[ad_1]

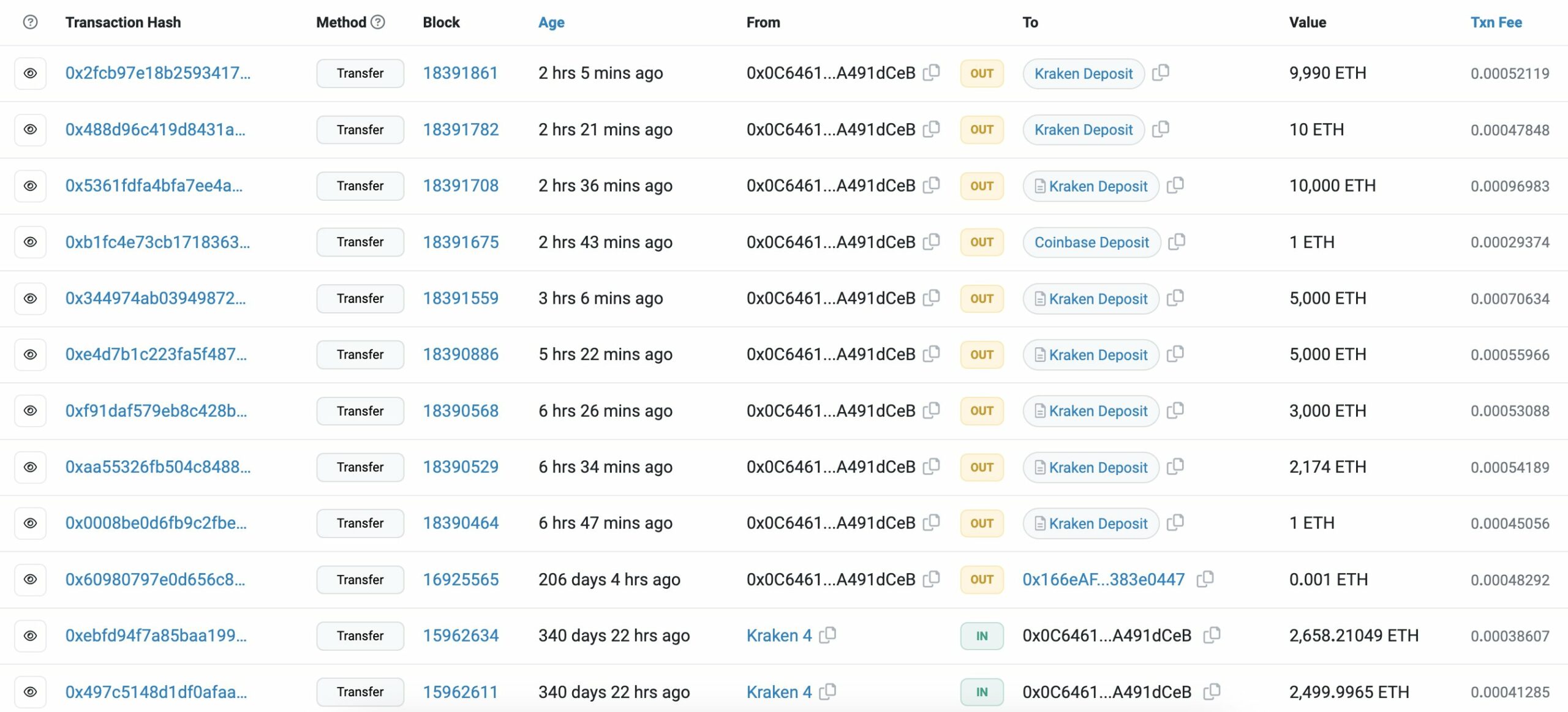

Data from Lookonchain, a blockchain analytics platform, on October 20, shows that one Ethereum (ETH) whale is actively transferring cash to Kraken, a crypto trade, and seems to be promoting. The unidentified whale deposited 35,176 ETH, value over $56.5 million when writing, and withdrew $10 million in USDT hours later. USDT is the world’s most liquid stablecoin, monitoring the worth of the USD.

Ethereum Whale Selling On Kraken

Still, it isn’t instantly clear whether or not the whale ended up promoting the entire stash and solely selecting to withdraw $10 million. What’s evident is that the unknown whale has been actively accumulating Ethereum for some years earlier than deciding to take revenue.

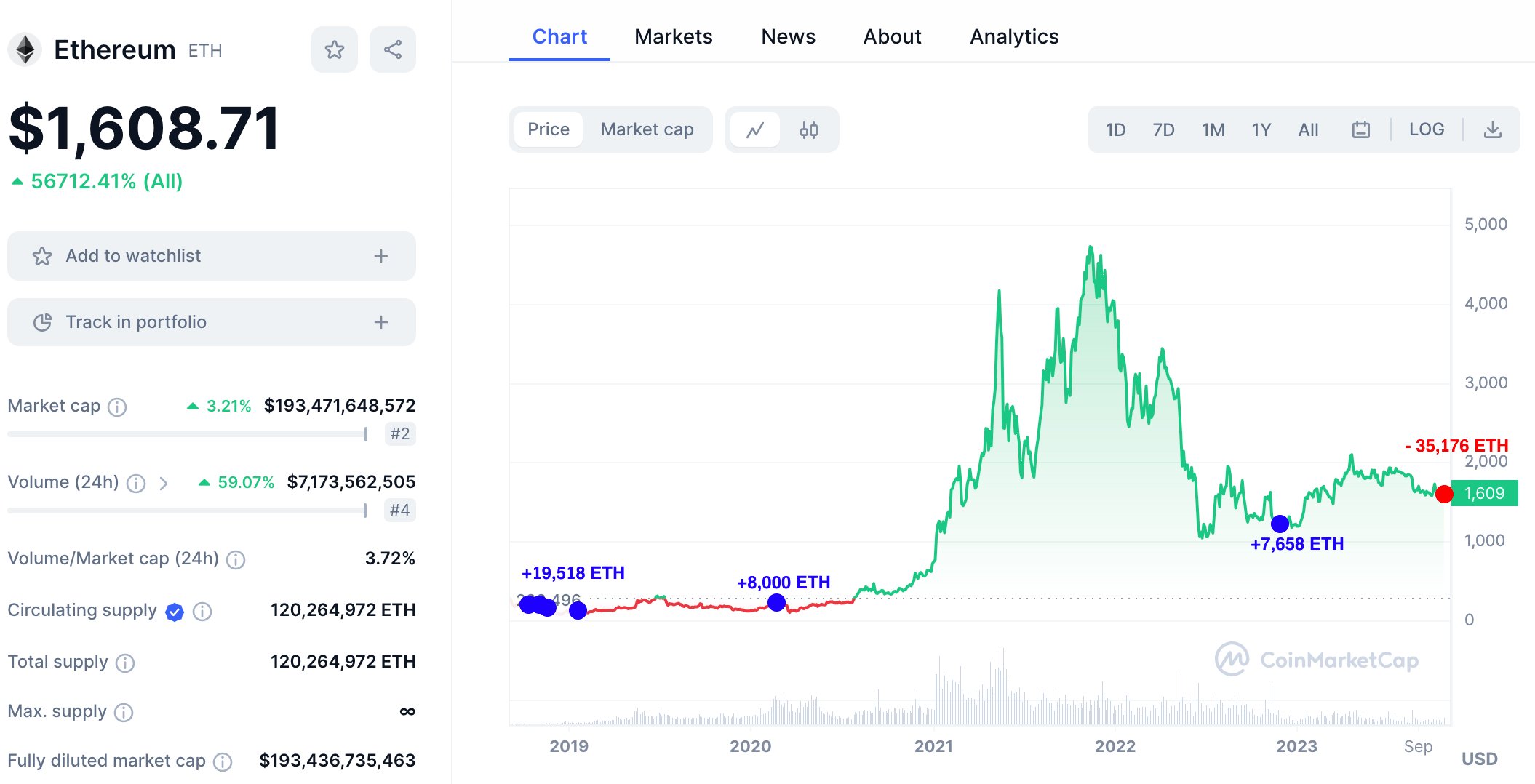

Looking at market developments, the whale seems to be taking revenue and exiting. Often, when cash are moved to centralized crypto exchanges, market individuals interpret the occasion as web bearish. This can influence sentiment, even forcing costs decrease, particularly if the broader crypto market is falling.

According to Lookonchain, the whale collected 35,176 ETH on Kraken at a median value of round $415. When the handle selected to liquidate, its realized revenue was roughly $41.8 million. Ethereum costs have greater than quadrupled the typical entry value at spot charges, which means the whale stays “in green” regardless of latest market gyrations.

Since costs have been primarily dicey, transferring horizontally and sometimes posting sharp falls, the whale might need chosen to exit. Even so, it couldn’t be ascertained what motivated the ETH holder to promote when sentiment is overly bettering throughout the crypto scene.

Presently, Ethereum merchants are bullish, anticipating costs to extend within the periods forward. Notably, as of October 20, costs had been comparatively agency and rising. To illustrate, Ethereum is up roughly 3%, and bulls are soaking promoting strain. At the identical time, the coin is up 5% from October 2023 lows.

Traders Bullish, Will ETH Clear $2,000?

Ethereum value charts present that the speedy resistance stage within the medium time period is at round $1,750, recorded in early October. On the flip facet, help is at $1,530. A bullish breakout behind rising volumes pushing the coin above the resistance stage might set off extra demand, propelling it towards the psychological $2,000 stage.

In early October, the United States Securities and Exchange Commission (SEC) approved a number of Ethereum Futures Exchange-Traded Funds (ETFs), together with VanEck Ethereum Strategy ETF (EFUT) and ProShares Ether Strategy ETF (EETH). Analysts interpreted this choice as a lift for ETH because it allowed establishments to have a regulated means of investing in Ethereum with out essentially having to purchase and retailer the cash by themselves.

Feature picture from Canva, chart from TradingView

[ad_2]

Source link