[ad_1]

The Bitcoin constructive sentiment has been rising slightly quickly in the previous few months because the market has staged an unimaginable restoration. This noticed the Bitcoin Fear & Greed Index go from deep concern to deep greed and that greed simply continued to develop. Now, the sentiment is on the point of excessive greed, which will be good within the brief time period, however may inherently flip bearish for the worth.

How The Fear & Greed Index Works

The Bitcoin Fear & Greed Index makes use of a quantity scale of 1-100 to identify how buyers are feeling towards the crypto market at any given time. This index makes use of numerous totally different indicators to provide you with a quantity which ranges from social media posts to market volatility and momentum, amongst others.

The scale is then divided into 5 distinct classes relying on how buyers are feeling and the quantity that the index is on. 1-25 is taken into account to be excessive concern and is a time when crypto buyers are likely to avoid the market as a consequence of value drops. However, this has usually confirmed to be the most effective time to purchase cryptocurrencies.

Next is the 26-46 vary which is called the concern territory. It is one step forward of extreme fear however can also be a time when buyers are usually not as cautious regardless of the rampant concern. It can also be an excellent time to purchase and precede the following stage, which is impartial.

Neutral is the area between 47-52 and signifies a time when buyers are not sure of this market. Mainly, buyers chorus from making any strikes throughout this time, ready for the market to swing both up or down earlier than deciding their subsequent transfer.

One step above that is the greed stage beginning at 53 and ending at 75. At this time, buyers are returning to the market and costs are recovering quickly. This usually leads to excessive greed between 76 and 100, the place main choices are being made.

BTC value reclaims $44,000 | Source: BTCUSD on Tradingview.com

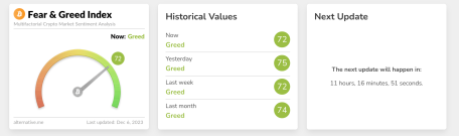

Bitcoin Sentiment Rests At 72

The Fear & Greed Index is at present at 72, treacherously near slipping into the intense greed territory which may have huge implications for the worth. Now, trying again at instances when the index’s rating has gone this excessive, it paints an image of bullishness adopted by bearishness.

An instance of that is in December 2020 when the index rose into the extreme greed territory. It would proceed to rise as buyers trooped into the market, finally topping out at 91. Then what adopted was a crash that despatched buyers spiraling. The similar factor occurred between October and November 2021 the place the rating reached excessive greed earlier than crashing.

Source: various.me

Given how the Bitcoin value has carried out each time the rating was this excessive, it stands to purpose that extreme greed can usually act as a high sign. So the index going into the 76-100 area can usually signify that it’s time to exit the market.

If this development does repeat, then the Bitcoin value may run additional and mount extra restoration. However, it’s headed towards a market crash that might lure bulls who haven’t timed their exit accurately.

Featured picture from Trade Santa, chart from Tradingview.com

[ad_2]

Source link