[ad_1]

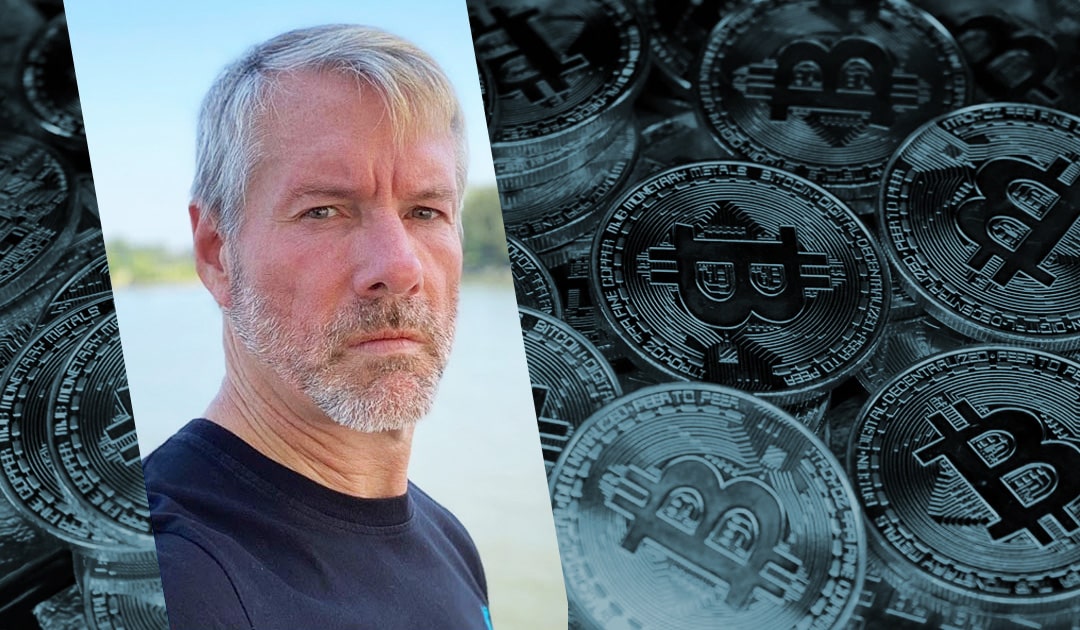

Bitcoin’s much-anticipated spot ETF launch is considered as a bullish occasion for the trade by Michael Saylor, co-founder and govt chair of MicroStrategy (MSTR). In a current Bloomberg interview, Saylor mentioned how the Bitcoin ETF differentiates from MicroStrategy’s shares for potential and present traders.

Also Read: BTC Spot ETF: Theories Emerge About SEC’s Potentially Conditional Green Light

MicroStrategy is often seen as a Bitcoin proxy, largely due to its substantial Bitcoin holdings. According to knowledge by Bitcoin Treasuries, it ranks as the highest public holder of Bitcoin.

However, Saylor was questioned about whether or not the ETF launch would negatively impression MSTR. Saylor responded, “ETFs are unlevered and they charge a fee. MicroStrategy is an operating company, so we’re fairly unique.”

Bitcoin spot ETF basically totally different

Saylor emphasised that MicroStrategy can generate extra Bitcoin by means of P&L or capital markets operations. He likened MicroStrategy to an airline compared to ETFs being like transport strains, providing larger efficiency and leverage with out charges. He added, “And we can take advantage of intelligent leverage. Like we can borrow money at 0% interest for many, many years [to buy Bitcoin].”

The govt additionally confirmed that the corporate will proceed to purchase Bitcoin, saying, “So our goal is always to find a way to pursue more Bitcoin, per share for our shareholders.”

MSTR’s BTC price-to-cost ratio improves

MicroStrategy, the main holder of Bitcoin, has seen its Bitcoin value-to-cost ratio enhance in December after a number of months of worth decline. While the corporate’s market capitalization stands at $9.1 billion, a staggering 83% of this worth is attributed to its Bitcoin holdings at press time. And an increase or fall within the Bitcoin worth impacts the corporate’s valuations considerably.

Looking forward to 2024, Saylor additionally predicts a significant bull run for Bitcoin.He additionally highlighted that market volatility presents extra alternatives for the corporate to improve shareholder worth.

Additionally, Saylor anticipates that the approval of spot ETFs in January will set off a demand shock. Further, he factors out that in April, a provide shock is anticipated when the day by day availability of Bitcoin from miners halves from 900 to 450, additional impacting Bitcoin’s worth.

Also Read: Bitcoin Spot ETF: Bitwise Advert Stirs Hope for Upcoming Approval

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: