[ad_1]

Wallet deal with linked to crypto trade FTX transfers $10 million value Solana (SOL) tokens on Wednesday as a part of the plan to liquidate crypto property held by FTX and Alameda Research to pay again collectors.

FTX and Alameda in September obtained a court docket order to liquidate $3.4 billion value of crypto property. The debtors introduced to promote crypto property progressively to stop any vital impression on costs.

FTX Dumps Solana (SOL) to Binance

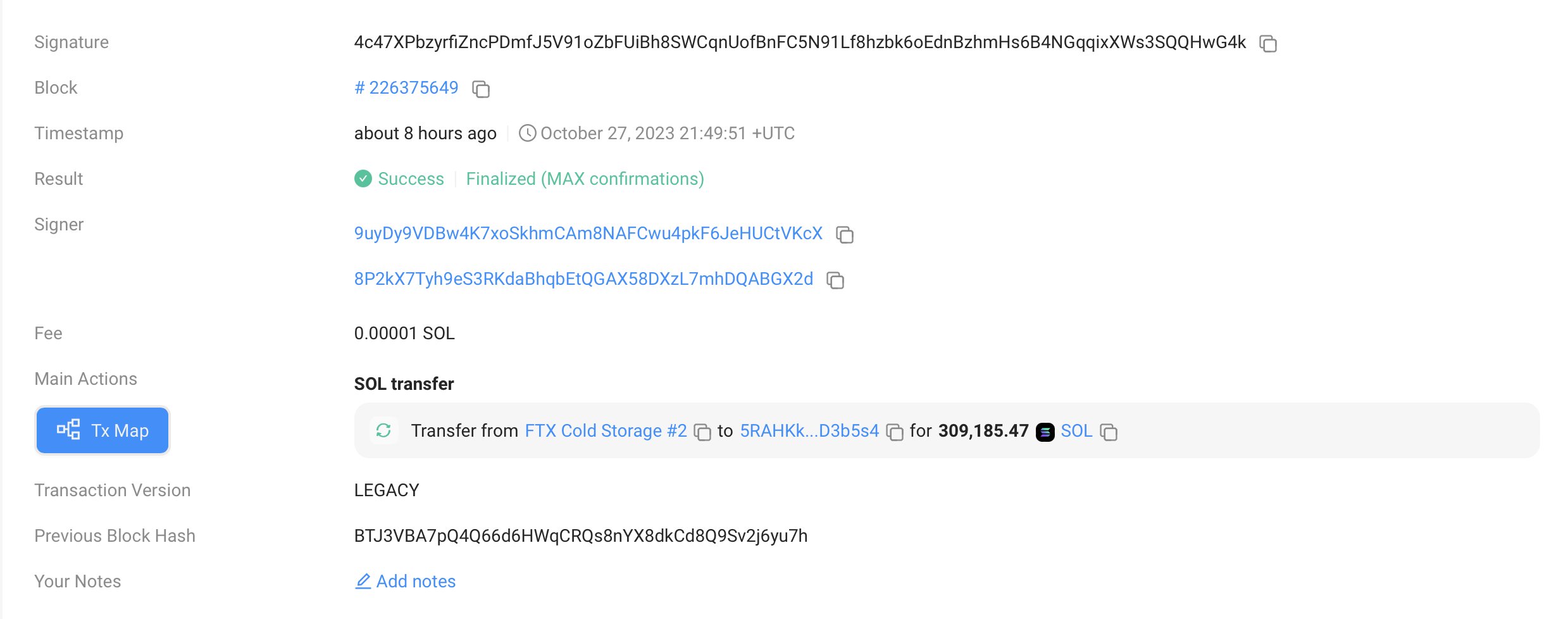

PackShieldAlert on October 28 reported that an FTX-labeled pockets deal with transferred 309.2k SOL tokens value greater than $9.9 million. Along them, almost 244k SOL tokens dumped to crypto trade Binance.

The transfer comes as Solana worth rallied 70% in October, permitting FTX Debtors to liquidate extra SOL holdings. Former FTX CEO Sam Bankman-Fried revealed to the jury that he began shopping for Solana when it was buying and selling at simply $0.20.

CoinGape Media today reported that FTX and Alameda have offered $14.4 million value of tokens to exchanges. As per information from Spot On Chain, FTX and Alameda Research nonetheless maintain $736 million value of EVM property following current deposits to varied crypto exchanges over the previous few days.

In September, a Delaware Bankruptcy Court approved a plan by FTX Debtors to liquidate crypto property value $3.1 billion held at FTX and Alameda Research.

Read More: VanEck Prediction on 10,600% Solana Price Rally By 2030 Triggers Debate

SOL Price Dips Amid Liquidations

SOL price fell greater than 2% within the final 24 hours, with the worth presently buying and selling at $31.60. The 24-hour high and low are $31.53 and $33.30, respectively. Furthermore, the buying and selling quantity has decreased by 25% prior to now 24 hours, indicating a decline within the curiosity of merchants.

Analysts predict Solana will step again looking for recent liquidity forward of one other breakout eyeing $40, bolstered by double golden cross patterns.

Also Read:

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: