[ad_1]

In a putting twin evaluation, the monetary charts paint contrasting futures for the US Dollar Index (DXY) and Bitcoin (BTC). Gert van Lagen, a technical analyst, has supplied a bearish prognosis for the DXY, whereas concurrently highlighting a bullish setup for Bitcoin that might see it aiming for a $46,000 goal.

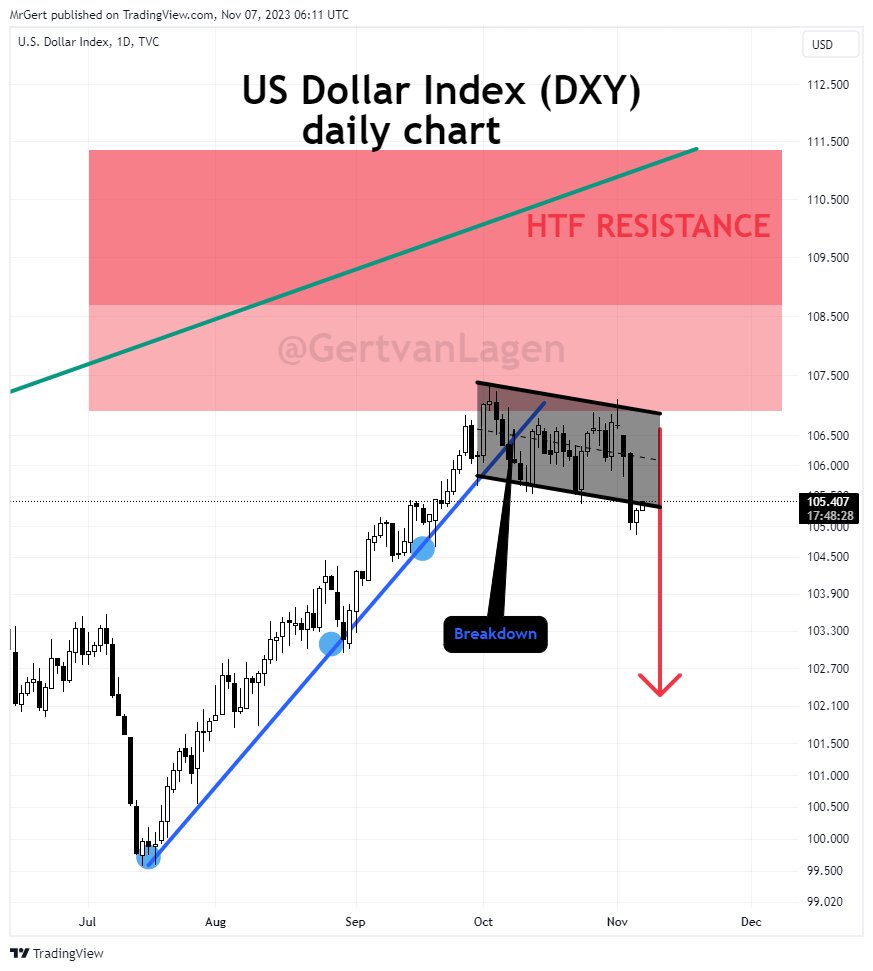

DXY Receives Kiss Of Death

The DXY has been in an upward pattern since July, as proven by the blue ascending pattern line on the day by day chart. However, this line was damaged to the draw back on October 9, indicating a change in market sentiment. Van Lagen explains, “Blue uptrend since July has been broken too. Time to continue down.”

This sentiment is strengthened by the worth motion throughout the black channel from the start of October until lately, the place a interval of consolidation is seen, succeeded by a powerful downward transfer. The DXY dropped by 1.2% final Friday, November 3, to 104.92 and is at present present process a retest of the channel, a standard technical sample the place the worth strikes again to the breakdown level earlier than persevering with within the course of the preliminary course.

A 3rd bearish argument for the DXY is the rejection on the highlighted purple zone on the chart which signifies a excessive timeframe Fibonacci resistance space. The Fibonacci retracement is a well-liked instrument amongst merchants to determine potential reversal ranges. The DXY’s worth motion reveals a “clear rejection” at this stage, the place the index tried to rise however was pushed again down, reinforcing the bearish stance.

Bitcoin Price Targets $46,000

Amidst the weak point of the DXY, the inverse correlation with Bitcoin turns into a focus for crypto buyers. Gert van Lagen provides perception into Bitcoin’s potential trajectory, observing a bullish sample rising on its 6-hour chart.

“BTC [6h] – Bullish pennant in play targeting $46k. The pennant is part of the shown ascending channel,” remarked van Lagen. The chart shows Bitcoin’s worth consolidating in a pennant construction, a continuation sample that alerts a pause in a powerful upward or downward pattern earlier than the subsequent transfer.

The pennant is delineated by converging pattern traces which have been fashioned by connecting the sequential highs and lows of worth motion, converging to some extent indicative of an imminent breakout.

In this case, the pennant follows a major upward pattern, suggesting that the breakout is prone to proceed within the bullish course. The ascending channel, highlighted by two parallel upward-sloping traces, encompasses the whole bullish motion of Bitcoin on the chart, together with the pennant formation. This channel serves as a information for the worth pattern, indicating the place assist and resistance ranges are anticipated in the meanwhile.

Van Lagen’s evaluation posits a focused worth of $46,000 upon the decision of the pennant, a stage that’s decided by the peak of the prior transfer that preceded the pennant, projected upward from the purpose of breakout. The dashed traces on the chart illustrate the potential path Bitcoin’s worth may take following the breakout.

An vital element in van Lagen’s chart is the ‘Invalidation’ stage marked beneath the pennant. This stage at $34,103 is crucial because it signifies the place the bullish speculation can be thought-about incorrect, serving as a stop-loss level for merchants performing on this sample.

At press time, BTC traded at $34,625.

Featured picture from Dmytro Demidko / Unsplash, chart from TradingView.com

[ad_2]

Source link