[ad_1]

The market has no mercy on Bitcoin (BTC) brief merchants as a brand new uptrend is brewing in response to the rise in Open Interest (OI) noticed in a single day. This pattern was predicted by market analyst CrediBULL Crypto who famous that the tendencies round Bitcoin quantity have set the stage for a pleasant squeeze that may drive value upward.

Bitcoin (BTC) Resilience Hurting Short Sellers

The present value motion of Bitcoin is posing a severe risk to the capital base of brief sellers. The coin is at the moment buying and selling at $35,217.97, up by 2.3% as buying and selling quantity soared by 11.89% to $15,318,050,817.

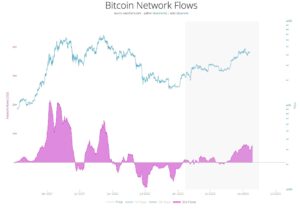

With this pattern, brief merchants are notably being obliterated as showcased by the chart proven beneath. This chart doubtlessly stems from the perpetual takers who’ve refused to promote, reducing funding in the futures market.

To put it in correct perspective, data from CoinGlass exhibits {that a} complete of $50.31 million price of crypto has been liquidated in the previous 4 hours. While lengthy merchants nonetheless dominate this liquidation with $29.47 million, the proportion of the amount from brief merchants liquidated has grown to $21.02 million.

The dynamics even current a extra attention-grabbing shift in the previous hour because the liquidated quantity from brief sellers is $14.43 million, far outpacing that of the longs at $1.33 million. Commenting on this pattern, CrediBULL Crypto famous that there can be little resistance transferring ahead, however that the $35,400 stage is one key stage to regulate.

Optimism Around Bitcoin Remain

CrediBULL Crypto is likely one of the mainstream crypto analysts with deep convictions that Bitcoin is primed for its subsequent main rally. While hurdles can’t be dominated out for Bitcoin in its journey up, the analyst forecasts the $34,600 as a local invalidation level or help zone to observe.

Bitcoin’s outlook is price keeping track of seeing the premier coin has grown by 114% 12 months thus far. As market stakeholders sustain anticipation for a potential approval of Bitcoin spot ETF by the US SEC, the imbalance in capital utilization in the futures market can function a set off to be careful for in the close to time period.

As the 12 months journeys to a detailed, extra inherent volatility are imminent however the ETF sentiment, complemented by the upcoming halving may help Bitcoin (BTC) pull a outstanding bullish stunt.

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link

✓ Share: