[ad_1]

Ethereum worth is on the verge of breaking out and shutting within the coveted psychological resistance at $2,000. Interest within the largest sensible contracts token has continued to extend with Bitcoin price reclaiming resistance/support at $31,000.

Most merchants anticipate a continued bullish motion throughout the market, with ETH following carefully within the footsteps of the bellwether cryptocurrency and beginning the second restoration part past $2,000 and focusing on areas round $2,500 and $3,000 respectively.

Ethereum DeFi TVL Grows To $21 Billion

The transition to the proof-of-stake (PoS) consensus mechanism from a proof-of-work (PoW) protocol opened Ethereum to an entire new decentralized finance (DeFi) world backed by the rise of liquid staking tokens like Lido and Rocket Pool.

Despite the prolonged crypto winter, traders have maintained publicity to DeFi merchandise throughout the Ethereum ecosystem, which in accordance with information by Defi Llama has a total value locked of $21.27 billion. The ecosystem’s 24-hour inflows elevated to $45 million with with $1.49 million recorded as income.

Ethereum Price Prediction: ETH On The Cusp of Validating 12% Move

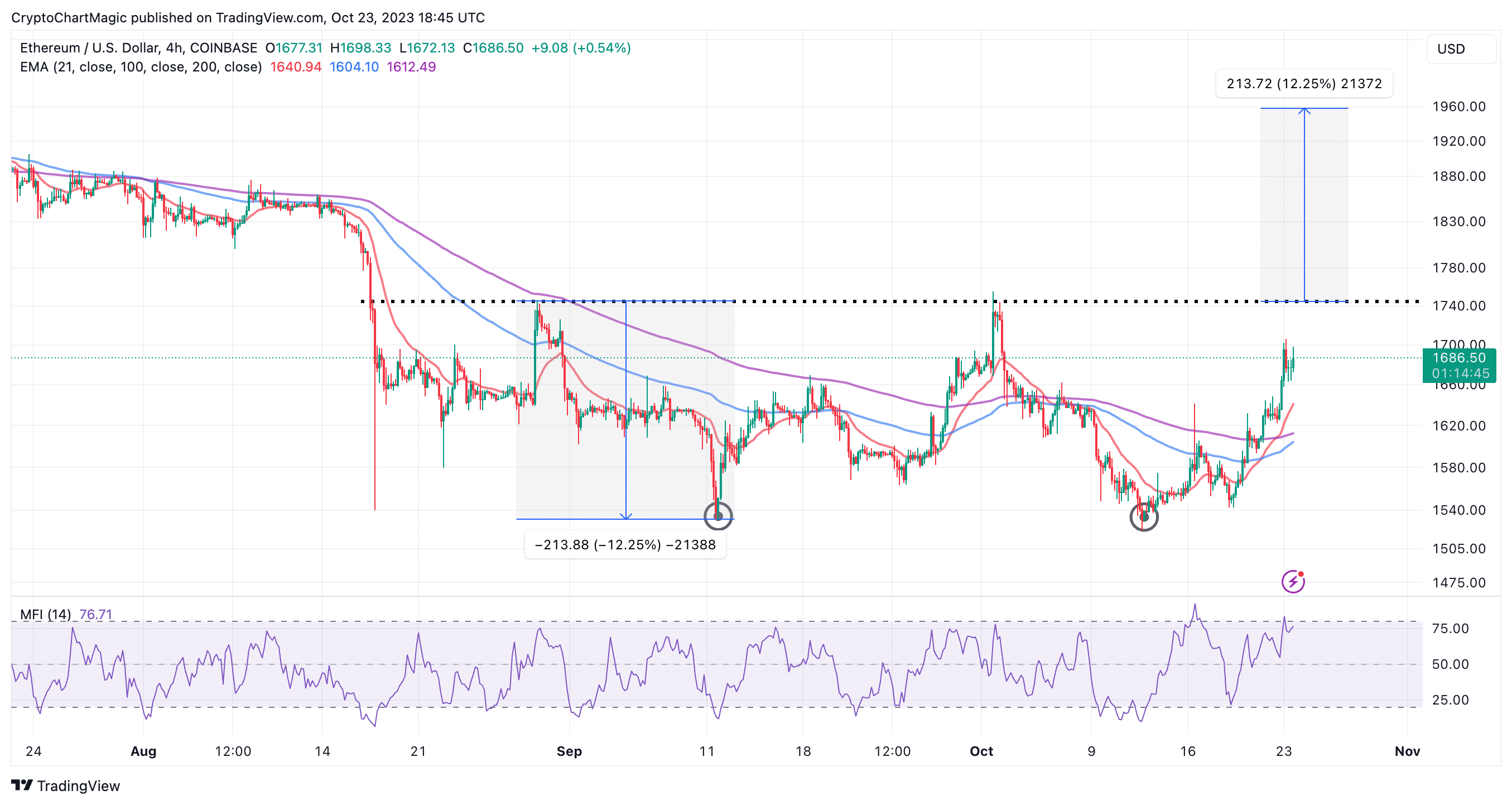

Ethereum accomplished the formation of a double-bottom sample following a rebound from help at $1,530, which presently awaits validation at $1,745 (neckline resistance).

The presence of two golden cross patterns fashioned when the 21-day Exponential Moving Average (EMA) (crimson) crossed above the 1000-day EMA (blue) and subsequently above the 200-day EMA (purple), hints on the uptrend’s continuation.

If merchants maintain their purchase orders open, they’re prone to construct momentum for a 12.25% breakout to $1,958. Following the breakout, buying and selling quantity is anticipated to surge considerably as merchants search contemporary publicity to Ether above the neckline resistance.

The Relative Strength Index (RSI) with a power of 75 reveals that Ethereum price is able to maintain the uptrend intact. However, warning is suggested as a result of oversold circumstances prone to encourage merchants to promote ETH to e-book earnings, or defend their capital.

Based on the cash ground index (MFI), bulls have the higher hand. This indicator tracks the influx and outflow of cash, therefore a persistent enhance implies that consumers are in command of the uptrend.

The MFI with a power of 76 isn’t but oversold implying that there’s nonetheless room for development. With Ethereum price at $1,690 on Monday, a break above $1,700 is required to safe the uptrend and affirm the bullish outlook to $2,000.

Trading above $2,000 could be a recreation changer for Ethereum bulls and is perhaps the catalyst the token has been ready for to start out the bull run. On the draw back, failure to retain help at $1,670 and $1,630 may set off one other sell-off to $1,550. However, so long as Ethereum holds above all of the shifting averages, the trail with the least resistance will stay to the upside.

Related Articles

The introduced content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: