[ad_1]

Ethereum has been notably underperforming Bitcoin via this newest rally. Here’s why that is so, in response to a CryptoQuant analyst.

Ethereum Net Taker Volume Has Been Mostly Negative Recently

In a brand new post on X, CryptoQuant Netherlands group supervisor Maartunn has identified what the “net taker volume” for Ethereum is trying like.

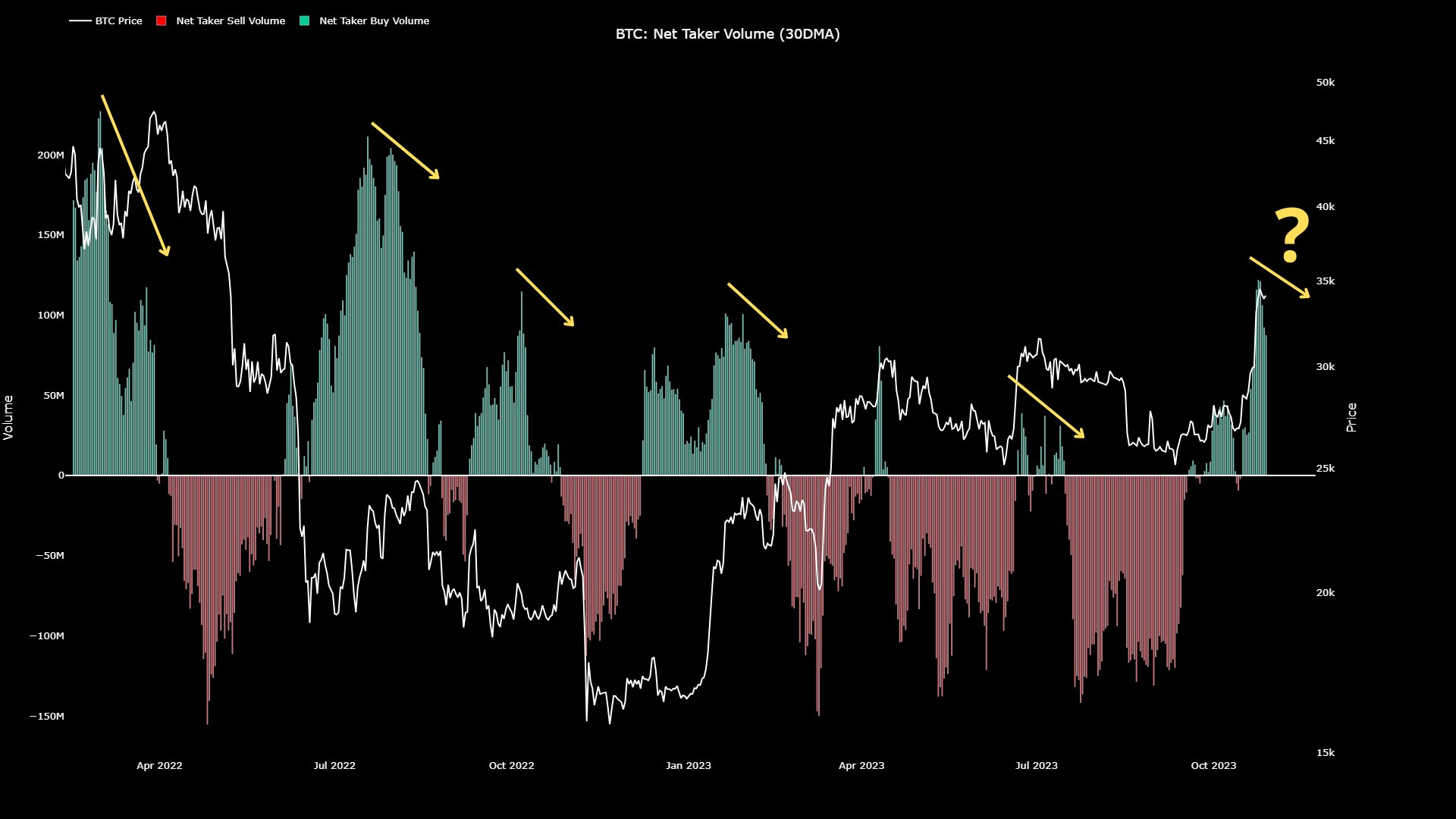

The web taker quantity right here is an indicator that retains monitor of the distinction between the taker purchase quantity and taker promote quantity on the Bitcoin futures market.

When the worth of this metric is optimistic, it signifies that the taker purchase quantity is dominating the taker promote quantity proper now. Such a pattern implies shopping for stress could also be robust available in the market at the moment.

On the opposite hand, unfavourable values may recommend the presence of a bearish sentiment among the many traders, as promoting stress is larger than the shopping for stress.

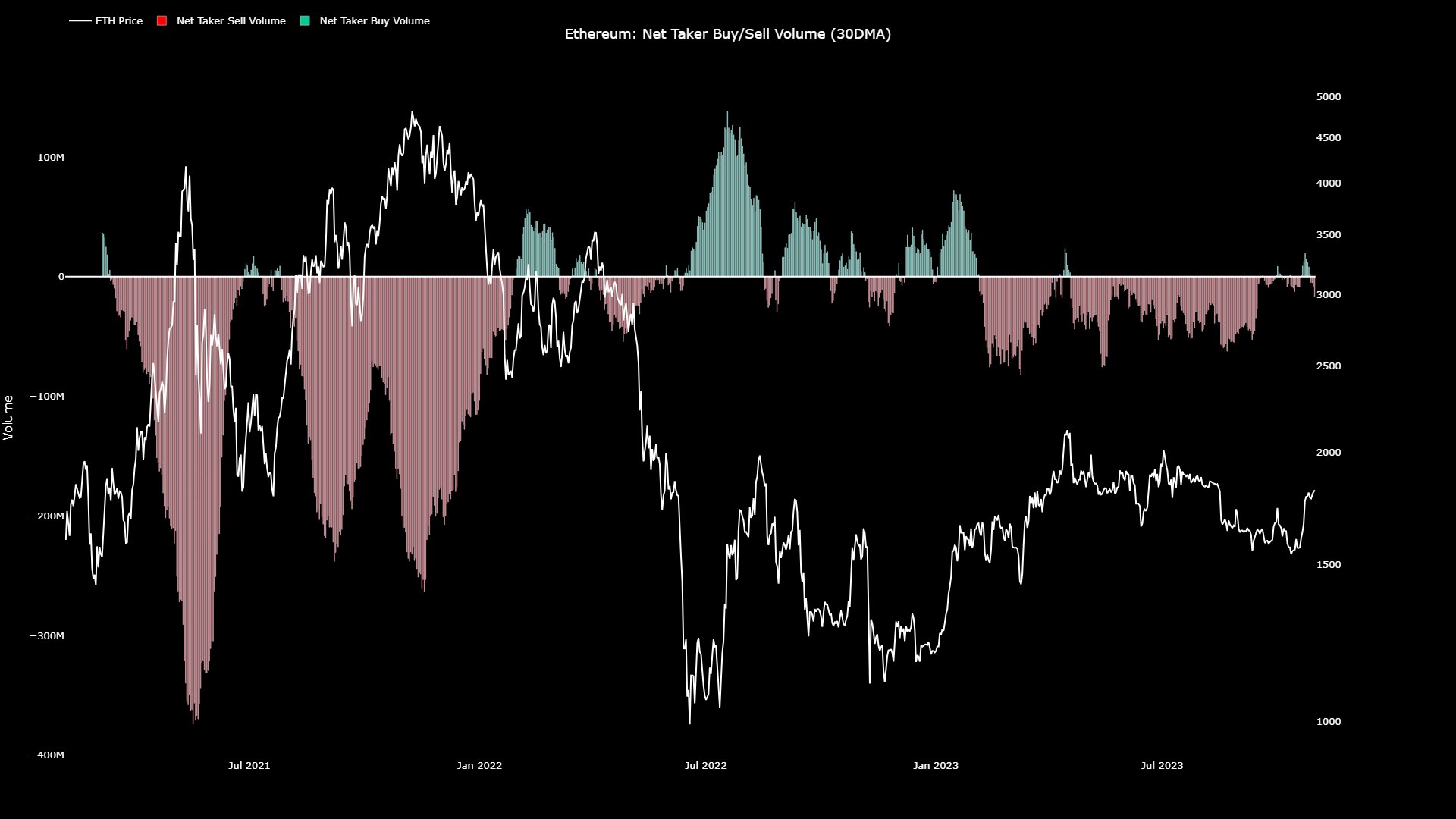

Now, here’s a chart that exhibits the pattern within the 30-day transferring common (MA) Ethereum web taker quantity over the previous few years:

Looks just like the 30-day MA worth of the metric has been close to the impartial mark in current days | Source: @JA_Maartun on X

As displayed within the above graph, the Ethereum web taker quantity has been principally unfavourable in the course of the previous few months, implying that sentiment across the asset has remained bearish.

Bitcoin, alternatively, has loved durations the place the taker purchase quantity has surpassed the taker promote quantity, because the chart shared by the analyst a couple of days again confirmed.

The 30-day MA worth of the indicator appears to have been inexperienced in the previous few weeks | Source: @JA_Maartun on X

Most notably, the online taker quantity of Bitcoin is considerably optimistic proper now, suggesting the robust shopping for stress current available in the market. Unsurprisingly, BTC’s sharp rally has come alongside these optimistic values of the metric.

Ethereum has no such shopping for stress current in the mean time. Maartunn believes this is the reason the ETH worth has been performing significantly poorly in opposition to BTC just lately.

Ethereum Has Still Not Touched The Highs Set Earlier In The Year

Ethereum’s underperformance in opposition to Bitcoin is well seen within the asset’s year-to-date chart.

ETH has loved some rise in the course of the previous month | Source: ETHUSD on TradingView

At the identical time as Bitcoin noticed its rally off the again of the extremely optimistic web taker quantity, Ethereum additionally noticed a surge of its personal. This rise, although, has been nowhere close to as sharp as that of the unique cryptocurrency, as ETH continues to be simply buying and selling round $1,800, which is notably lower than the highest of round $2,100 that the asset set again in April.

Not solely has Bitcoin surpassed the $31,000 high it set again in July, it has additionally executed so in spectacular style, because it’s now buying and selling above the $34,000 stage, which is considerably larger.

If the online taker quantity is something to go by, the second largest cryptocurrency might proceed to underperform versus the biggest, as long as investor sentiment round it stays unfavourable.

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link