[ad_1]

Bitcoin (BTC) value paced to $35,000 for the primary time in 2023, with the spot buying and selling quantity rising by 187% to $50 billion and the market cap rising by 13% to $676 billion.

Although the rally began final week amid faux information relating to the approval of a BTC spot ETF proposal by BlackRock, buyers, particularly establishments have been racing to fulfill their risk appetite for Bitcoin.

According to market information by CoinGecko, Bitcoin value has within the final 24 hours elevated by 13%, 21.5% in seven days, and 30.5% within the final month to commerce at $34,520 on Tuesday.

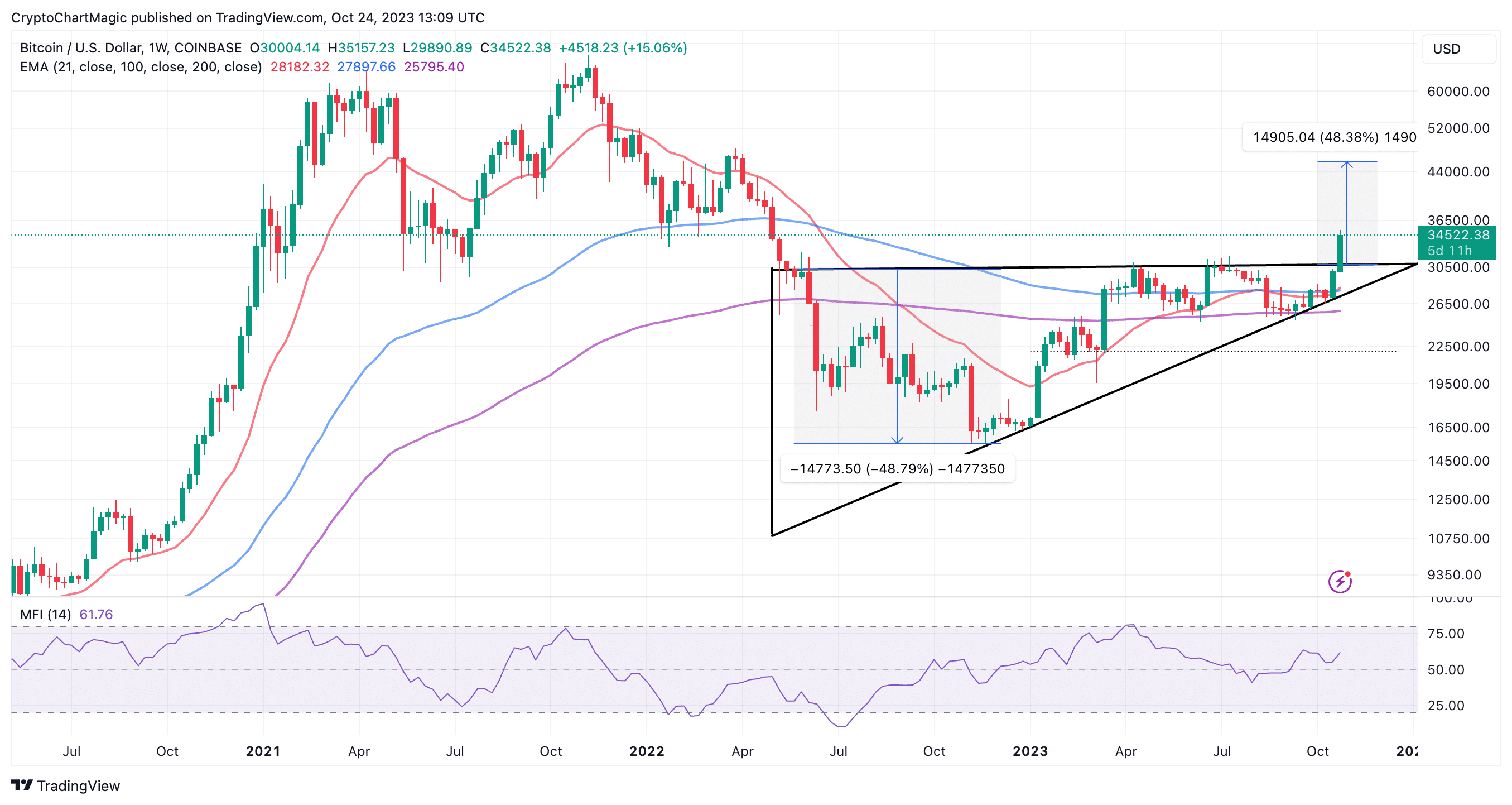

The technical outlook is bullish as we’ll see later, with the uptrend not displaying any indicators of weak point. The validation of an ascending triangle sample hints at a bigger breakout to $45,711, however first, let’s dissect the forces behind the upswing to highs barely above $35,000.

Institutions Rush To Buy Bitcoin As Open Interest Soars

Institutional buyers are leaving no stone unturned within the race to e book positions and capitalize on the impromptu Bitcoin value rally. Optimism across the approval of a spot BTC ETF within the US will be singled out as one of many main forces behind the breakout—first above $30,000 and now to $35,000.

According to CoinDesk, curiosity in Bitcoin continued in the course of the Asian hours on Tuesday following the revelation of a BlackRock ETF on the Depository Trust & Clearing Corp. (DTCC) web site.

Meanwhile, the Bitcoin futures open curiosity (OI) hit 100k BTC on the Chicago Mercantile Exchange (CME) for the primary time in historical past implying that institutional buyers had elevated their urge for food for probably the most outstanding cryptocurrency.

CME BTC futures OI has breached 100k BTC for the primary time ever.

While offshore perp OI shrank by 26,735 BTC yesterday, CME’s OI grew by 4,380 BTC. pic.twitter.com/kjKBRYCoSX

— Vetle Lunde (@VetleLunde) October 24, 2023

The market share of CME subsequently surged by 25% and will quickly surpass that of Binance’s perpetual market, in accordance to Vetle Lunde, a K33Research analyst.

Bitcoin Price Breakout To $45,000 Seems Imminent

Bitcoin has damaged above an ascending triangle sample with a 49% breakout concentrating on $45,711. Although bulls have nurtured the continued uptrend for the reason that starting of the yr, resistance at $30,806 prevented the breakout.

Trading above the x-axis ($30,806) validated the triangle breakout bolstered by an enormous enhance in buying and selling quantity. Traders had been anticipated to set off their purchase orders barely above the x-axis for beneficial properties concentrating on $45,771.

The Relative Strength Index (RSI), which continues to pattern north, with a energy of 61 reinforces the bullish outlook. Besides, Bitcoin price is holding above all of the bull market indicators such because the 21-week Exponential Moving Average (EMA), the 100-week EMA, and the 200-week EMA.

For now, merchants needs to be looking out for the way BTC reacts to the rapid resistance at $35,000. Holding above this degree might function affirmation for bulls to push the triangle breakout to $45,771.

On the draw back, rolling again might give already sidelined buyers a possibility to leap onto the moon-bound bandwagon, with help anticipated to be offered by the chosen shifting averages at $28,200, $27,901, and $25,797, respectively.

Rekt Capital, a crypto analyst, dealer, and investor, has inspired his followers not to really feel sidelined by the move in Bitcoin price as a result of “when retracement presents itself in the coming months – it should be treated as an opportunity for re-accumulation.”

#BTC has damaged out

However, when retracement presents itself within the coming months – it needs to be handled as a possibility for re-accumulation

It will be straightforward to assume you have missed out on all the Bull Market and that $BTC won’t ever pullback

But a market cycle lasts a protracted… https://t.co/e6CNQ2D36b

— Rekt Capital (@rektcapital) October 24, 2023

FOMO may see most buyers consider that they’ve missed the bull run however as Rekt Capital places it “A market cycle lasts a long time, there will always be breakout rallies and there will always be pullbacks. Another opportunity will always present itself.”

Related Articles

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: