[ad_1]

A latest report has revealed an upcoming important occasion that may see the expiration of a notable quantity of Bitcoin (BTC) and Ethereum (ETH) choices contracts.

Bitcoin And Ethereum Options Contract Set To Expire

Global choices buying and selling service platform Greeks.dwell, took to X (previously Twitter) to share knowledge concerning the expiration of the crypto belongings.

According to the platform, about 37,000 BTC choices with a notional worth of $1.58 billion are set to run out. In addition, Bitcoin’s present put-call ratio stands at 1.02 with a “Maxpain” level of $42,000.

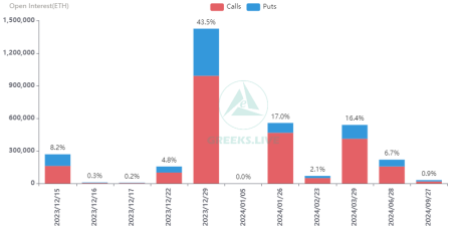

Meanwhile, for Ethereum, the information exhibits that about 268,000 choices valued at $610 million are set to run out quickly. In addition, the present put-call ratio for ETH stand at 0.66, with a “maxpain” level of $2,250. The publish learn:

Dec. 15 Options Data. 37,000 BTC choices are about to run out with a Put Call Ratio of 1.02, a Maxpain level of $42,000, and a notional worth of $1.58 billion. 268,000 ETH choices are as a consequence of expire with a Put Call Ratio of 0.66, a Maxpain level of $2,250, and a notional worth of $610 million.

Notably, the put-call ratio, to place it merely, contrasts the buying and selling quantity of put and name choices. A ratio increased than 1 signifies a better variety of places (promote) than calls (purchase) choices, implying a detrimental outlook amongst merchants.

Furthermore, the value at which the best variety of choices would expire nugatory is named the utmost ache (Maxpain) level.

Greeks.dwell asserted that this week noticed a decline available in the market, with BTC dropping near $40,000 at one level. As a end result, many hedge their positions, which led to a better proportion of Put than Call positions this week. The bulk of buying and selling continues to be targeting Bitcoin choices even with the decline.

The platform additionally highlighted that the Implied Volatility (IV) has remained fairly flat for a couple of month now. In addition, important possibility strikes are nonetheless occurring.

The Crypto Assets Set To See Substantial Inflow

Cryptocurrency analyst Ali has just lately revealed that billions of influx are set to be poured into Bitcoin and Ethereum. The analyst shared this important data with the crypto group in an X publish on Thursday, December 14.

According to Ali, over $19.7 billion is about to movement into the 2 main gamers within the cryptocurrency market. He additionally added that this capital influx is corresponding to what we noticed in December 2020.

The X publish was accompanied by a chart exhibiting a digital clarification of the same state of affairs. Ali additional highlighted that after the state of affairs, the value of BTC moved from $18,000 to $65,000.

With billions of {dollars} flooding into the 2 main crypto, the market may be poised for additional earnings.

Featured picture from iStock, chart by Tradingview.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site fully at your individual threat.

[ad_2]

Source link