propelling Solana to $25. Up 4.6% SOL is buying and selling at $24.72 on Thursday backed by $709 million in buying and selling quantity and $10 billion in market capitalisation.

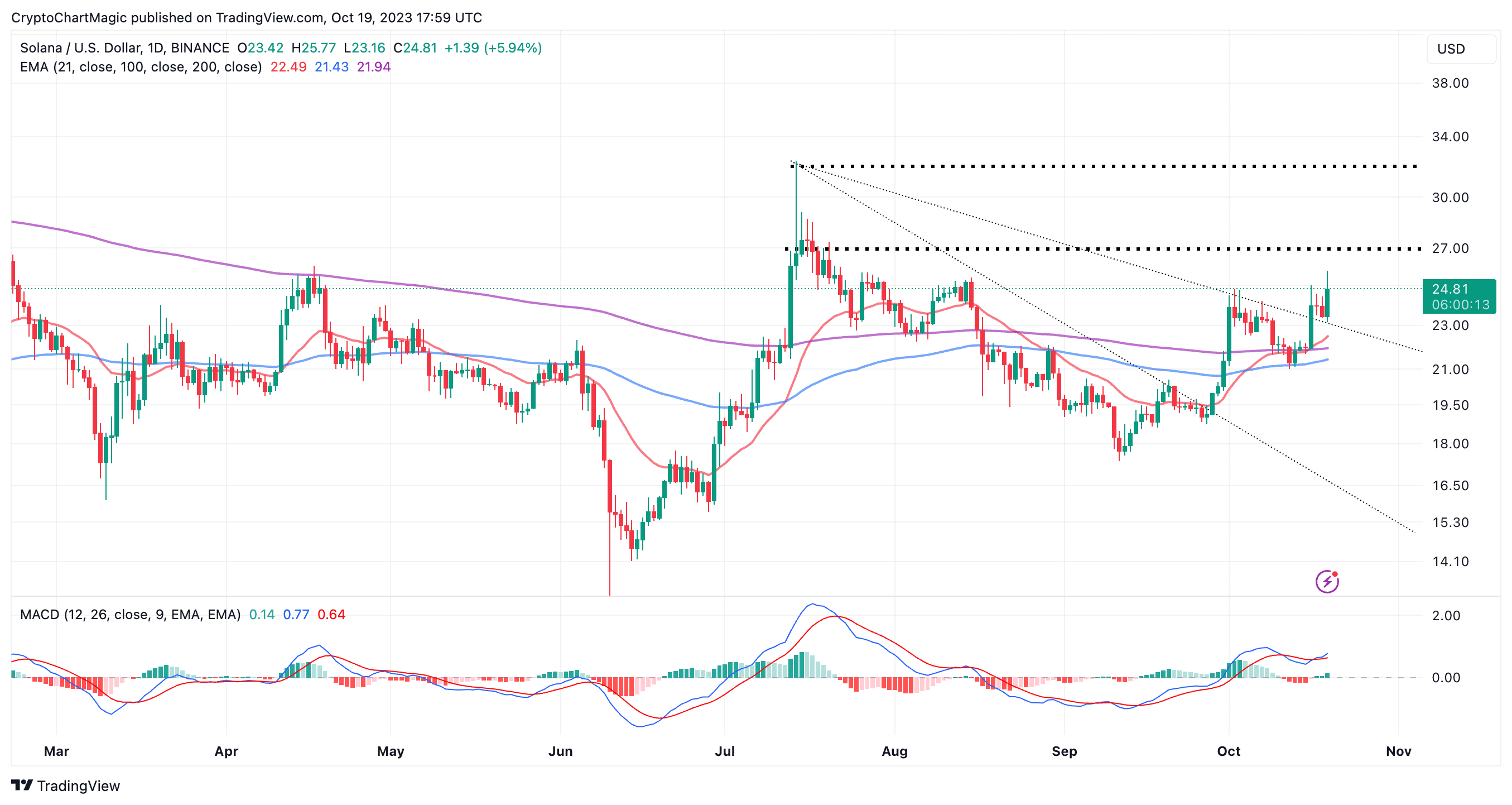

Solana bulls have this week, strengthened the bullish image, first by upholding help at $25 and breaking above the higher dotted falling trendline. Traders additionally sought recent publicity to SOL longs with the Moving Average Convergence Divergence (MACD) indicator sending a purchase sign on the each day chart.

The call to buy SOL manifested with the MACD line in blue crossing above the pink sign line. Note that the inexperienced histograms above the impartial space at 0.00 reinforce the bullish grip along with the momentum indicator’s usually upward-slopping pattern.

A golden cross sample on the identical each day chart sample exhibits that consumers have the higher hand. This sample is fashioned when a short-term transferring common flips above a long-term transferring common, as an example, the 21-day EMA (pink) and the 100-day EMA (blue) in Solana’s case.

Nevertheless, a each day shut above $25 is required to validate the following climb focusing on $30. Otherwise, merchants could contemplate reserving earnings if SOL stays beneath $25 longer than anticipated which can set off a sell-off again to $20.

Related Articles

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: