[ad_1]

Ethereum worth rally took a breather on Thursday following every week filled with track and dance amongst crypto buyers. The speak majorly centered across the potential approval of Bitcoin spot exchange funds (ETFs), prompted by tale-tale indicators of the US Securities and Exchange Commission (SEC) warming as much as the concept.

The second-largest cryptocurrency broke out in tandem with BTC, seemingly ending the longstanding downtrend. For the primary time since August, Ether traded above $1,800, though it had corrected to commerce at $1,781 on Friday from highs round $1,864.

Ethereum Price Consolidates Gains, Will It Breakout Again?

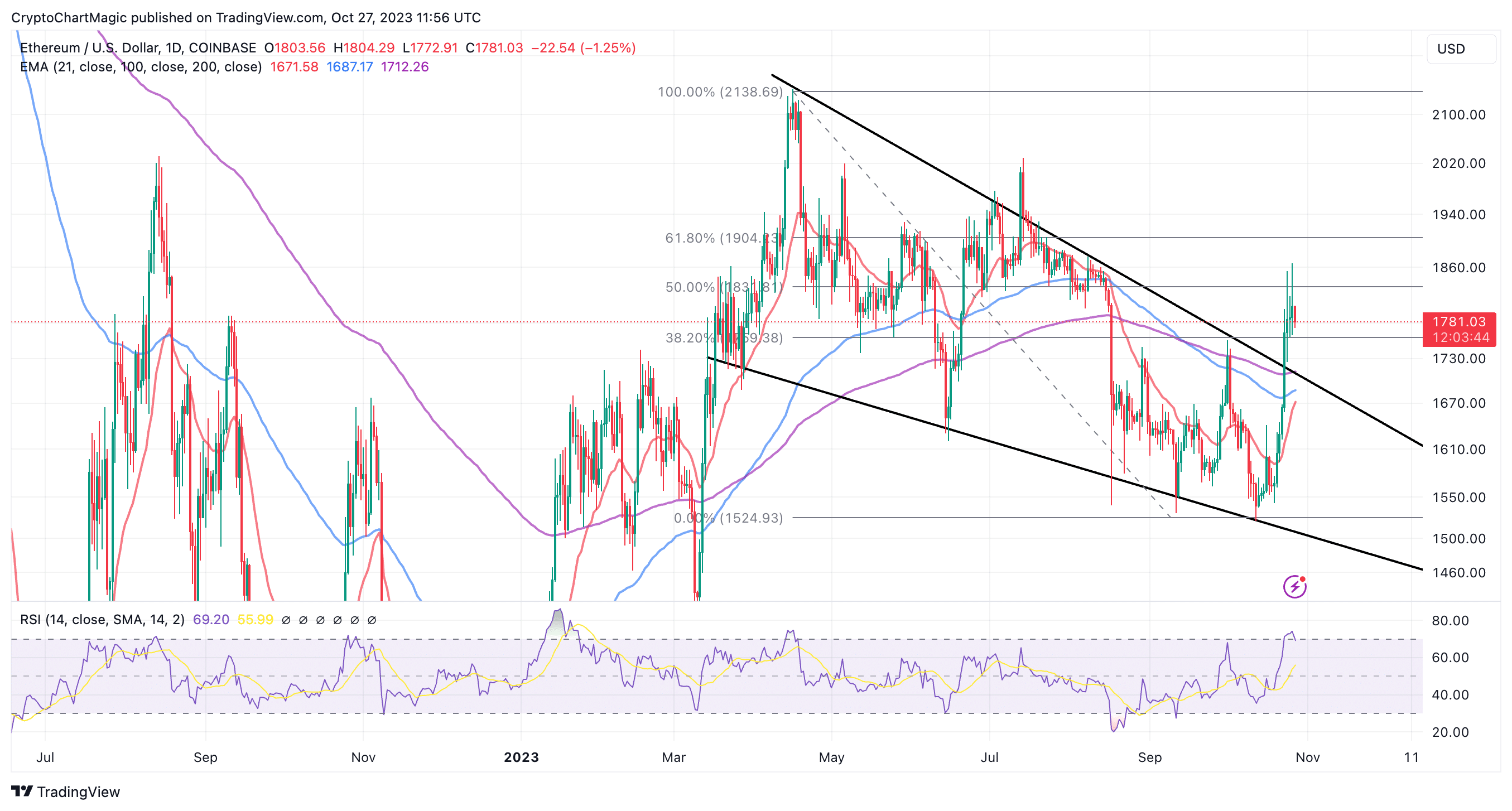

Following the widespread uptake of Ethereum amongst merchants and buyers rooting for the bull run, the biggest good contracts token ascending above a falling wedge sample, as proven within the chart beneath.

This transfer marked the primary vital breakout above a multi-month trendline that has been in existence since April when the bullish outlook within the early months of 2023 light at $2,138.

Price motion past all three utilized transferring averages, beginning with the 21-day Exponential Moving Average (EMA) (purple), the 100-day EMA (blue), and the 200-day EMA (purple) inspired merchants to maintain their positions open whereas buyers fought the urge to leap on the slightest signal of revenue.

The falling wedge sample breakout was additionally accompanied by a big enhance in buying and selling quantity, creating an ideal surroundings for a significant rally.

Ethereum price forex holds above the 38.2% Fibonacci retracement degree, which bulls could be relying on to renew the uptrend.

Traders ought to proceed with warning however not promote out of panic, contemplating the Relative Strength Index (RSI) reveals indicators of a pullback on the playing cards. If the RSI falls again into the impartial space from the overbought area, declines may ensue, with merchants closing their positions to lock within the features.

The Ethereum Community Eyes Increased Scalability With The Dencun Upgrade

The Ethereum neighborhood is wanting ahead to the discharge of the Dencun upgrade, anticipated to extend the blockchain’s stability, in accordance with a report by Goldman Sachs (GS) on Thursday.

According to the report, the improve’s “primary impact will be to increase its data availability for layer-2 rollups via proto-danksharding, resulting in a reduction of rollup transaction costs which will be passed on to end users.”

Layer 2 protocols are constructed on high of the Layer 1 blockchain, on this case, Ethereum, and are sometimes called off-chain programs and even separate blockchains.

Rollups operate by processing transactions on a separate quicker; they’re cheaper, and extra scalable blockchains that lodge the transactions onto the guardian blockchain (layer 1) later.

The Dencun improve will considerably “enhance Ethereum’s scalability via rollups” and is anticipated to have a constructive impact on “gas fees and improve the network’s security.”

This could be the following main improve after Shapella which achieved full staking standing for Ethereum. In different phrases, after the improve buyers had been in a position to withdraw staked Ether on the Beacon Chain along with the rewards earned.

Shapella improve turned an ideal enhance to Ethereum staking, particularly on liquidity staking platforms like Lido and Rocket Pool.

Related Articles

The offered content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link

✓ Share: