[ad_1]

Solana (SOL) has rallied persistently during the last couple of weeks, because of the final constructive outlook of the crypto market during the last two weeks. Prior to this run-up to $32, SOL bulls struggled to maintain assist at $20, to not point out, the almost paralyzing drop to $8 after the FTX implosion in November.

Solana Price Prediction: Can SOL Rally To Hit $40

The final couple of weeks have seen elevated curiosity in cryptos, especially in Bitcoin, whose rally to $35,000 stems from optimism across the anticipated approval of a spot exchange-traded fund (ETF) and choose altcoins that traders consider can shortly rally in double-digits.

Solana price is buying and selling at $31.26 on Tuesday throughout American enterprise hours, up 8% in 24 hours. A 47% improve in buying and selling quantity coupled with an 8% spike out there cap confirms the enhancing investor curiosity. SOL has additionally displaced Cardano (ADA) to develop into the seventh-largest crypto.

Interest in Solana goes past the native token SOL, because the protocol is repeatedly being adopted within the Web3 house. For occasion, Ryder, the primary {hardware} pockets secured by an individual’s social circle, has introduced it’s tapping the Solana blockchain for “its unparalleled scalability, and rapid transaction capabilities.”

Ryder will combine @solana and be a part of the mission of unlocking worth past browsers and telephones.

Imagine a world the place Web3 seamlessly weaves into our day by day lives.https://t.co/wq7Y0RJu6N

— Ryder (@Ryder_ID) October 24, 2023

According to Ryder, Solana’s wager on {hardware} wallets gives a framework for the last word decentralization of its ecosystem with out dependence on huge tech giants.

“In alignment with our commitment to pioneer more real-world use cases for digital assets and enable true decentralized economy, we will integrate Solana upon launch to fuel our shared vision of “Web3 on the go,” Ryder said via a blog post. “Mainstream adoption is not just about innovation but also accessibility.”

Solana Price Decouples From Altcoins

As mainstream adoption of SOL, the token, and Solana the good contracts platform grows, possibilities of a bigger restoration improve. The breakout from assist at $20 was validated when SOL stepped above numerous key ranges just like the higher falling trendline and the resistance at $27.

Double golden cross patterns inspired merchants to hunt extra publicity to SOL whereas trying ahead to features above $30.

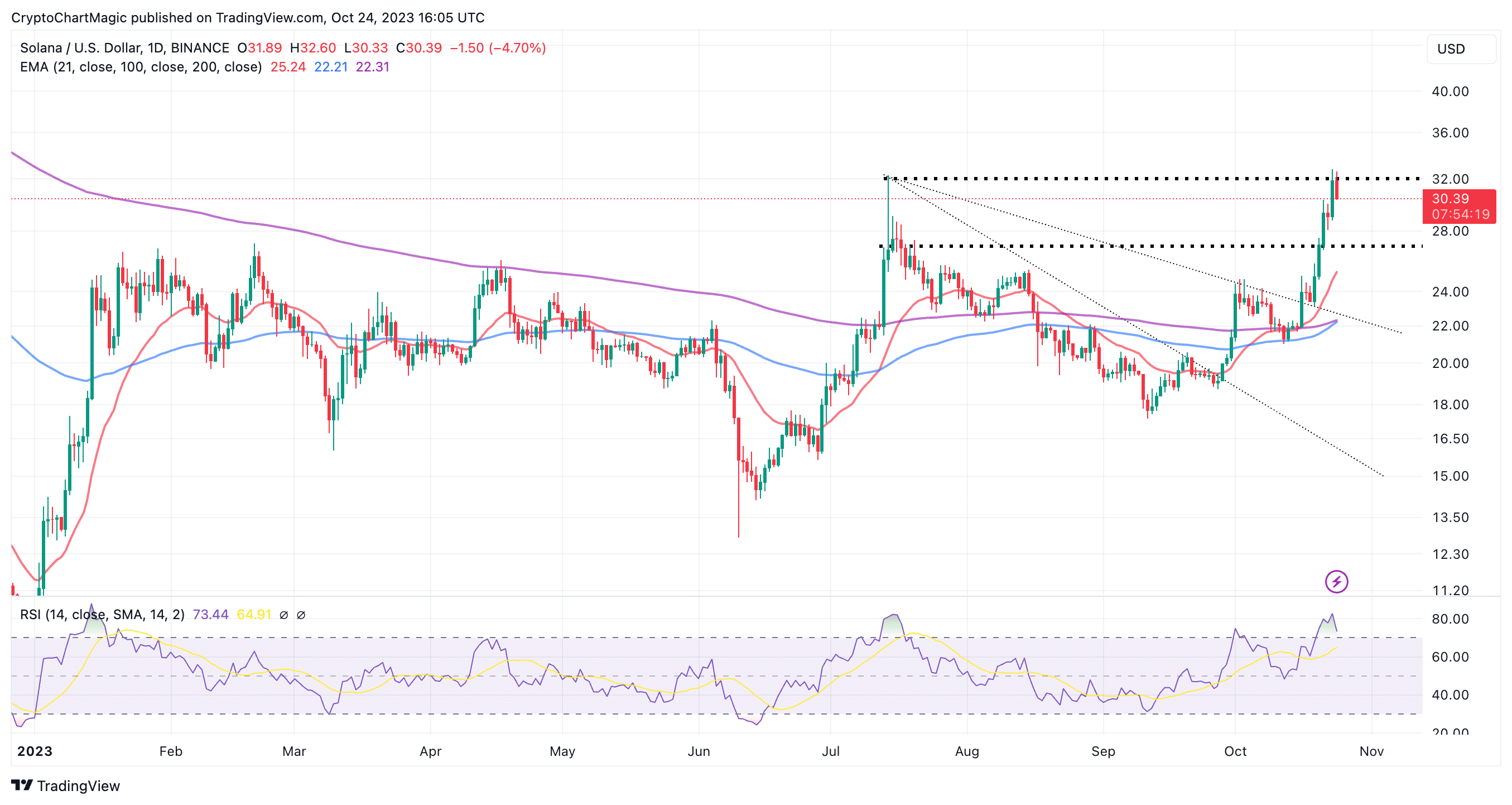

A golden cross is a bullish sample fashioned when a short-term shifting common crosses above a long-term shifting common. In Solana’s case. The 21-day Exponential Moving Average (EMA) (purple) flipped initially above the 100-day EMA (blue) and lately the 200-day EMA (purple).

The run-up above $30 elevated Solana as one of many best-performing cryptos in October however resistance at $32 might endanger the uptrend, particularly with the Relative Strength Index (RSI) retreating from the overbought area into the impartial space.

Support at $30 is essential for the continuation of the uptrend and will assist bulls keep away from counting losses if Solana dips into the $20 vary. Sidelined traders and merchants may take into account shopping for the token if they will verify that SOL has what it takes to maintain the uptrend going.

A rally to $40 would begin to materialize if Solana breaks and holds above $32 — the rapid hurdle. Meanwhile, dips beneath assist at $30 will encourage profit-booking and presumably set off a sell-off to $27 and the 21-day EMA bolstered assist at $25.

Related Articles

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: