[ad_1]

The rising spot Bitcoin ETF hypothesis coupled with different elements together with the dovish U.S. Federal Reserve triggered an over 22% rally in Bitcoin worth in a month. Popular analysts identified spot bids from the important thing assist degree at $43,000 retail traders take buy-the-dip alternative after an institutional investors-led rally. Will BTC worth hit $50,000 subsequent week?

Can Bitcoin Price Hit $50,000 Despite Pullback?

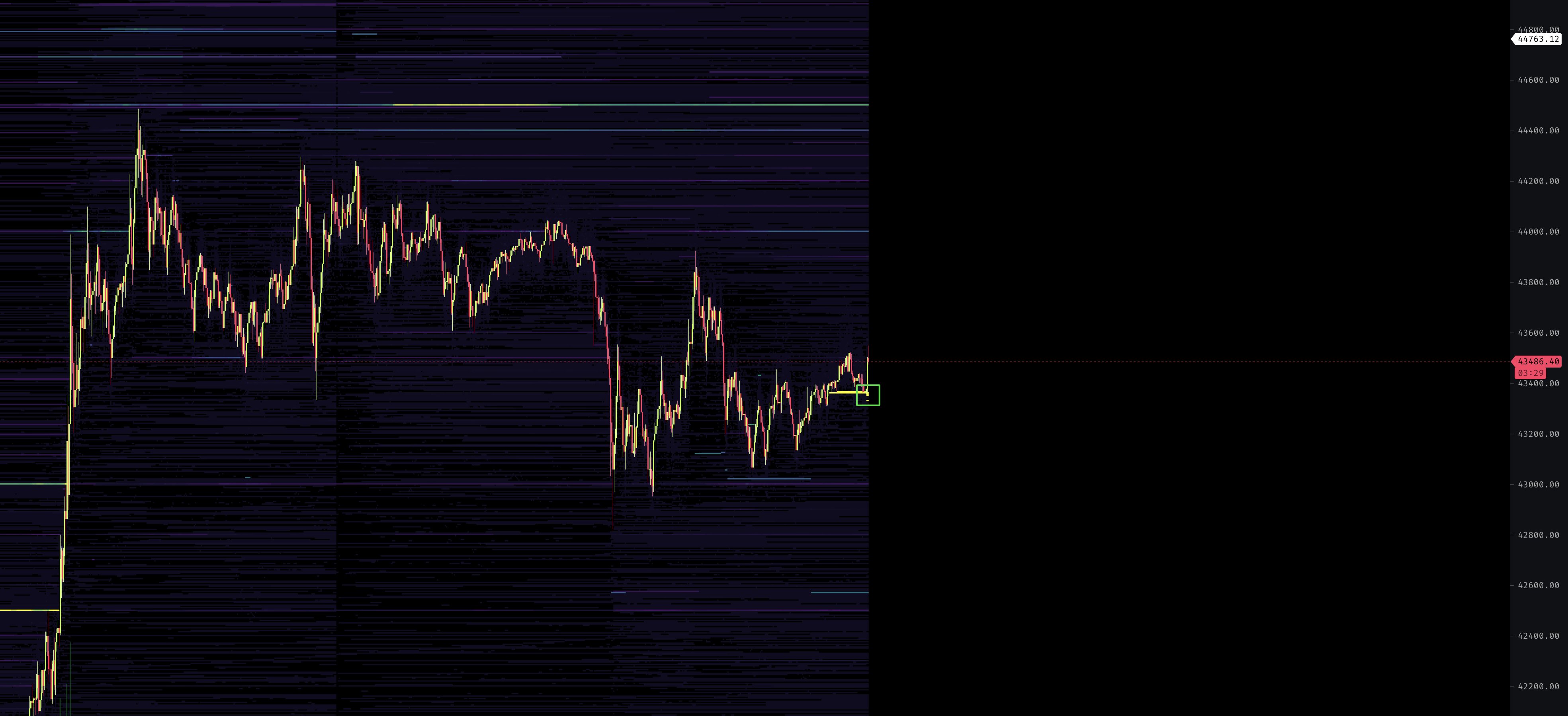

Popular analyst CredibleCrypto in a contemporary put up on X revealed that 30 million in spot bids have popped up from close to assist ranges. He earlier predicted that Bitcoin might sweep beneath native BTC lows.

However, the rising bids from beneath recommend large bullish sentiment. He believes BTC worth may even hit $50,000 subsequent week if spot BTC shopping for continues.

Another well-liked analyst Skew stated “bids sold into and filled it seems” on Binance Spot. Despite open pursuits wiped on Binance and Bybit, bids chase the value greater. Traders should search for confirmations akin to RSI bouncing from 50 & worth holding 4H 21EMA.

CoinGape earlier reported that prime analysts Michael van de Poppe, John Bollinger, and Ali Martinez have predicted Bitcoin’s rally towards the $50,000 mark. The analysts are assured a few robust upside momentum and BTC worth closing the yr on a robust observe.

Also Read: Fidelity Spot Bitcoin ETF Added To Active ETF And Pre-Launch List

Miners Hold Onto Their BTCs

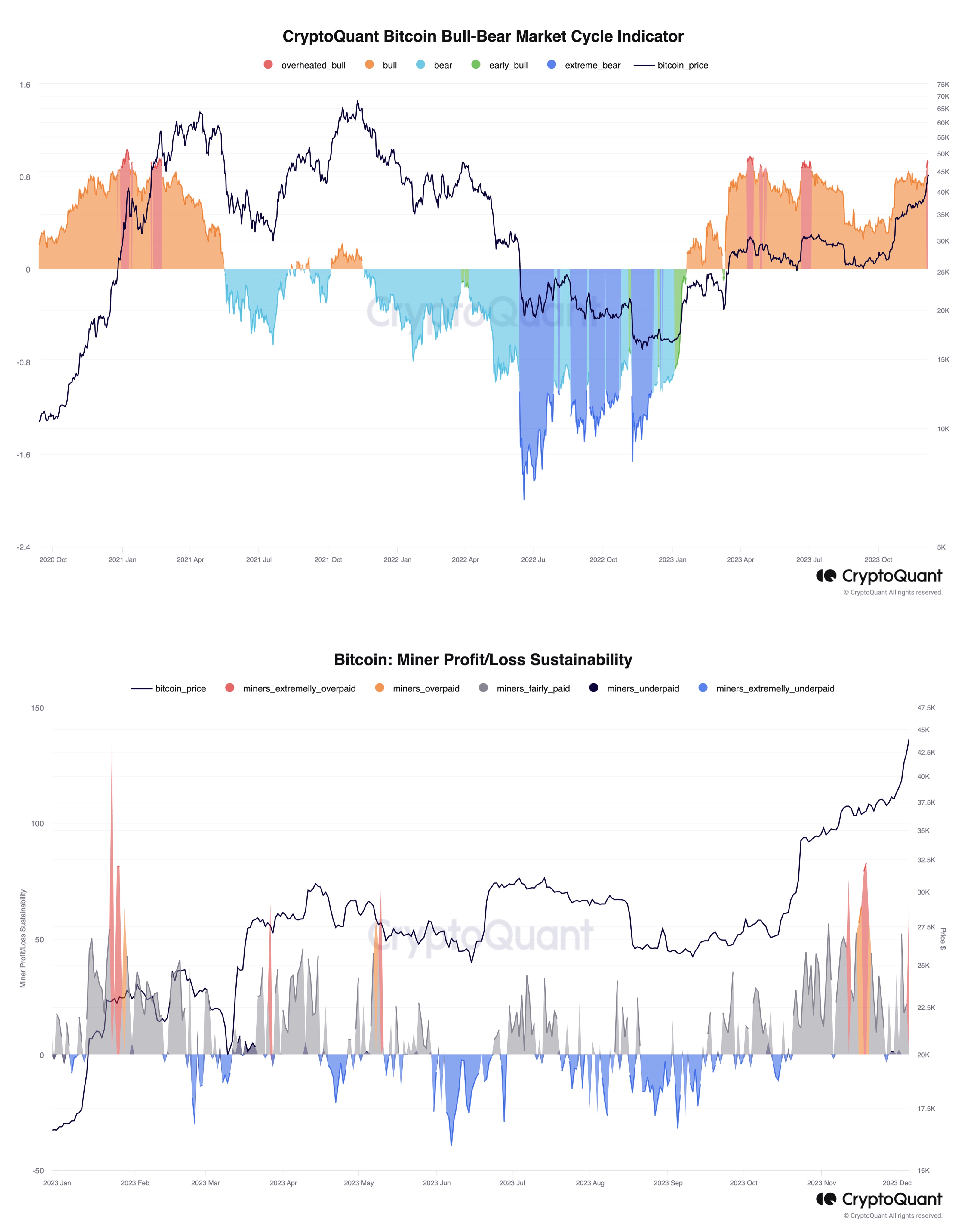

CryptoQuant head of analysis Julio Moreno warned that some on-chain metrics point out that BTC worth is “overheating” after the latest rally.

The Bull-Bear Market Cycle Indicator reveals overheated bull section for the primary time since July. In addition, Miner Profit/Loss Sustainability signifies block reward rising a lot sooner than mining issue.

However, these overheated bull section and rising miners’ revenue are because of inscriptions on Bitcoin blockchain. Miners are holding onto their BTC holdings.

BTC price presently buying and selling at $43,200, paring earlier features because of CME gap at $39,700. The 24-hour high and low are $42,880 and $43,951, respectively. Furthermore, the buying and selling quantity has elevated barely within the final 24 hours.

Also Read: XRP Lawyer Reacts As Uphold Head Of Research Predicts Price Bitcoin To Cross $200k

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link

✓ Share: